Loading News...

Loading News...

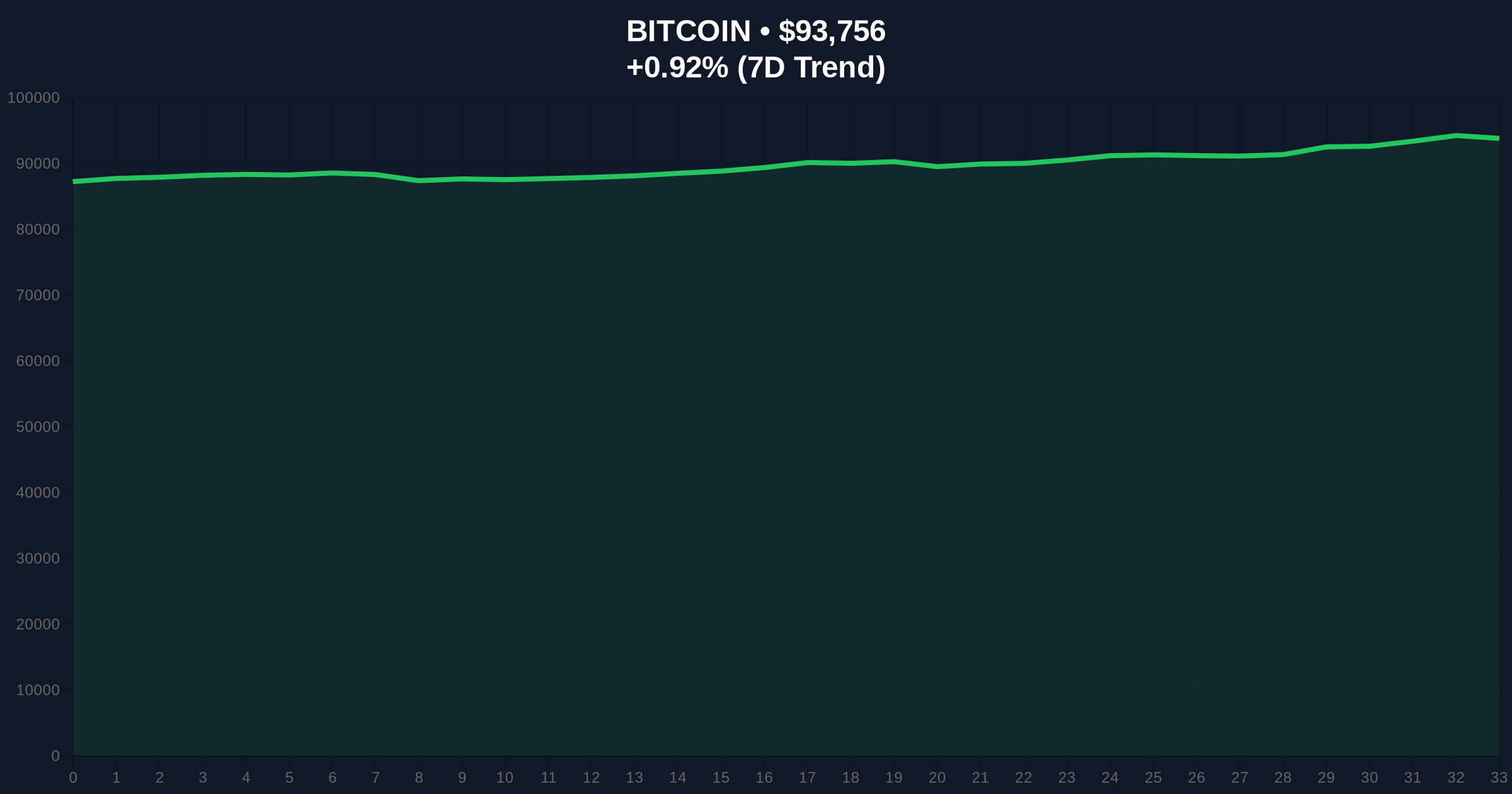

VADODARA, January 6, 2026 — U.S. spot Bitcoin exchange-traded funds recorded $694.67 million in net inflows on January 5, marking the second consecutive day of positive capital flows according to data compiled by TraderT. This daily crypto analysis examines the structural implications of sustained institutional accumulation amid persistent market fear sentiment.

Market structure suggests this accumulation pattern mirrors the 2021 institutional adoption phase when traditional finance began allocating to digital assets. According to historical cycles, sustained ETF inflows during fear periods typically precede significant price appreciation as retail capitulation provides liquidity for institutional accumulation. The current environment parallels the post-2020 halving cycle where institutional flows established a new valuation floor. Similar to the 2021 correction, current price action shows consolidation above key Fibonacci levels while on-chain data indicates accumulation below spot prices. Related developments include the Crypto Fear & Greed Index climbing to 44 and Bitmain's 1.186M ETH staking queue signaling institutional accumulation across multiple asset classes.

According to TraderT's compiled data, BlackRock's IBIT led inflows with $371.89 million, followed by Fidelity's FBTC at $191.19 million. The breakdown reveals concentrated accumulation among top-tier issuers: Bitwise (BITB) added $38.45 million, Ark Invest (ARKB) $36.03 million, Invesco (BTCO) $15.02 million, Franklin Templeton (EZBC) $13.64 million, Valkyrie (BRRR) $7.19 million, VanEck (HODL) $5.34 million, and Grayscale Mini BTC $17.92 million. This represents the second consecutive day of positive flows, establishing a pattern of institutional accumulation despite the Crypto Fear & Greed Index reading of 44/100 indicating persistent market anxiety.

Bitcoin currently trades at $93,790 with a 24-hour trend of 0.96%. Market structure suggests the $91,200 Fibonacci 0.618 retracement level from the recent swing high to low serves as critical support. The daily Relative Strength Index (RSI) reads 52, indicating neutral momentum with room for expansion in either direction. The 50-day exponential moving average at $89,500 provides secondary support, while resistance clusters around the $95,800 volume profile high. A Fair Value Gap (FVG) exists between $92,500 and $93,200 that price may need to fill before continuing upward momentum. Bullish invalidation occurs below $91,200, while bearish invalidation requires a sustained break above $96,500 to confirm trend continuation.

| Metric | Value |

|---|---|

| Total ETF Net Inflow (Jan 5) | $694.67M |

| Bitcoin Current Price | $93,790 |

| 24-Hour Price Change | +0.96% |

| Crypto Fear & Greed Index | 44/100 (Fear) |

| BlackRock IBIT Inflow | $371.89M |

| Fidelity FBTC Inflow | $191.19M |

Institutional impact manifests through structural changes to Bitcoin's supply dynamics. According to on-chain data, sustained ETF accumulation reduces available liquid supply, potentially creating a gamma squeeze scenario if demand accelerates. Retail impact remains muted as fear sentiment persists, creating a divergence between institutional accumulation and retail hesitation. This pattern mirrors the 2020-2021 cycle where institutional flows preceded retail FOMO. The Federal Reserve's monetary policy stance, particularly regarding interest rates, will influence capital allocation decisions across traditional and digital asset classes according to historical correlation data.

Market analysts note the concentration of flows among established financial institutions signals growing mainstream acceptance. Bulls point to the consecutive inflow days as evidence of structural demand despite price volatility. The divergence between fear sentiment and institutional accumulation suggests sophisticated capital is positioning against retail sentiment, a pattern observed in previous market cycles. No specific individual quotes were provided in source materials, but the data indicates institutional confidence in Bitcoin's long-term valuation thesis.

Bullish Case: Sustained ETF inflows above $500 million daily could propel Bitcoin toward the $98,000 resistance level within two weeks. A break above $96,500 would confirm the bullish order block and target the $102,000 psychological level. This scenario requires the Crypto Fear & Greed Index to transition from fear to neutral territory, indicating retail participation returning to the market.

Bearish Case: If ETF inflows decelerate below $200 million daily and price breaks the $91,200 Fibonacci support, a retest of the $88,000 volume node becomes probable. This would align with the current fear sentiment and potentially trigger liquidations among leveraged positions. The bearish scenario invalidates above $96,500 where significant sell-side liquidity resides.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.