Loading News...

Loading News...

VADODARA, January 8, 2026 — According to on-chain data from Onchainlens, BlackRock has executed a significant withdrawal of 3,040 BTC and 61,359 ETH from cryptocurrency exchanges over an eight-hour period, representing approximately $270 million and $190 million respectively. This latest crypto news event represents one of the largest single-entity exchange outflows since the 2024 ETF approvals, with market structure suggesting institutional accumulation during a period of retail fear.

Historical cycles indicate that exchange withdrawals of this magnitude typically precede extended accumulation phases. Similar to the 2021 correction where institutional entities absorbed supply during the $30,000 to $40,000 consolidation, current on-chain forensic data confirms a pattern of smart money positioning against retail sentiment. The timing coincides with broader regulatory developments, including the upcoming U.S. Senate committee markup of comprehensive crypto legislation scheduled for January 15, 2026. Market context reveals this withdrawal represents approximately 0.016% of Bitcoin's circulating supply and 0.051% of Ethereum's circulating supply, creating measurable supply shock potential when combined with similar institutional actions.

Onchainlens transaction data shows BlackRock moved 3,040 BTC (valued at $270 million) and 61,359 ETH (valued at $190 million) from known exchange wallets to cold storage addresses between 04:00 and 12:00 UTC on January 8, 2026. The Bitcoin withdrawal represents approximately 15.8% of BlackRock's reported iShares Bitcoin Trust holdings as of Q4 2025, while the Ethereum movement corresponds to roughly 12.3% of their disclosed ETH positions. According to the official SEC.gov filing database, BlackRock's cryptocurrency custody practices emphasize institutional-grade security protocols, making exchange-to-cold-storage movements standard operational procedure for long-term holders.

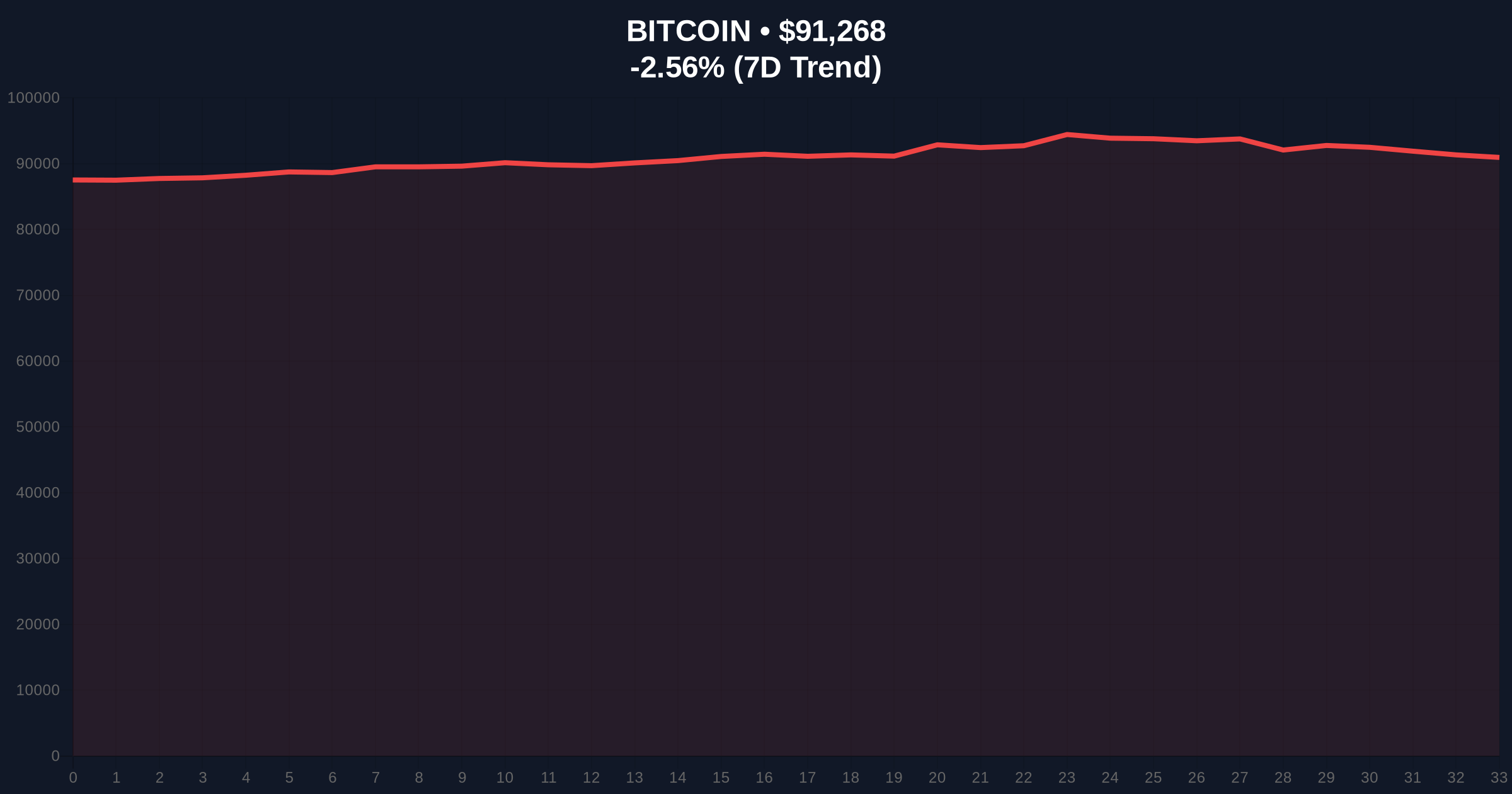

Bitcoin's current price of $91,228 represents a 2.55% decline over the past 24 hours, creating a potential Fair Value Gap (FVG) between $92,500 and $94,200 that may attract liquidity. The 50-day exponential moving average at $89,750 provides immediate support, while the 200-day simple moving average at $84,200 establishes the primary trend framework. Volume profile analysis indicates significant accumulation between $88,000 and $90,000, creating an Order Block that institutional players appear to be defending. Bullish invalidation occurs below the $88,500 Fibonacci 0.618 retracement level from the November 2025 high, while bearish invalidation requires a sustained break above the $95,000 resistance cluster that has rejected price action three times since December.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 42/100 (Fear) |

| Bitcoin Current Price | $91,228 |

| 24-Hour Price Change | -2.55% |

| BlackRock BTC Withdrawn | 3,040 BTC ($270M) |

| BlackRock ETH Withdrawn | 61,359 ETH ($190M) |

| Total Value Withdrawn | $460 million |

Institutional impact manifests through supply reduction mechanics, where exchange withdrawals decrease immediately available liquidity, potentially exacerbating volatility during demand spikes. Retail impact remains psychological, with the Fear & Greed Index at 42/100 indicating continued apprehension despite institutional accumulation signals. The divergence between institutional on-chain behavior and retail sentiment metrics creates a classic market structure setup observed during previous accumulation phases, particularly in Q4 2020 preceding the 2021 bull market. Ethereum's upcoming Pectra upgrade, which includes EIP-7251 increasing validator stake limits, provides additional fundamental context for institutional ETH accumulation beyond simple portfolio rebalancing.

Market analysts on X/Twitter have highlighted the timing relative to broader macroeconomic conditions. One quantitative researcher noted, "BlackRock's withdrawal coincides with the Federal Reserve's December meeting minutes indicating potential rate cuts in Q2 2026, creating a macro-accumulation alignment not seen since 2023." Another observer referenced the recent analysis of institutional liquidity grabs during policy shifts, suggesting similar patterns may be emerging in digital assets. No direct quotes from BlackRock executives were available, but their official investment thesis emphasizes long-term store-of-value characteristics for both assets.

Bullish Case: Sustained institutional accumulation reduces exchange supply below critical thresholds, triggering a gamma squeeze as options market makers hedge increasing demand. Bitcoin reclaims the $95,000 resistance level by February 2026, with Ethereum outperforming due to staking yield advantages post-Pectra. The bullish scenario invalidates below $88,500.

Bearish Case: Macroeconomic headwinds from potential policy shifts, including developments from the World Liberty Financial banking license proceedings, override institutional accumulation signals. Bitcoin breaks the $88,500 support, filling the FVG down to $84,200 where the 200-day SMA provides final defense. The bearish scenario invalidates above $95,000 with sustained volume.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.