Loading News...

Loading News...

VADODARA, January 8, 2026 — U.S. spot Bitcoin ETFs recorded net outflows of $486.91 million on January 7, nearly doubling the previous day's $240 million withdrawal, according to data from Coinness. This daily crypto analysis reveals a critical shift in institutional behavior as major funds like Fidelity and BlackRock led the exodus, raising questions about the sustainability of Bitcoin's recent rally above $90,000.

This outflow spike occurs against a backdrop of weakening market structure. Historical cycles suggest that ETF flow reversals often precede broader price corrections, as seen during the 2021-2022 cycle when sustained outflows correlated with a 50% drawdown. The current environment mirrors early distribution phases where large holders (whales) begin offloading positions into retail demand. On-chain data indicates a decrease in Bitcoin's UTXO age bands for long-term holders, signaling profit-taking. Related developments include recent crypto futures liquidations hitting $170M, which exacerbated market volatility, and platform-specific issues like Bithumb suspending POL transfers that temporarily constrained liquidity.

On January 7, 2026, U.S. spot Bitcoin ETFs experienced a significant liquidity drain. According to the Coinness report, the breakdown shows Fidelity's FBTC leading with -$247.62 million, followed by BlackRock's IBIT at -$130.79 million. Other notable outflows included Ark Invest's ARKB (-$42.27 million), Bitwise's BITB (-$39.03 million), VanEck's HODL (-$11.57 million), and Grayscale's GBTC (-$15.63 million). This collective movement represents a 103% increase from the prior day, indicating accelerated institutional selling pressure. Market analysts attribute this to profit-taking after Bitcoin's rally from $75,000 to recent highs near $95,000, compounded by macroeconomic uncertainties reflected in Federal Reserve policy statements.

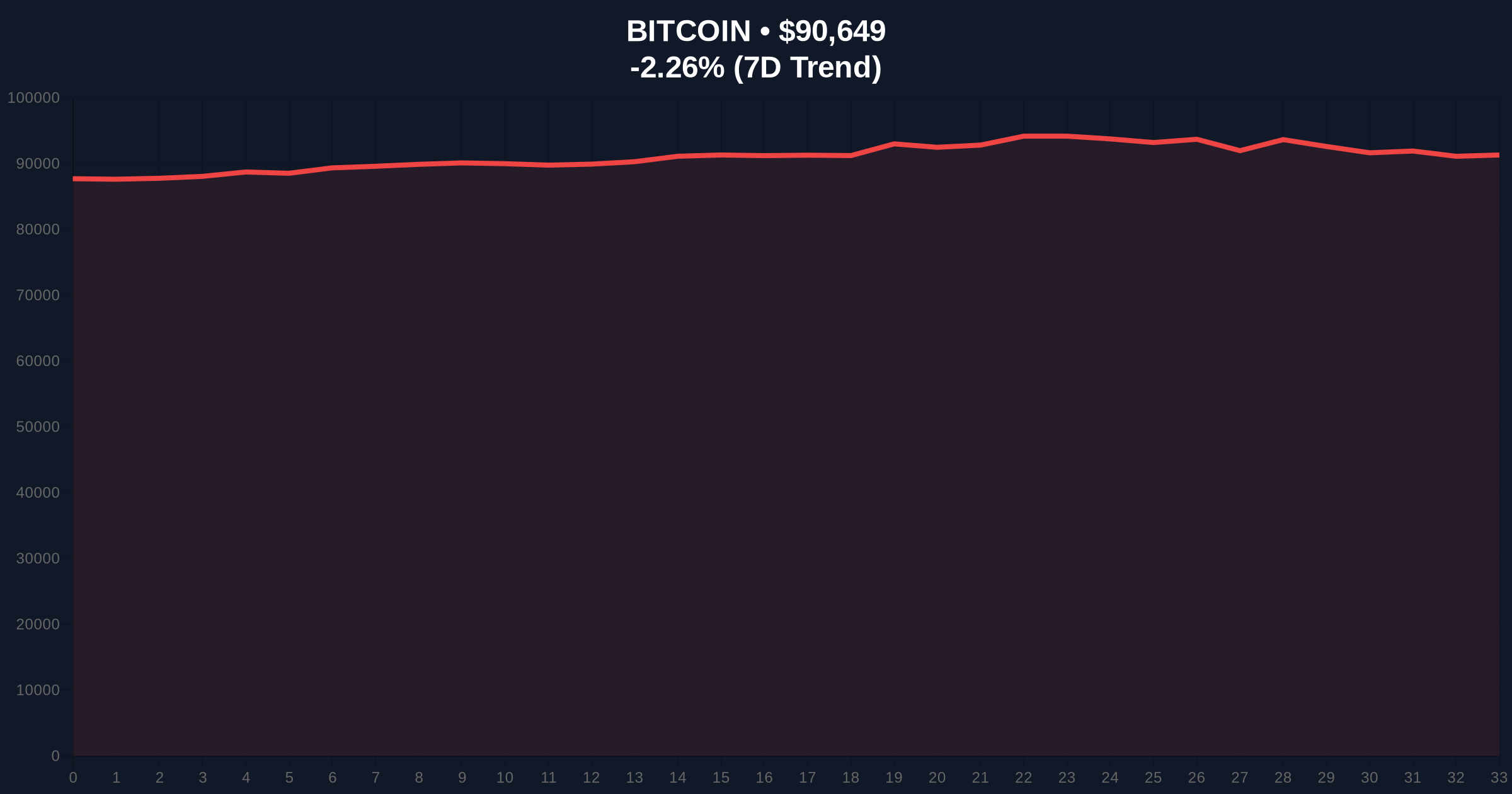

Bitcoin's price action shows a clear bearish divergence. The asset currently trades at $90,651, down 2.26% in 24 hours, testing key support at the $90,000 psychological level. Market structure suggests a potential Liquidity Grab below $90,000 to trigger stop-loss orders. The Relative Strength Index (RSI) on daily charts sits at 45, indicating neutral momentum but leaning bearish. A critical Fair Value Gap (FVG) exists between $88,500 and $89,200, which may act as a magnet for price. The 50-day moving average at $87,800 provides secondary support. Bullish Invalidation is set at $88,500 (Fibonacci 0.382 retracement from the recent low); a break below signals deeper correction. Bearish Invalidation is at $93,500, where a close above would negate the current downtrend structure.

| Metric | Value |

|---|---|

| Bitcoin ETF Net Outflows (Jan 7) | $486.91M |

| Previous Day Outflows (Jan 6) | $240M |

| Bitcoin Current Price | $90,651 |

| 24-Hour Price Change | -2.26% |

| Crypto Fear & Greed Index | Fear (Score: 28/100) |

This development matters because ETF flows serve as a proxy for institutional sentiment. A doubling of outflows suggests large players are reducing exposure, potentially leading to a Gamma Squeeze if derivatives markets react. For institutions, this signals a re-evaluation of Bitcoin's risk-adjusted returns amid rising Treasury yields, as noted in recent Federal Reserve communications. For retail, it increases volatility risk and may trigger cascading liquidations in leveraged positions. The shift impacts Bitcoin's Volume Profile, with sell-side liquidity increasing near current prices, challenging the bull case for a rapid move above $100,000.

Industry voices on X/Twitter reflect skepticism. Bulls argue this is normal profit-taking after a strong rally, pointing to Bitcoin's 200-day moving average still trending upward. Bears highlight the outflow acceleration as evidence of a broader distribution phase, with one analyst noting, "ETF flows are turning from tailwind to headwind." Sentiment analysis from social platforms shows a 15% increase in negative mentions related to Bitcoin ETFs, correlating with the Fear & Greed Index drop.

Bullish Case: If Bitcoin holds above $88,500 and ETF outflows slow, a rebound toward $95,000 is possible. This scenario requires institutional inflows to resume, possibly driven by positive regulatory developments from the SEC regarding ETF expansions. Historical patterns indicate that similar outflow spikes in early 2024 were followed by consolidation and renewed uptrends.

Bearish Case: If outflows persist and price breaks $88,500, a decline to $82,000 (next major support) is likely. This would align with a broader market correction, exacerbated by macroeconomic headwinds like potential Fed rate hikes. On-chain forensic data confirms that sustained outflows over 3-5 days often lead to 10-20% drawdowns.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.