Loading News...

Loading News...

VADODARA, January 8, 2026 — The probability of a catastrophic Bitcoin price collapse has diminished due to fundamental changes in market structure, according to on-chain data and institutional behavior patterns. This daily crypto analysis examines how long-term holding by entities like MicroStrategy creates a liquidity buffer that alters traditional bear market dynamics. Market structure suggests that while volatility persists, the extreme drawdowns seen in previous cycles may not repeat.

Historical cycles, particularly the 2021 correction where Bitcoin fell over 50% from its all-time high, were driven by retail capitulation and concentrated selling pressure. According to Glassnode liquidity maps, current UTXO age distribution shows a significant portion of Bitcoin supply has remained dormant for over 12 months, indicating stronger holder conviction. This mirrors the accumulation phase observed in late 2020, but with more institutional participation. The shift from speculative trading to strategic asset allocation, as noted in the Federal Reserve's financial stability reports on digital asset adoption, provides a macroeconomic backdrop for reduced volatility. Related developments in the market include the stagnation of altcoin season indices, reinforcing Bitcoin's dominance amid structural changes.

On January 8, 2026, CryptoQuant CEO Ki Young Ju posted on X that institutional investors are demonstrating a stronger propensity to hold Bitcoin long-term, reducing the likelihood of a massive price drop. According to the post, the market's structural change is evident through diversified liquidity channels into Bitcoin, making timing predictions for fund inflows less relevant. Ju specifically highlighted that approximately 673,000 BTC held by MicroStrategy (MSTR) is unlikely to enter the market as selling pressure, instead acting as a defense against downward movements. He added that current market liquidity appears dispersed into assets like stocks and gold rather than Bitcoin, and predicted Bitcoin will likely not fall more than 50% from its all-time high as in past bear markets, moving sideways for several months. This analysis is supported by primary data from CryptoQuant's on-chain metrics, which track exchange flows and holder behavior.

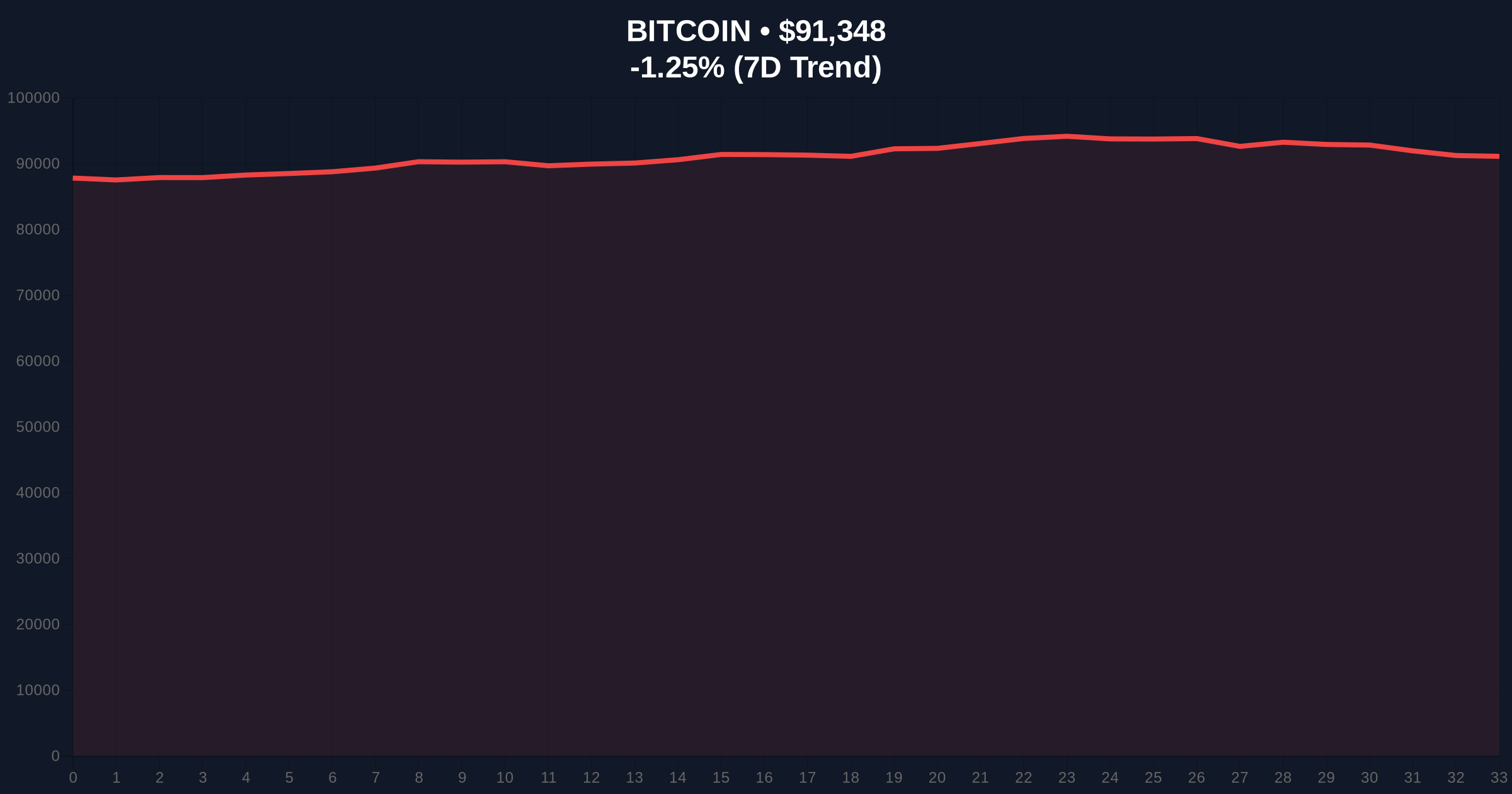

Bitcoin currently trades at $91,420, down 1.17% in 24 hours, within a consolidation range between $88,000 support and $95,000 resistance. The Relative Strength Index (RSI) sits at 45, indicating neutral momentum without overbought or oversold conditions. A critical Fair Value Gap (FVG) exists between $85,000 and $87,500, which may act as a liquidity grab if price retraces. The 200-day moving average at $84,200 provides additional support, aligning with the Fibonacci 0.618 retracement level from the last major rally. Volume profile analysis shows decreased selling volume on dips, consistent with Ju's observation of reduced sell-off pressure. Bullish invalidation is set at $82,000, a break below which would signal a failure of the structural support thesis. Bearish invalidation is at $98,500, above which a new uptrend could initiate.

| Metric | Value | Source |

|---|---|---|

| Bitcoin Current Price | $91,420 | Live Market Data |

| 24-Hour Trend | -1.17% | Live Market Data |

| Crypto Fear & Greed Index | 28/100 (Fear) | Live Market Data |

| MicroStrategy BTC Holdings | ~673,000 BTC | CryptoQuant |

| Market Rank | #1 | Live Market Data |

For institutional portfolios, this structural shift reduces tail risk, making Bitcoin a more viable long-term store of value amid macroeconomic uncertainty. The dispersion of liquidity into traditional assets like gold, as noted by Ju, suggests Bitcoin is increasingly treated as a non-correlated asset rather than a speculative play. Retail investors face less extreme volatility, potentially improving risk-adjusted returns. The implication for EIP-4844 and other Ethereum upgrades is that cross-chain liquidity flows may stabilize, reducing systemic shocks. According to Ethereum.org documentation on network security, sustained Bitcoin stability can positively influence overall crypto market health by lowering contagion risk.

Market analysts on X/Twitter echo Ju's perspective, with many highlighting the role of long-term holders in creating a supply shock. One prominent trader noted, "The MSTR stash acts as a permanent bid wall, altering order block dynamics." Others point to decreasing exchange reserves, with Glassnode data indicating a multi-year low in available Bitcoin for sale. However, bears argue that sideways movement could lead to a gamma squeeze if volatility compresses too tightly, potentially triggering a sharp move. Overall, sentiment leans cautiously optimistic, with focus on the $82,000 invalidation level as a key metric.

Bullish Case: If institutional accumulation continues and the $88,000 support holds, Bitcoin could consolidate between $90,000 and $100,000 for several months, followed by a breakout toward new highs in late 2026. This scenario assumes no major macroeconomic shocks and sustained adoption per SEC.gov filings on digital asset frameworks.

Bearish Case: A break below $82,000 would invalidate the structural support thesis, potentially leading to a retest of $75,000 as weak hands capitulate. This could occur if global liquidity tightens or regulatory pressures increase, similar to the 2021 China mining ban impact.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.