Loading News...

Loading News...

VADODARA, January 6, 2026 — According to validator queue analysis site ValidatorQueue, 1.186 million ETH are currently queued for staking on the Ethereum Proof-of-Stake network, with an estimated completion time of 20 days and 14 hours, while the unstaking queue remains empty. This daily crypto analysis reveals a significant liquidity grab by mining giant Bitmain, highlighting institutional confidence despite a broader market fear sentiment. Market structure suggests this backlog could create a supply squeeze, with on-chain data indicating reduced liquid ETH availability as staked tokens become illiquid for extended periods.

Ethereum's transition to Proof-of-Stake via The Merge in 2022 fundamentally altered its issuance model, introducing staking as a core mechanism for network security and yield generation. Historically, large staking inflows have correlated with periods of accumulation, as seen during the Shanghai upgrade when over 500,000 ETH were staked within weeks. The current backlog mirrors this pattern but on a larger scale, driven by institutional actors rather than retail. Underlying this trend is Ethereum's EIP-4844 implementation, which reduced layer-2 transaction costs and increased network utility, making staking more attractive for long-term holders. Related developments include Bitmain's previous $600M ETH stake and shifts in the Crypto Fear & Greed Index.

ValidatorQueue data confirms a staking queue of 1.186 million ETH, valued at approximately $3.8 billion at current prices, with a 20-day, 14-hour processing time. The backlog is attributed to a large-scale staking operation by Bitmain, a major player in cryptocurrency mining and infrastructure. In contrast, the unstaking queue is empty, indicating no significant withdrawal demand. This asymmetry creates a net inflow of ETH into staking contracts, reducing circulating supply. According to Ethereum.org documentation, staked ETH is subject to a withdrawal queue mechanism that processes requests sequentially, but current data shows zero pending unstakes, suggesting holders are opting for illiquidity amid market volatility.

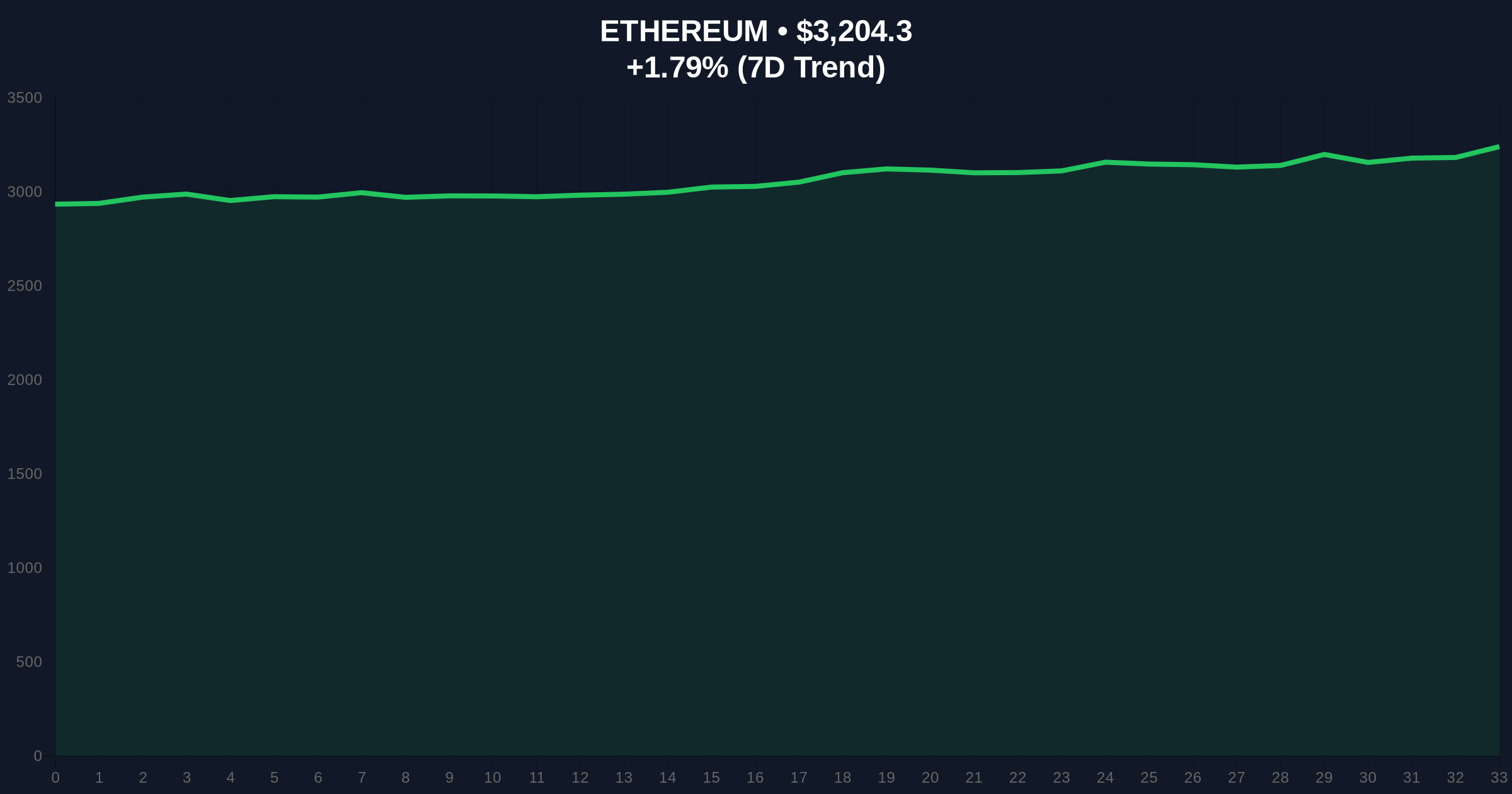

Ethereum's price currently sits at $3,204.93, up 1.82% in 24 hours, but remains below its all-time high near $4,900. The Relative Strength Index (RSI) on daily charts is at 52, indicating neutral momentum without overbought or oversold conditions. Key support levels include the 50-day moving average at $3,150 and a Fibonacci retracement level at $3,100 from the 2024-2025 rally. Resistance is noted at $3,350, where previous order blocks have formed. The staking backlog acts as a bullish catalyst by potentially creating a gamma squeeze if demand outpaces liquid supply. Bullish invalidation level: $3,100—a break below suggests failed accumulation and could trigger further downside. Bearish invalidation level: $3,350—a sustained move above indicates strength and may accelerate the staking trend.

| Metric | Value |

|---|---|

| ETH Staking Queue | 1.186 million ETH |

| Queue Completion Time | 20 days, 14 hours |

| Current ETH Price | $3,204.93 |

| 24-Hour Trend | +1.82% |

| Crypto Fear & Greed Index | 44 (Fear) |

| Market Rank | #2 |

This development matters for both institutional and retail participants. Institutionally, Bitmain's move signals confidence in Ethereum's long-term value, potentially encouraging other firms to follow suit, as seen in filings with the SEC regarding crypto holdings. For retail, the staking backlog reduces liquid ETH supply, which could support prices if demand persists, but also increases illiquidity risk during market downturns. The empty unstaking queue suggests holders are not seeking exits despite fear sentiment, indicating a divergence between short-term sentiment and long-term conviction. Consequently, this may lead to a fair value gap if price action lags behind on-chain accumulation metrics.

Market analysts on X/Twitter highlight the staking queue as a bullish signal amid fear. One observer noted, "Bitmain's ETH stake is a liquidity grab that could tighten supply dramatically." Others point to the empty unstaking queue as evidence of holder resilience, with sentiment leaning toward accumulation rather than distribution. However, bears caution that high staking levels could exacerbate sell pressure if validators eventually exit, though current data does not support this near-term.

Bullish Case: If the staking backlog persists and demand increases, ETH could break above $3,350 resistance, targeting $3,600 as reduced supply meets institutional buying. Historical cycles suggest such accumulation phases often precede rallies, especially with EIP-4844 enhancing network efficiency.Bearish Case: A failure to hold $3,100 support, coupled with a sudden rise in unstaking requests, could trigger a sell-off toward $2,800. Market fear at 44/100 indicates vulnerability to negative catalysts, such as broader macroeconomic shifts from the Federal Reserve.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.