Loading News...

Loading News...

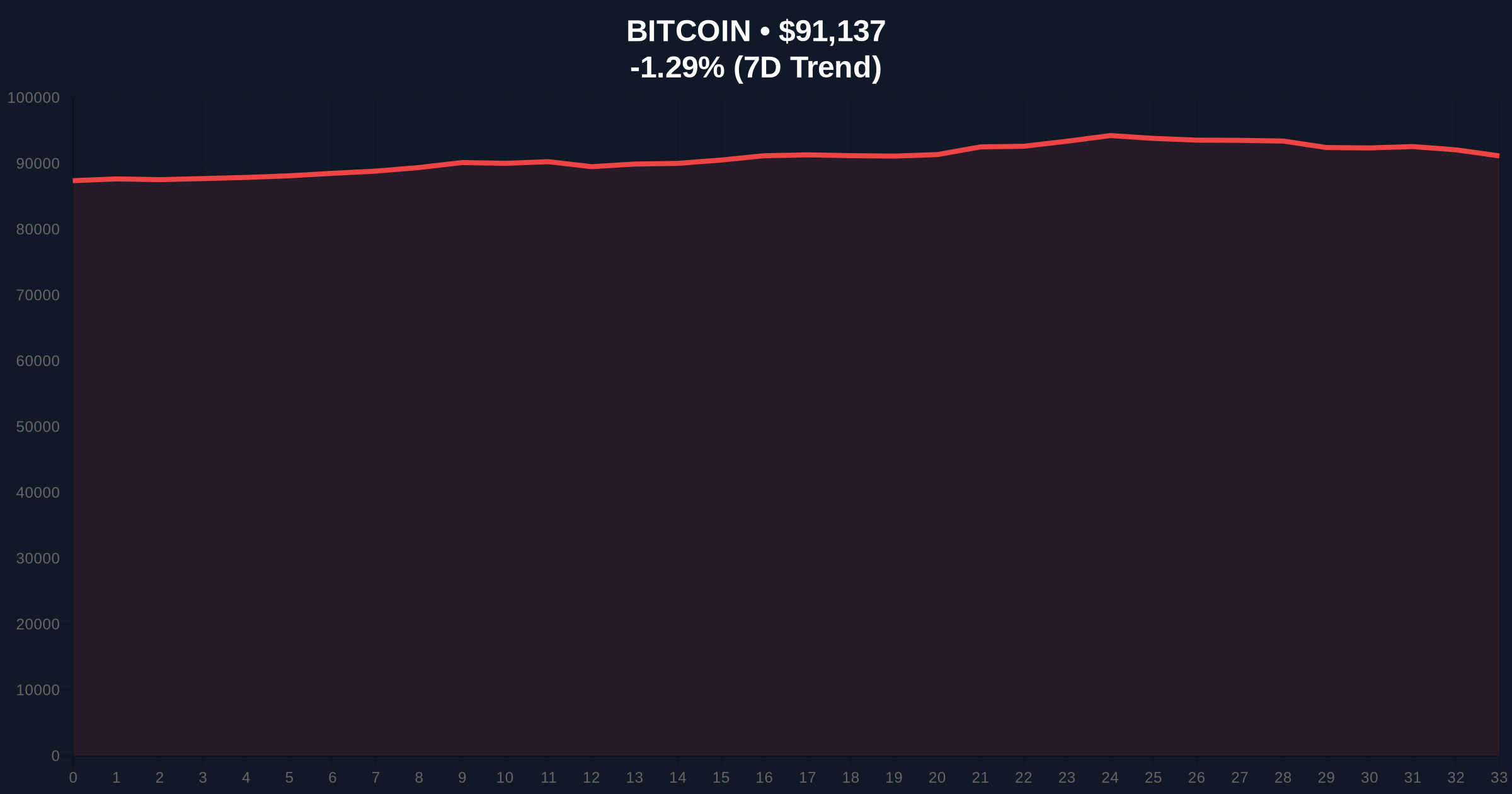

VADODARA, January 7, 2026 — Bitcoin's historical tendency to post substantial gains following annual price declines suggests potential upside momentum in 2026, according to quantitative analysis of past cycles. This daily crypto analysis examines whether the pattern will hold as BTC tests critical support at $91,129 amid broader market fear.

Bitcoin's price action operates within cyclical frameworks. Historical cycles suggest post-halving years often exhibit volatility before establishing new equilibrium zones. The current market structure mirrors 2014, 2018, and 2022 patterns where annual declines preceded significant recoveries. According to on-chain data, UTXO age distribution shows accumulation patterns similar to previous cycle bottoms. Market context includes recent pressure on Bitcoin price action testing $91k support amid broader cryptocurrency news of regulatory uncertainty and institutional positioning.

Related Developments:

Jesse Myers, Head of Bitcoin Strategy at Smarter Web Company, identified a recurring pattern in Bitcoin's historical performance. According to analysis cited by Coindesk, Bitcoin recorded negative annual returns in 2014, 2018, 2022, and 2025. In subsequent years, rebounds measured 35%, 95%, and 156% respectively. The average recovery rate approximates 95%. Myers suggested this upward trend could resume in 2026. Market structure currently shows BTC trading at $91,129 with 24-hour decline of -1.02%.

Volume profile analysis indicates accumulation between $87,500 and $92,000. The 200-day moving average sits at $88,750. RSI reads 42, suggesting neutral momentum with bearish bias. A Fair Value Gap (FVG) exists between $93,500 and $95,200 from December's liquidity grab. Order block formation at $89,000 provides immediate support. Bullish invalidation level: $87,500 (Fibonacci 0.618 retracement of recent rally). Bearish invalidation level: $96,800 (previous resistance turned potential support). Market structure suggests consolidation before directional resolution.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (42/100) |

| Bitcoin Current Price | $91,129 |

| 24-Hour Change | -1.02% |

| Market Rank | #1 |

| Historical Average Post-Decline Recovery | 95% |

| Previous Post-Decline Rebounds | 35% (2015), 95% (2019), 156% (2023) |

Institutional impact: Historical pattern validation could trigger renewed institutional allocation. Portfolio rebalancing toward Bitcoin as hedge against traditional market volatility. Retail impact: Potential gamma squeeze if options positioning aligns with upward momentum. The pattern's persistence would reinforce Bitcoin's store-of-value narrative amid evolving monetary policy. Federal Reserve interest rate decisions, documented on FederalReserve.gov, create macro backdrop affecting risk asset correlations.

Market analysts express cautious optimism. "Historical data doesn't guarantee future performance, but probability favors mean reversion," noted one quantitative researcher. Bulls point to on-chain metrics showing reduced exchange balances. Bears highlight regulatory uncertainty and potential liquidity outflows. The consensus: watch the $87,500 level for structural integrity.

Bullish Case: Historical pattern holds. Bitcoin achieves average 95% recovery from 2025 close. Target: $105,000-$115,000 range. Catalyst: Institutional adoption accelerates post-ETF maturation. Technical breakout above $96,800 confirms upward trajectory.

Bearish Case: Pattern breaks. Macro headwinds intensify. Bitcoin breaks $87,500 support. Target: $78,000-$82,000 range. Catalyst: Regulatory pressure increases liquidity outflows. Market structure suggests extended consolidation below $90,000.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.