Loading News...

Loading News...

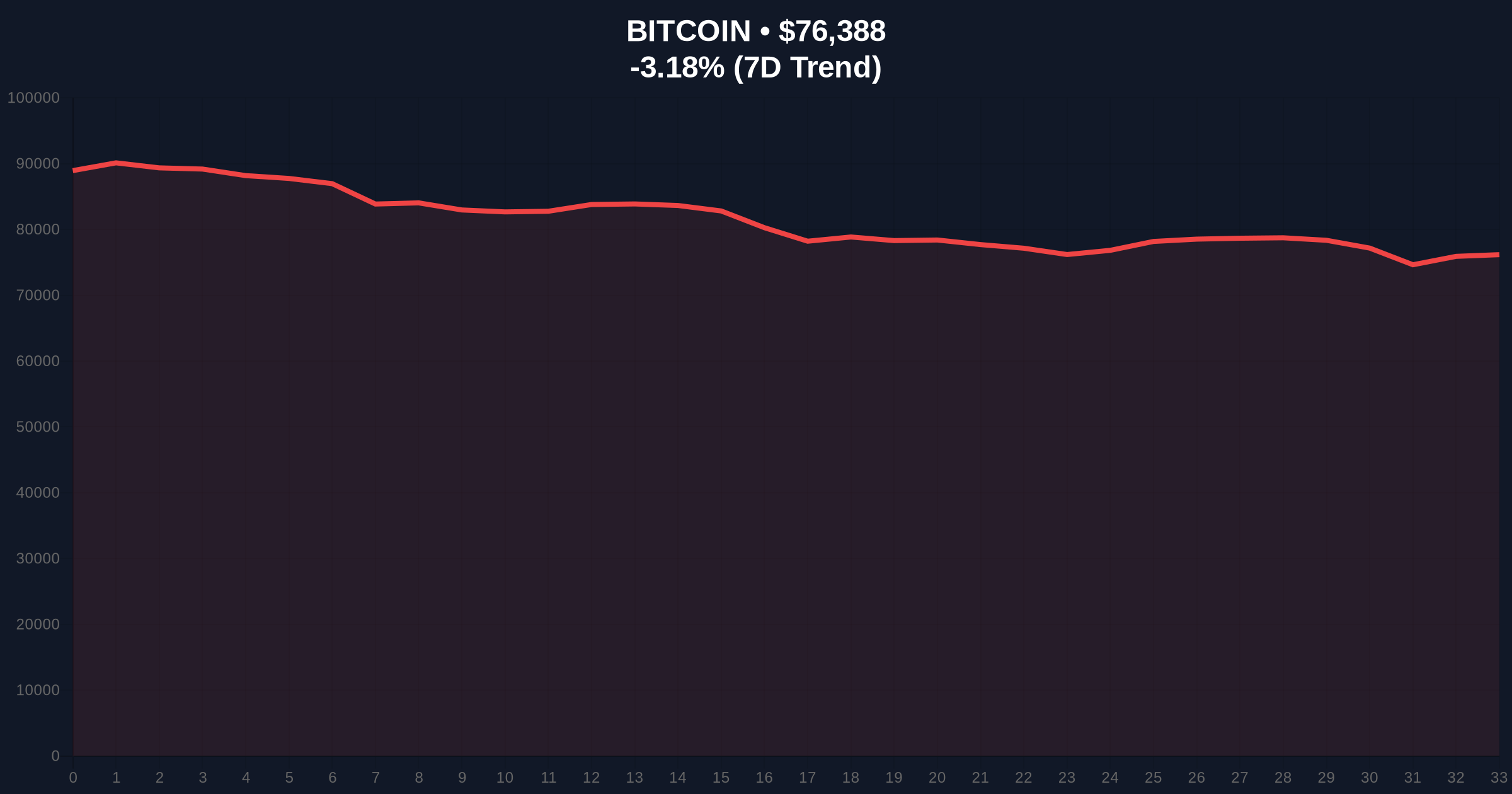

VADODARA, February 4, 2026 — Bitcoin recorded its largest inflow of the year to Binance. Approximately 59,000 BTC moved to the exchange between February 2 and 3. This daily crypto analysis reveals extreme fear driving short-term holders to sell at a loss. Market structure suggests a potential capitulation phase.

According to on-chain data from CryptoQuant, analyst Darkfost reported the massive inflow. Between February 2 and 3, Binance received 56,000 to 59,000 BTC. This marks the largest deposit of 2026. Short-term holders drove the activity. They sent 54,000 BTC to exchanges at a loss on February 2 alone.

Darkfost noted the inflow creates real selling pressure on the spot market. Fear spread as BTC threatened the $74,000 level. This is a key long-term trend line. The analyst explained the paradox. Record inflows indicate an oversold region. Historically, market bottoms form during such capitulation phases.

Historically, large exchange inflows correlate with panic selling. The 2021 cycle saw similar patterns before reversals. In contrast, the current inflow exceeds typical capitulation volumes. Underlying this trend is extreme fear among retail investors.

, this event mirrors past liquidity crises. For instance, the Bitcoin liquidity crisis in early 2026 highlighted similar risks. Market analysts note that short-term holder behavior often signals local bottoms. The $74,000 level now acts as a critical psychological support.

Market structure suggests key levels. The $74,000 trend line is a Fibonacci 0.618 retracement from the 2025 high. RSI data indicates oversold conditions below 30. The 200-day moving average sits at $72,500. A break below this would invalidate the bullish structure.

Consequently, UTXO age bands show young coins moving. This confirms short-term holder capitulation. Order blocks near $75,000 are now under pressure. The Fair Value Gap (FVG) between $76,000 and $78,000 remains unfilled. This creates a liquidity grab zone for sellers.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Bitcoin Current Price | $76,361 |

| 24-Hour Price Change | -3.21% |

| BTC Inflow to Binance (Feb 2-3) | 59,000 BTC |

| BTC Sent at a Loss (Feb 2) | 54,000 BTC |

This matters for institutional liquidity cycles. Large inflows often precede market reversals. Retail market structure is breaking. Short-term holders are capitulating. This creates a potential buying opportunity for long-term investors.

On-chain data indicates oversold conditions. The Volume Profile shows high volume nodes at $74,000. A hold here could trigger a short squeeze. Conversely, a break lower may lead to further downside. The Ethereum network's recent staking queue delays, as seen in related developments, highlight broader market stress.

"Capitulation phases are painful but necessary. The 59,000 BTC inflow to Binance signals extreme fear. Historically, this marks local bottoms. However, traders must watch the $74,000 level for confirmation." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge. First, a bullish reversal if support holds. Second, further downside if capitulation continues.

The 12-month institutional outlook remains cautious. Capitulation often leads to consolidation. For the 5-year horizon, this event may represent a buying opportunity. However, immediate price action depends on the $74,000 hold.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.