Loading News...

Loading News...

VADODARA, February 3, 2026 — Mike Silagadze, CEO of Ether.fi, labels Ethereum's recent price decline as temporary market noise. In an interview with CoinDesk, he cites a 70-day staking queue and steady institutional demand. This latest crypto news a growing disconnect between short-term volatility and long-term fundamentals.

Mike Silagadze directly addressed Ethereum's price weakness. He called it "merely market noise, not a sign of weakening fundamentals." According to on-chain data, the ETH staking queue now extends to approximately 70 days. This metric demonstrates persistent network demand.

Silagadze emphasized long-term staking trends. He noted institutional demand is holding steady. , user numbers and network revenue are rising. "We are looking at long-term growth," he stated. The current environment favors builders over speculators.

He recalled historical patterns. Ethereum often achieves technical milestones during chaotic markets. Builders continue implementing new technology regardless of price. This cycle will focus on adoption and utility. Meme-driven hype has subsided.

Historically, Ethereum's price and development activity frequently diverge. The 2018 bear market saw significant protocol upgrades. Similarly, the 2022 downturn coincided with The Merge. Current conditions mirror these phases.

In contrast, retail overheating has cooled. This reduces speculative froth. Consequently, institutional capital dominates staking queues. Market structure suggests a shift toward quality. Long-term value creation takes precedence.

Related developments highlight broader trends. For instance, Binance's margin delistings signal liquidity consolidation amid extreme fear. Additionally, Pharos Foundation's $10M incubator targets RWA and DeFi infrastructure, aligning with Silagadze's utility focus.

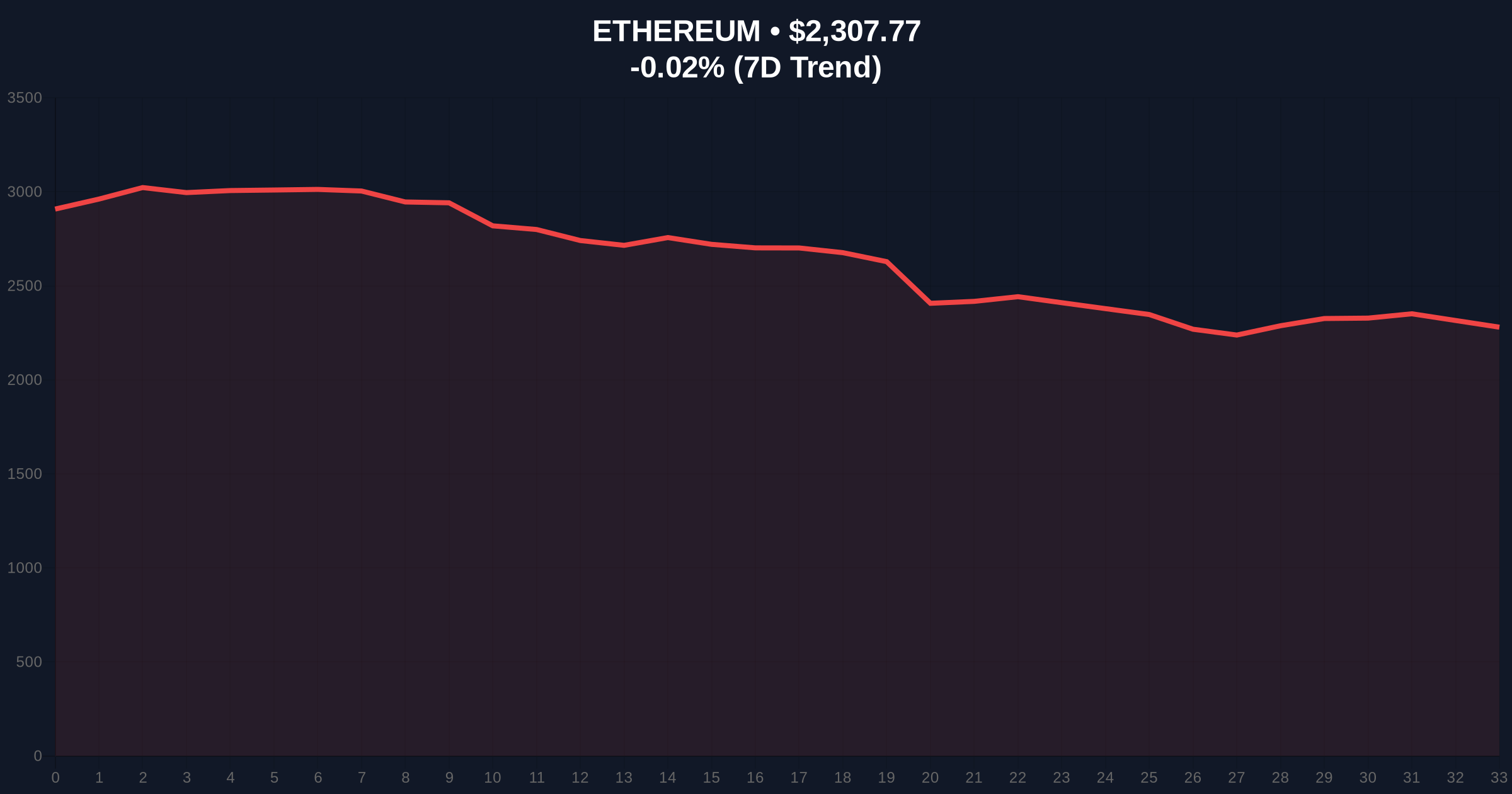

Market structure suggests key levels are in play. Ethereum currently trades near $2,301.74. The 24-hour trend shows a minor decline of -0.28%. Critical support resides at the $2,200 level.

This zone aligns with the 200-day moving average. It also corresponds to the 0.618 Fibonacci retracement from the 2025 high. A breach here would invalidate the bullish structure. Resistance sits at $2,450, a previous order block.

On-chain metrics reveal underlying strength. The staking queue extension indicates locked supply. Post-merge issuance remains deflationary during high activity. This creates a structural bid for ETH. Volume profile analysis shows accumulation near current prices.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) | Contrarian bullish signal historically |

| Ethereum Current Price | $2,301.74 | Testing key support zones |

| 24-Hour Price Trend | -0.28% | Minor correction within range |

| ETH Staking Queue | ~70 days | Strong institutional demand indicator |

| Market Rank | #2 | Maintains dominance vs. altcoins |

This event matters for portfolio allocation. The staking queue acts as a liquidity sink. It reduces circulating supply. Consequently, any demand surge could trigger a gamma squeeze. Institutional cycles favor assets with utility.

Real-world evidence supports this. Ethereum's revenue growth continues despite price drops. Network upgrades like EIP-4844 enhance scalability. This attracts long-term builders. Retail sentiment is decoupling from fundamentals.

Market structure suggests the current price action is noise. The 70-day staking queue represents a structural bid. Institutional demand remains intact. We view this as a typical Fair Value Gap in a bullish macro trend. - CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge. First, support holds at $2,200. This triggers a rally toward $2,800. Second, breakdown occurs. That leads to a test of $2,000.

The 12-month outlook hinges on adoption. Institutional staking trends suggest accumulation. Regulatory clarity, as seen in global banking shifts, could accelerate inflows. Over five years, Ethereum's utility focus may drive outperformance.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.