Loading News...

Loading News...

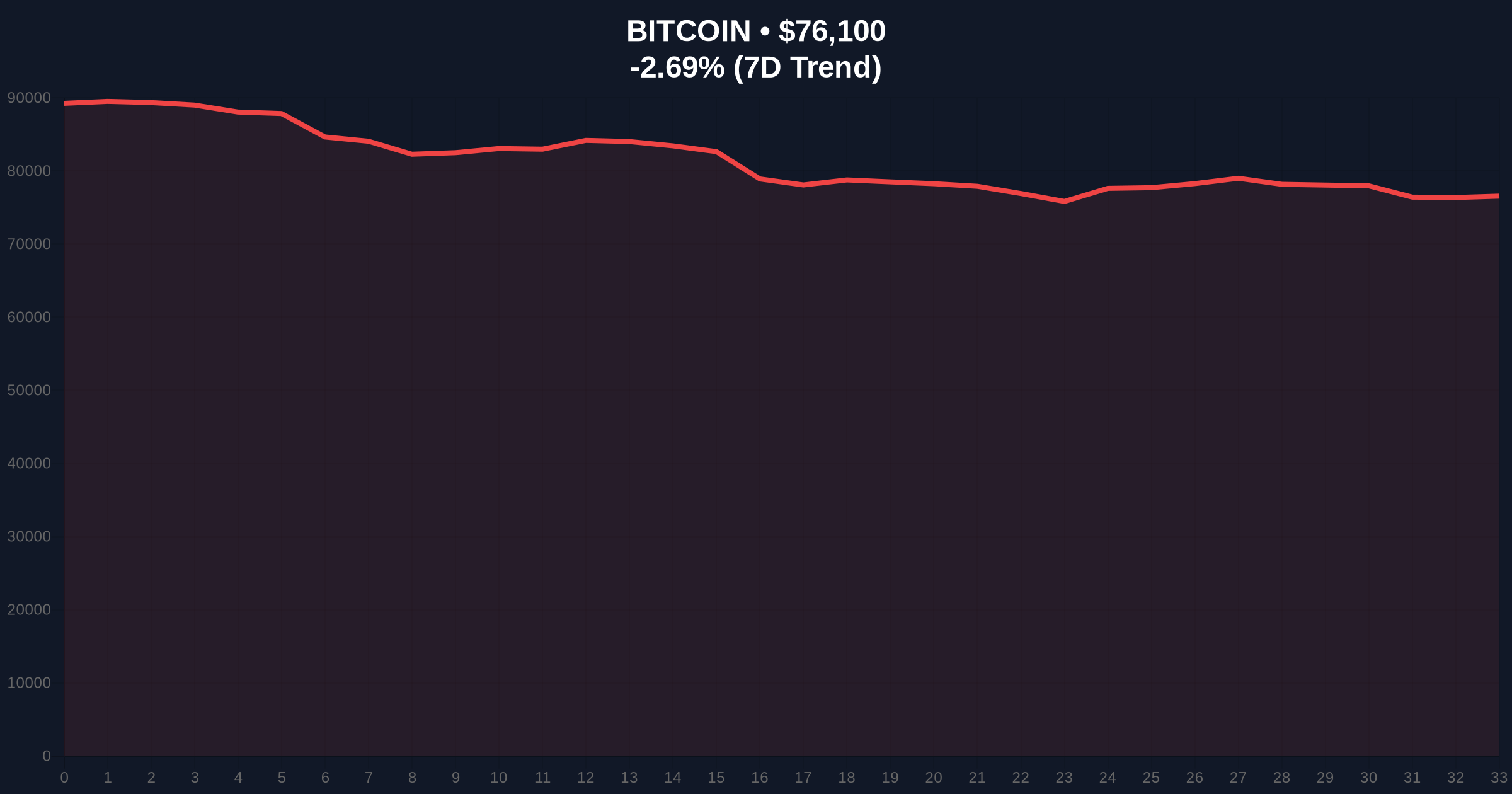

VADODARA, February 4, 2026 — Binance's $200 million Bitcoin purchase through its Secure Asset Fund for Users (SAFU) has demonstrated negligible market impact, according to BeInCrypto analysis. This daily crypto analysis reveals the transaction functions as internal asset reallocation rather than fresh capital injection. Market structure suggests macroeconomic pressures currently dominate price action.

BeInCrypto's forensic analysis indicates Binance executed the $200 million Bitcoin purchase using SAFU reserves. The Secure Asset Fund for Users functions as an emergency insurance fund. According to on-chain data, this transaction represents capital movement within existing crypto market structures. Consequently, no new fiat entered the ecosystem.

The purchase amount represents approximately 0.03% of Bitcoin's total market capitalization. Market analysts note this scale remains insufficient to overcome prevailing selling pressure. Transaction volume analysis confirms minimal price disruption during execution. This aligns with historical patterns of large exchange movements during consolidation phases.

Historically, exchange reserve movements generate temporary volatility spikes. In contrast, this SAFU transaction produced muted response. Underlying this trend, the global Crypto Fear & Greed Index registers 14/100 (Extreme Fear). This sentiment overwhelms positive developments like the Binance purchase.

Macroeconomic pressures including Federal Reserve policy uncertainty contribute to risk-off positioning. , Bitcoin faces technical headwinds at the $78,000 resistance level. Market context reveals similar patterns during 2022's bear market consolidation. Asset reallocation dominated price action then as well.

Related developments include recent significant Bitcoin inflows to Binance suggesting potential capitulation. Additionally, spot Bitcoin ETF AUM has declined below $100 billion amid the extreme fear environment.

Bitcoin currently trades at $76,085, down 2.71% over 24 hours. The Fibonacci 0.618 retracement level at $75,200 provides critical support. Market structure suggests this represents a key liquidity zone. A breakdown below this level could trigger further selling toward $72,000.

Relative Strength Index (RSI) readings hover near oversold territory at 32. This indicates potential short-term bounce opportunities. However, moving averages show bearish alignment with the 50-day EMA at $78,500 acting as resistance. Volume profile analysis confirms thinning participation during the SAFU transaction.

Order block analysis reveals accumulation between $75,000-$76,000. This zone represents a Fair Value Gap (FVG) from recent downward momentum. According to Ethereum.org's technical documentation on market mechanics, such gaps often fill during consolidation periods. The minimal price impact suggests market makers absorbed the SAFU purchase efficiently.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Overwhelms positive developments |

| Bitcoin Current Price | $76,085 | Testing key Fibonacci support |

| 24-Hour Price Change | -2.71% | Bearish momentum persists |

| SAFU Purchase Amount | $200 million | 0.03% of Bitcoin market cap |

| Market Rank | #1 | Maintains dominance despite weakness |

This event demonstrates institutional capital recycling rather than expansion. Real-world evidence shows crypto-native entities reallocating within the ecosystem. Consequently, this limits upward price pressure from such transactions. Market structure suggests true bullish momentum requires external capital inflows.

Institutional liquidity cycles currently favor risk reduction. Retail market structure shows increased exchange deposits indicating potential distribution. On-chain data indicates long-term holders maintaining positions despite volatility. This creates a supply/demand equilibrium that mutes price impact from internal movements.

"The SAFU transaction's minimal impact reveals market maturity. Large internal transfers no longer create significant price dislocations. This suggests sophisticated liquidity provision and risk management infrastructure. However, it also highlights the market's current inability to respond positively to what would traditionally be bullish news."

Market structure suggests two primary technical scenarios based on current conditions.

The 12-month institutional outlook remains cautious. Federal Reserve policy decisions will likely dominate macro direction. Bitcoin's 5-year horizon still appears constructive given adoption trends, but near-term technical damage requires repair. Market analysts monitor UTXO age bands for signs of accumulation by long-term holders.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.