Loading News...

Loading News...

VADODARA, February 4, 2026 — Spot Bitcoin Exchange-Traded Fund assets under management have collapsed below $100 billion for the first time since April 2025. This latest crypto news reveals a dramatic 40% decline from October's peak of $168 billion. According to data from SoSoValue cited by Cointelegraph, the current AUM represents a new yearly low. Market structure suggests this liquidity drain reflects deeper institutional repositioning.

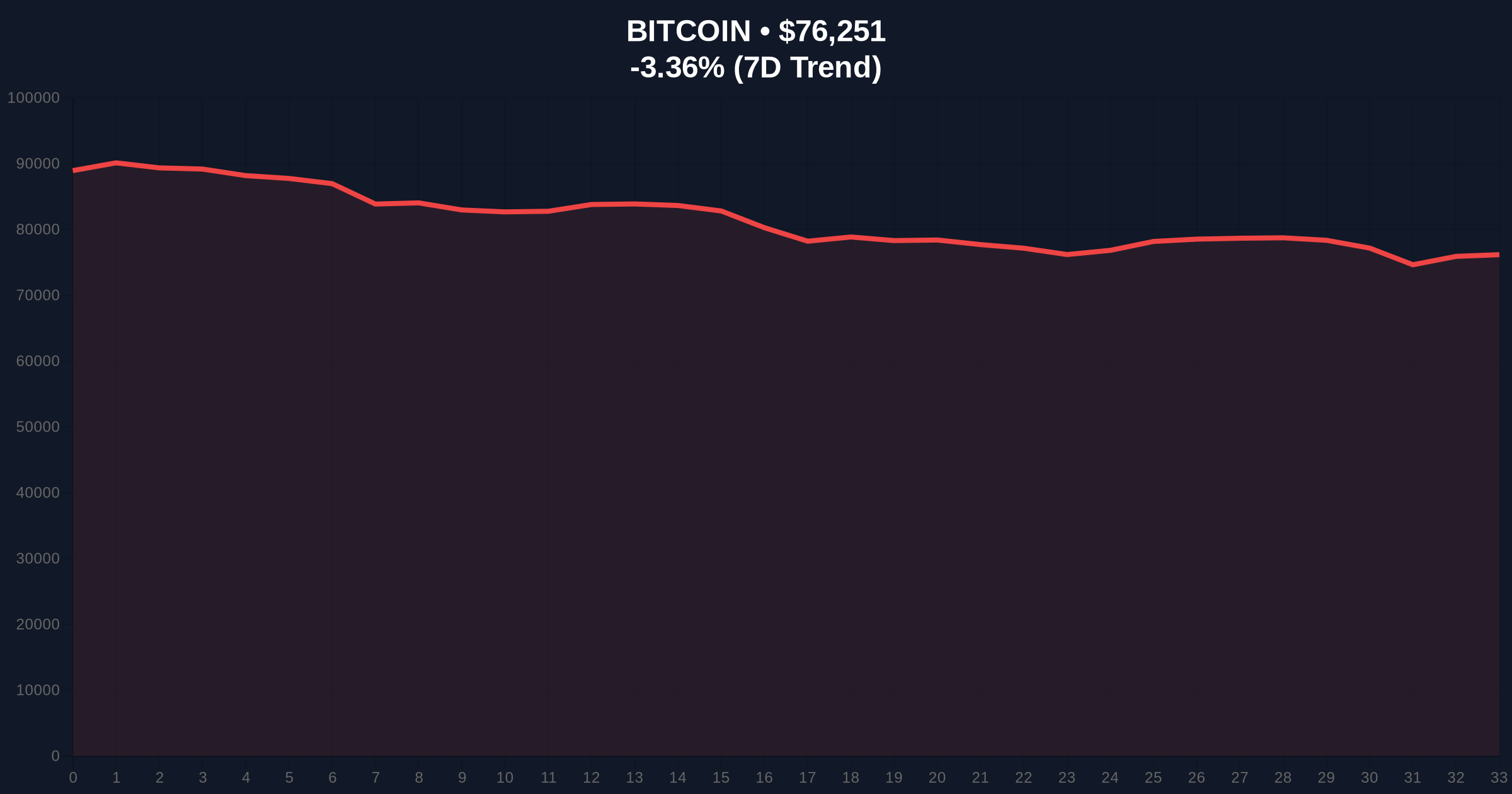

On-chain data indicates spot Bitcoin ETF AUM now sits below the psychological $100 billion threshold. This marks the first breach since April 2025. The Cointelegraph report, citing SoSoValue metrics, shows a steady decline from October's $168 billion peak. The average entry price for ETF holders stands at $84,000. Bitcoin currently trades at $76,191, creating a significant negative spread.

This price discrepancy pressures fund flows. Institutional investors face unrealized losses at current levels. Many experts predict these investors will evolve beyond ETFs. They may trade Bitcoin directly. This shift could fundamentally alter market liquidity patterns.

Historically, ETF AUM declines correlate with broader market capitulation phases. The current drop mirrors patterns from Q2 2025. In contrast, the October 2025 peak represented maximum institutional euphoria. Underlying this trend is a critical question about ETF sustainability as a primary vehicle.

Market analysts note contradictory signals in the data. While AUM declines, Bitcoin's network fundamentals remain robust. Hash rate continues near all-time highs. This divergence suggests the sell pressure may be ETF-specific rather than blockchain-wide. Consequently, the market faces a liquidity grab from strategic players.

Related developments in the crypto space highlight similar pressures. For instance, the Bitcoin liquidity crisis signals capitulation risk amid this extreme fear environment. Additionally, institutional tools like the Nansen NX8 Index track major Layer 1 performance during these volatile periods.

Market structure suggests Bitcoin faces critical technical levels. The $84,000 average ETF entry price creates a massive Fair Value Gap (FVG). This FVG acts as overhead resistance. Bitcoin's current price of $76,191 represents a 9.3% discount to this level. The 24-hour trend shows a -3.44% decline.

Technical analysis reveals Fibonacci support at the 0.618 retracement level near $72,000. This level aligns with key UTXO age bands indicating long-term holder cost basis. The RSI sits in oversold territory below 30. Moving averages show death cross formation on daily charts. This technical setup suggests continued downward pressure.

Order block analysis identifies significant liquidity pools below $75,000. These pools represent potential bearish targets. Volume profile indicates thinning liquidity at current levels. This creates conditions for accelerated moves in either direction. The market currently tests a major support confluence zone.

| Metric | Value | Significance |

|---|---|---|

| Spot Bitcoin ETF AUM | <$100B | First below $100B since April 2025 |

| October 2025 AUM Peak | $168B | 40% decline from peak |

| Average ETF Entry Price | $84,000 | Critical resistance level |

| Current Bitcoin Price | $76,191 | 9.3% below entry price |

| 24-Hour Price Change | -3.44% | Continued downward pressure |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Maximum fear sentiment |

This AUM decline matters for institutional liquidity cycles. Spot Bitcoin ETFs represented the primary gateway for traditional capital. Their shrinking AUM suggests capital rotation or outright withdrawal. This could trigger a broader market repricing. Retail market structure often follows institutional leads.

Real-world evidence shows correlation between ETF flows and Bitcoin price action. The $84,000 average entry price creates psychological resistance. Many ETF holders now face unrealized losses. This may force further selling if prices don't recover. The market faces a potential gamma squeeze scenario if volatility spikes.

Institutional investors may indeed evolve beyond ETFs. Direct Bitcoin trading offers better liquidity management. It also avoids ETF management fees. This transition could reshape market microstructure. The SEC's regulatory framework continues to influence these developments.

"The ETF AUM drop below $100 billion signals institutional reassessment of Bitcoin exposure. Market structure suggests this isn't mere profit-taking but strategic repositioning. The $84,000 average entry price creates a massive overhead supply zone that must be absorbed before any sustained recovery."

Market structure suggests two primary technical scenarios based on current data.

The 12-month institutional outlook depends on ETF flow stabilization. If AUM continues declining, direct Bitcoin trading may accelerate. This could initially increase volatility but ultimately deepen market liquidity. The 5-year horizon suggests hybrid models where ETFs coexist with direct exposure vehicles.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.