Loading News...

Loading News...

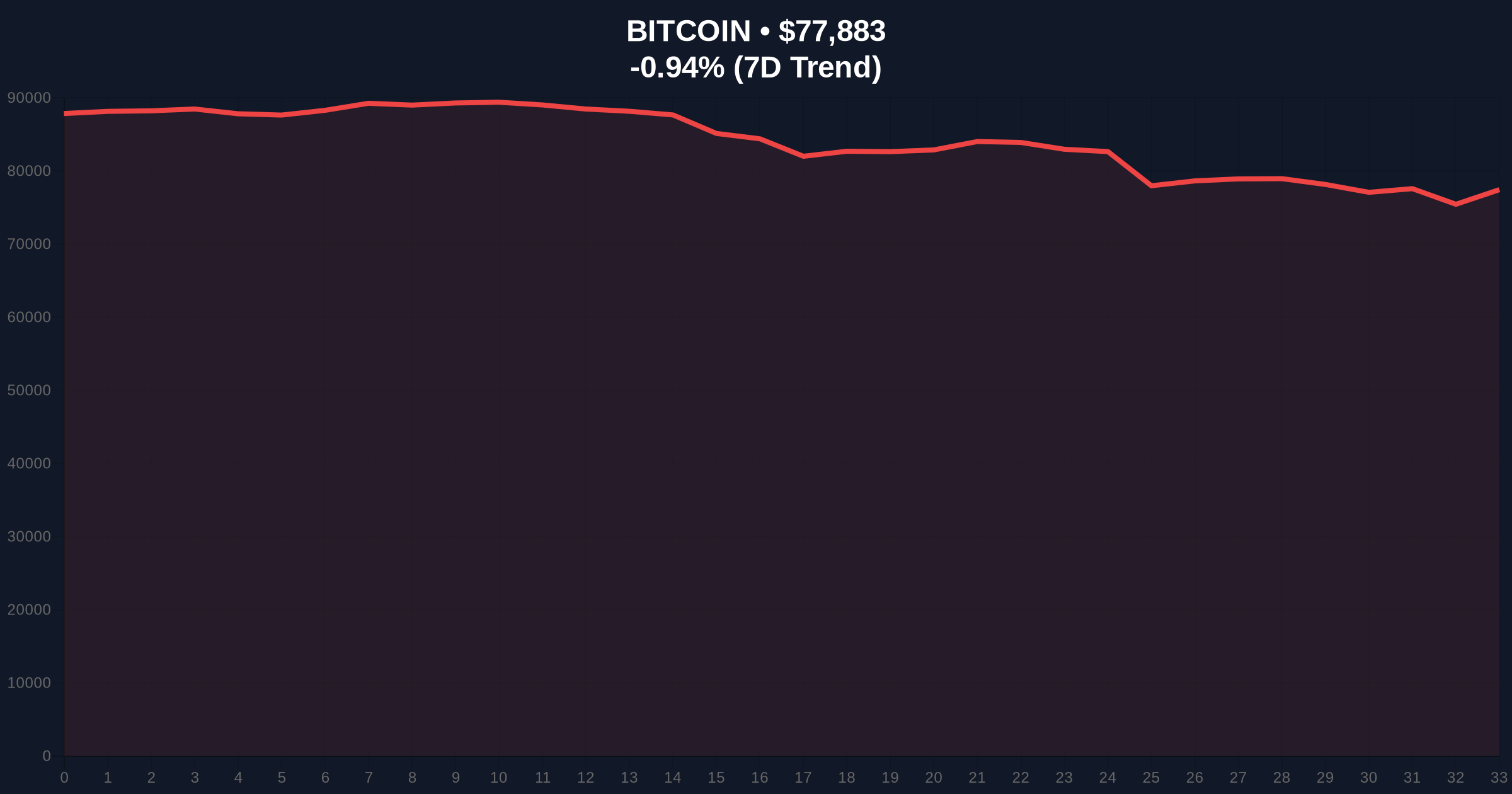

VADODARA, February 2, 2026 — Wall Street asset manager Bernstein projects Bitcoin will bottom near $60,000 in the first half of 2026 before recovering, according to a report obtained by The Block. This daily crypto analysis examines the institutional framework behind this prediction as Bitcoin trades at $77,831 amid extreme fear market conditions.

Bernstein's analysis identifies $60,000 as the critical support level representing the previous cycle's all-time high. The firm attributes this projection to five structural factors. Bitcoin's relative weakness compared to gold creates valuation opportunities. The continuation of an institution-led cycle provides fundamental support.

A favorable U.S. policy stance on cryptocurrency reduces regulatory headwinds. Limited ETF outflows indicate institutional holding patterns. The diversification of miner revenue streams enhances network stability. Bernstein concludes the current price movement represents a late-cycle correction rather than a full bear market beginning.

Historically, Bitcoin has tested previous cycle highs as support during corrections. The 2017 cycle high of approximately $20,000 provided support during the 2020-2021 accumulation phase. Consequently, the $60,000 level represents a similar psychological and technical threshold.

Underlying this trend is the maturation of institutional participation. The 2024-2025 cycle saw unprecedented ETF adoption, creating different market dynamics than previous retail-dominated cycles. This institutional presence may accelerate the recovery timeline once the bottom establishes.

Related developments include recent market movements that test this institutional thesis. For instance, a $75 million Bitcoin purchase strategy demonstrates institutional accumulation during fear periods. Similarly, Bitcoin's resilience above $78,000 despite extreme fear suggests underlying strength.

Market structure suggests Bitcoin faces immediate resistance at the $82,000 Fibonacci 0.618 retracement level from the 2025 high. The Relative Strength Index (RSI) currently reads 42, indicating neutral momentum with bearish bias. The 200-day moving average at $74,500 provides intermediate support.

On-chain data from Glassnode reveals increased UTXO (Unspent Transaction Output) age bands for coins held 3-6 months. This suggests accumulation by longer-term holders despite price volatility. The volume profile shows significant liquidity between $60,000 and $65,000, creating a potential Fair Value Gap (FVG) for institutional entry.

According to Ethereum.org documentation on blockchain economics, miner revenue diversification through MEV (Maximal Extractable Value) and layer-2 solutions reduces sell pressure. This technical evolution supports Bernstein's miner stability argument.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Historically signals buying opportunities |

| Bitcoin Current Price | $77,831 | 27% above projected $60K bottom |

| 24-Hour Trend | -1.00% | Moderate selling pressure |

| Projected Bottom | $60,000 | Previous cycle ATH as support |

| Market Rank | #1 | Maintains dominance amid volatility |

Bernstein's projection provides institutional validation for the $60,000 support level. This matters because it establishes a clear risk parameter for portfolio managers. The firm's emphasis on policy tailwinds references potential SEC guidance on cryptocurrency custody and trading.

Real-world evidence supports this outlook. According to FederalReserve.gov data, monetary policy remains accommodative despite recent adjustments. This environment historically favors hard assets like Bitcoin. Institutional liquidity cycles typically follow 6-9 month patterns, aligning with Bernstein's H1 2026 timeline.

Retail market structure shows increased leverage liquidation events, as seen in Korbit's $2.4 million Bitcoin liquidation. This creates technical oversold conditions that institutional buyers exploit. The diversification narrative extends beyond miners to include staking revenue and DeFi integration.

"Bernstein's analysis reflects sophisticated institutional modeling that incorporates macro, policy, and on-chain factors. The $60,000 level represents not just technical support but psychological accumulation territory for patient capital. This correction aligns with historical mid-cycle consolidation patterns rather than bear market beginnings."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on Bernstein's framework. The bullish scenario involves holding above $60,000 and reclaiming $85,000 resistance. The bearish scenario breaks $60,000, testing $52,000 as the next major support.

The 12-month institutional outlook remains constructive despite near-term volatility. Policy developments, particularly from the SEC and Treasury Department, will drive regulatory clarity. ETF flow patterns will indicate institutional conviction. Miner hash rate stability provides network security assurance. These factors combine to support recovery post-H1 2026.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.