Loading News...

Loading News...

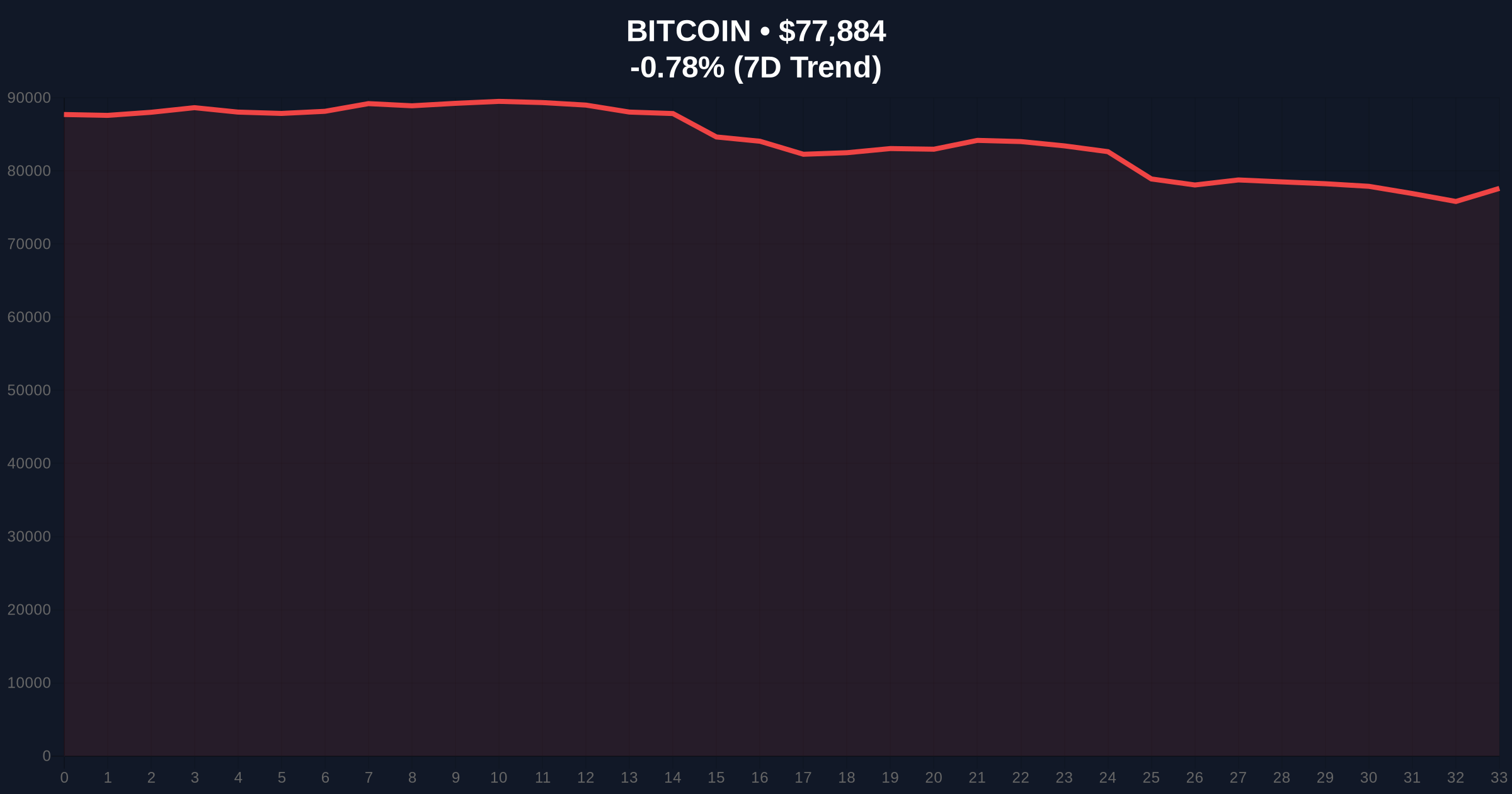

VADODARA, February 2, 2026 — Bitcoin demonstrates technical resilience by maintaining a position above $78,000 despite market-wide Extreme Fear sentiment. According to CoinNess market monitoring, BTC traded at $78,013.65 on the Binance USDT market earlier today. This daily crypto analysis examines the underlying market structure and technical drivers behind this price action.

CoinNess market monitoring data confirms Bitcoin breached the $78,000 threshold. The asset currently trades at $77,865, representing a minor 24-hour decline of -0.80%. This price action occurs against a backdrop of Extreme Fear, with the Crypto Fear & Greed Index registering a score of 14/100. Market structure suggests this divergence between price and sentiment often precedes significant directional moves.

Consequently, analysts scrutinize on-chain liquidity flows for clues. The price stability above $78,000 indicates potential institutional accumulation during periods of retail capitulation. This pattern mirrors historical cycles where smart money accumulates during fear-driven selloffs.

Historically, Bitcoin has demonstrated inverse correlations between price and sentiment during accumulation phases. The current Extreme Fear reading of 14/100 represents one of the lowest sentiment scores since the 2022 bear market bottom. Underlying this trend, institutional players often increase positions when retail sentiment reaches extreme lows.

In contrast to previous cycles, today's market features more sophisticated derivatives and ETF products. These instruments create complex liquidity dynamics that can amplify both fear and greed cycles. The Federal Reserve's monetary policy decisions, documented on FederalReserve.gov, continue to influence macro liquidity conditions affecting all risk assets.

Related developments in the broader cryptocurrency ecosystem include White House discussions on stablecoin regulation and institutional position adjustments by firms like Laser Digital.

Technical analysis reveals critical support and resistance zones. The current price sits within a Fair Value Gap (FVG) created between $75,000 and $79,000. This FVG represents a liquidity void that price must eventually fill. Market structure suggests the $75,000 level corresponds with the 0.618 Fibonacci retracement from the 2024 all-time high.

, the 200-day moving average provides dynamic support around $74,500. A sustained break below this level would invalidate the current bullish structure. On-chain data indicates significant UTXO (Unspent Transaction Output) accumulation between $76,000 and $78,000, creating a strong support band.

Volume profile analysis shows decreasing volume on down moves, suggesting selling pressure is exhausting. This technical setup often precedes bullish reversals when combined with extreme sentiment readings.

| Metric | Value |

|---|---|

| Current BTC Price | $77,865 |

| 24-Hour Change | -0.80% |

| Crypto Fear & Greed Index | Extreme Fear (14/100) |

| Market Rank | #1 |

| Key Support Level | $75,000 (Fibonacci 0.618) |

This price action matters because it tests the resilience of Bitcoin's market structure during periods of extreme psychological stress. Institutional liquidity cycles typically accelerate when retail sentiment reaches extremes. The ability to hold above $78,000 suggests underlying demand exists despite surface-level fear indicators.

Market analysts observe that such divergences often mark accumulation phases before significant rallies. The current setup resembles patterns observed in early 2023 before Bitcoin's 150% rally. Consequently, this period could represent a critical inflection point for the 2025-2026 market cycle.

Market structure suggests institutional players are accumulating during this fear-driven environment. The Extreme Fear reading of 14/100 historically correlates with intermediate-term bottoms when combined with technical support holding. We're watching the $75,000 level as critical for maintaining the bullish thesis.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure:

The 12-month institutional outlook remains cautiously optimistic. Historical cycles suggest that periods of Extreme Fear followed by technical resilience often precede sustained rallies. The upcoming Ethereum Pectra upgrade and potential Fed policy shifts will influence macro liquidity conditions throughout 2026.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.