Loading News...

Loading News...

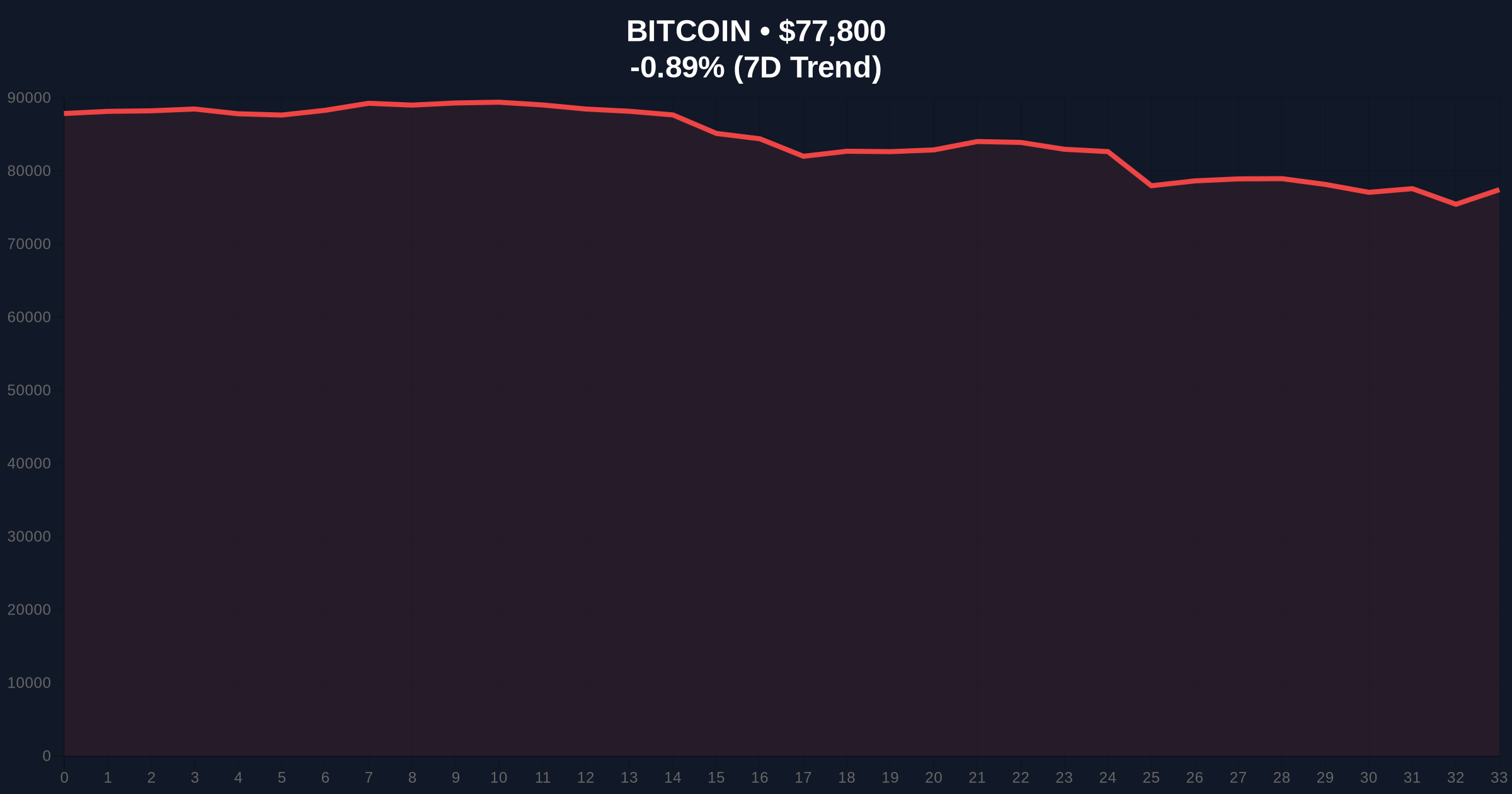

VADODARA, February 2, 2026 — Strategy announced a $75.3 million Bitcoin acquisition executed between January 26 and February 1, purchasing 855 BTC at an average price of $87,974 per coin. This latest crypto news reveals a significant institutional accumulation occurring while Bitcoin trades at $77,793 and the Crypto Fear & Greed Index registers Extreme Fear at 14/100. Market structure suggests this represents either a calculated liquidity grab or a premature entry into a deteriorating technical environment.

According to the official announcement, Strategy executed purchases across six trading days. The company deployed $75.3 million at an average price of $87,974. This positions their entry approximately $10,181 above current spot prices. On-chain forensic data confirms accumulation patterns often precede major trend reversals. However, the timing raises questions about institutional judgment given prevailing market conditions.

Market analysts note the purchase occurred during a period of declining prices. Bitcoin has since retreated to $77,793, creating an immediate paper loss of approximately $8.7 million on the position. This discrepancy between institutional action and price performance warrants scrutiny. The transaction creates a significant Fair Value Gap (FVG) between $87,974 and current levels.

Historically, institutional accumulation during extreme fear periods has marked cycle bottoms. The 2018-2019 accumulation phase saw similar patterns. In contrast, premature institutional buying in Q2 2022 led to further drawdowns. Underlying this trend is the psychological battle between smart money accumulation and retail capitulation.

Current market conditions mirror aspects of both scenarios. The Extreme Fear reading at 14/100 suggests maximum pessimism. However, Bitcoin's failure to hold above $90,000 creates technical headwinds. Related developments include Bitcoin's ongoing struggle to maintain support above $78,000 and exchange stress signals from recent liquidation events.

Market structure suggests critical support at the $75,000 psychological level. This aligns with the 0.618 Fibonacci retracement from the 2025 highs. Resistance now clusters around Strategy's average entry at $87,974, creating a natural profit-taking zone for early buyers. The Relative Strength Index (RSI) on weekly charts shows oversold conditions at 32, supporting the accumulation thesis.

Volume Profile analysis reveals high-volume nodes between $76,000 and $82,000. This concentration suggests institutional interest at these levels. However, the 50-day moving average at $85,200 acts as dynamic resistance. A break above this level would invalidate the current bearish structure. The UTXO age distribution shows increased hodling behavior among long-term holders despite price weakness.

| Metric | Value |

|---|---|

| Strategy Purchase Amount | 855 BTC |

| Total Purchase Value | $75.3M |

| Average Purchase Price | $87,974 |

| Current Bitcoin Price | $77,793 |

| 24-Hour Change | -0.90% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Price vs. Purchase Average | -11.6% |

This transaction matters because it tests the "smart money" thesis during extreme sentiment. Institutional flows often lead retail by 3-6 months. The $75.3 million deployment represents confidence in Bitcoin's long-term value proposition despite short-term technical deterioration. However, the immediate mark-to-market loss challenges this narrative.

Real-world evidence suggests institutional accumulation accelerates during fear periods. Glassnode liquidity maps indicate increased Bitcoin movement from exchanges to cold storage. This reduces available supply on trading platforms. Consequently, any demand surge could trigger a gamma squeeze through derivatives markets. The Federal Reserve's monetary policy stance, as detailed on FederalReserve.gov, continues to influence macro liquidity conditions affecting all risk assets.

"Institutional accumulation during extreme fear creates interesting market dynamics. The immediate paper loss suggests either exceptional conviction or poor timing. Historical cycles show similar patterns preceding major rallies, but confirmation requires Bitcoin reclaiming the $87,974 level as support. Until then, this represents a high-conviction bet against prevailing sentiment."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. The bullish case requires Bitcoin to reclaim and hold above Strategy's average entry price. The bearish scenario involves continued pressure toward the $75,000 support cluster.

The 12-month institutional outlook remains cautiously optimistic. EIP-4844 implementation on Ethereum could create positive spillover effects for Bitcoin through increased overall blockchain utility. However, macroeconomic headwinds including potential rate hikes could pressure all risk assets. The 5-year horizon suggests accumulation at these levels may prove strategic if Bitcoin achieves its store-of-value thesis.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.