Loading News...

Loading News...

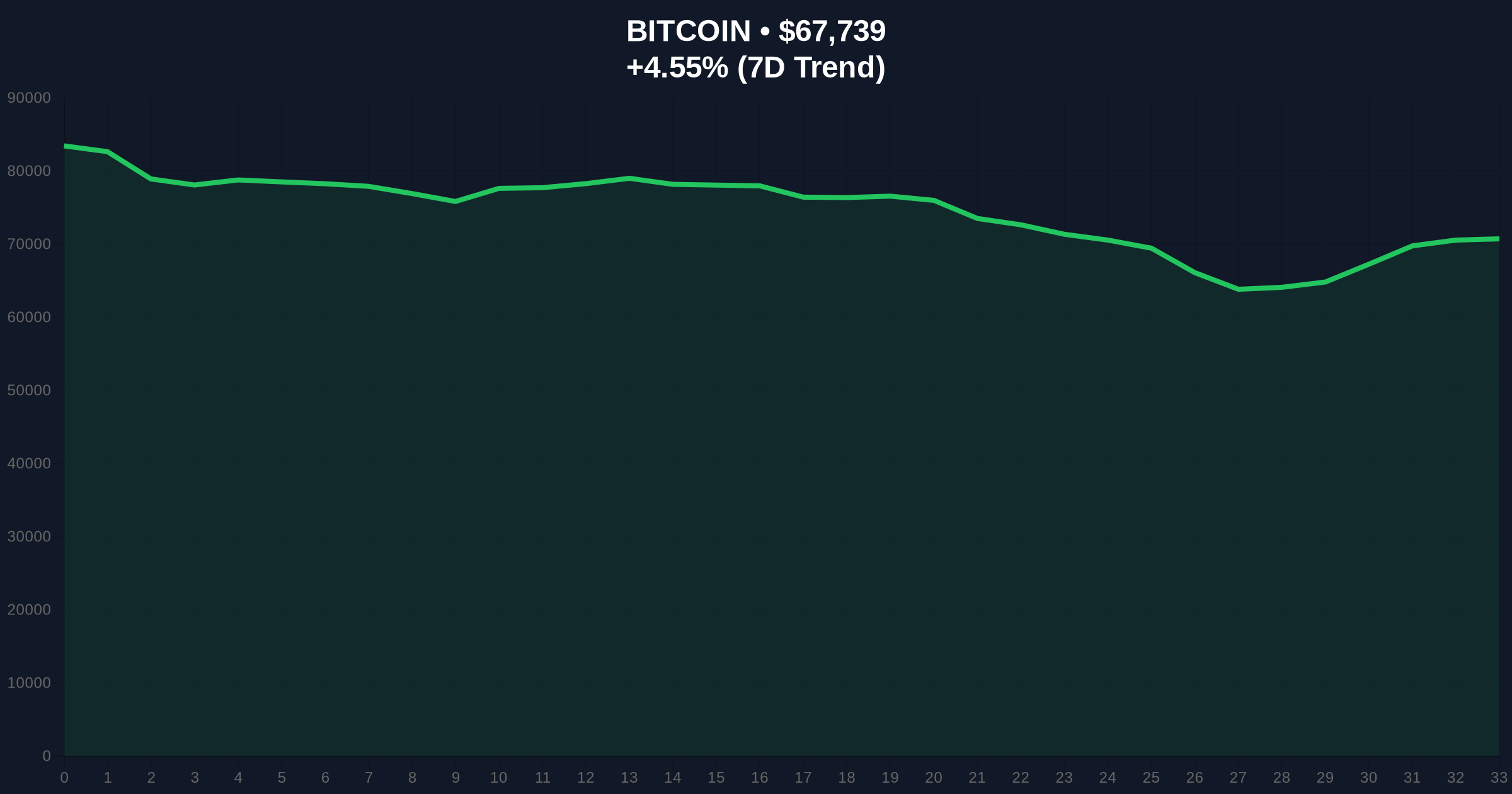

VADODARA, February 7, 2026 — Bitcoin has broken below the psychologically significant $68,000 level, trading at $67,978.64 on the Binance USDT market according to CoinNess market monitoring. This daily crypto analysis examines the technical breakdown, market structure implications, and institutional liquidity flows driving the move.

According to CoinNess market monitoring, BTC fell below $68,000 on February 7, 2026. The asset traded at $67,978.64 on the Binance USDT market at the time of reporting. This represents a 4.93% decline over 24 hours. Market structure suggests this move invalidated a key order block that had provided support since late January.

Consequently, the breakdown created a Fair Value Gap (FVG) between $68,200 and $67,800. This FVG now acts as immediate resistance. On-chain data indicates increased selling pressure from short-term holders (STHs) with UTXOs aged 1-3 months. These holders typically represent weak hands during volatility spikes.

Historically, Bitcoin has experienced similar breakdowns during periods of extreme fear sentiment. The current Crypto Fear & Greed Index reading of 6/100 mirrors conditions seen in June 2022 and March 2020. In contrast to 2021's bull market corrections, today's move occurs amid broader regulatory uncertainty and institutional positioning shifts.

Underlying this trend is a confluence of macro factors. The Federal Reserve's monetary policy stance, detailed in recent Federal Reserve meeting minutes, continues to influence risk asset correlations. , related developments in the crypto ecosystem are contributing to market nervousness. These include Erebor securing a U.S. national bank charter, South Korea's ruling party demanding a Bithumb probe, and Binance's co-CEO characterizing withdrawal activity as a stress test.

The technical architecture reveals critical levels. The breakdown below $68,000 invalidated the 50-day exponential moving average (EMA) as support. Volume profile analysis shows increased selling volume at the $68,500 level, confirming distribution. Market structure now points to the Fibonacci 0.618 retracement level at $66,500 as the next major support zone.

This level coincides with the 200-day simple moving average (SMA) and represents a high-volume node on the Volume Profile Visible Range (VPVR). A hold at $66,500 would maintain the broader bullish structure from the 2025 lows. Conversely, a break below this level would target the $64,000 liquidity pool, where significant bid clusters exist according to Glassnode liquidity maps.

| Metric | Value | Context |

|---|---|---|

| Current Price | $67,980 | Binance USDT Market |

| 24-Hour Change | -4.93% | Significant bearish momentum |

| Market Rank | #1 | Maintains dominance |

| Fear & Greed Index | 6/100 (Extreme Fear) | Historical buy zone indicator |

| Key Support | $66,500 | Fibonacci 0.618 level |

This breakdown matters for institutional liquidity cycles. The $68,000 level previously acted as a psychological barrier and options gamma neutral zone. A sustained break below alters dealer hedging strategies, potentially accelerating downward momentum. Retail market structure shows increased long liquidations in perpetual swap markets, exceeding $150 million in the past 24 hours according to CoinGlass data.

, the move tests the resilience of Bitcoin's post-halving issuance schedule. With block rewards at 3.125 BTC, the network's security budget relies increasingly on transaction fees. A prolonged price decline could pressure miner profitability, though current hash rate derivatives suggest miners are hedging effectively.

"Market structure suggests we're witnessing a liquidity grab below $68,000. The Extreme Fear reading often precedes institutional accumulation phases. However, the $66,500 Fibonacci level must hold to maintain the macro uptrend. On-chain data indicates long-term holders remain steadfast, with UTXOs older than 1 year actually increasing during this dip."

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic despite near-term volatility. Historical cycles suggest Extreme Fear periods often precede significant rallies. The 5-year horizon continues to favor Bitcoin's network effects, particularly as traditional finance integration accelerates through vehicles like spot ETFs and regulated custody solutions.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.