Loading News...

Loading News...

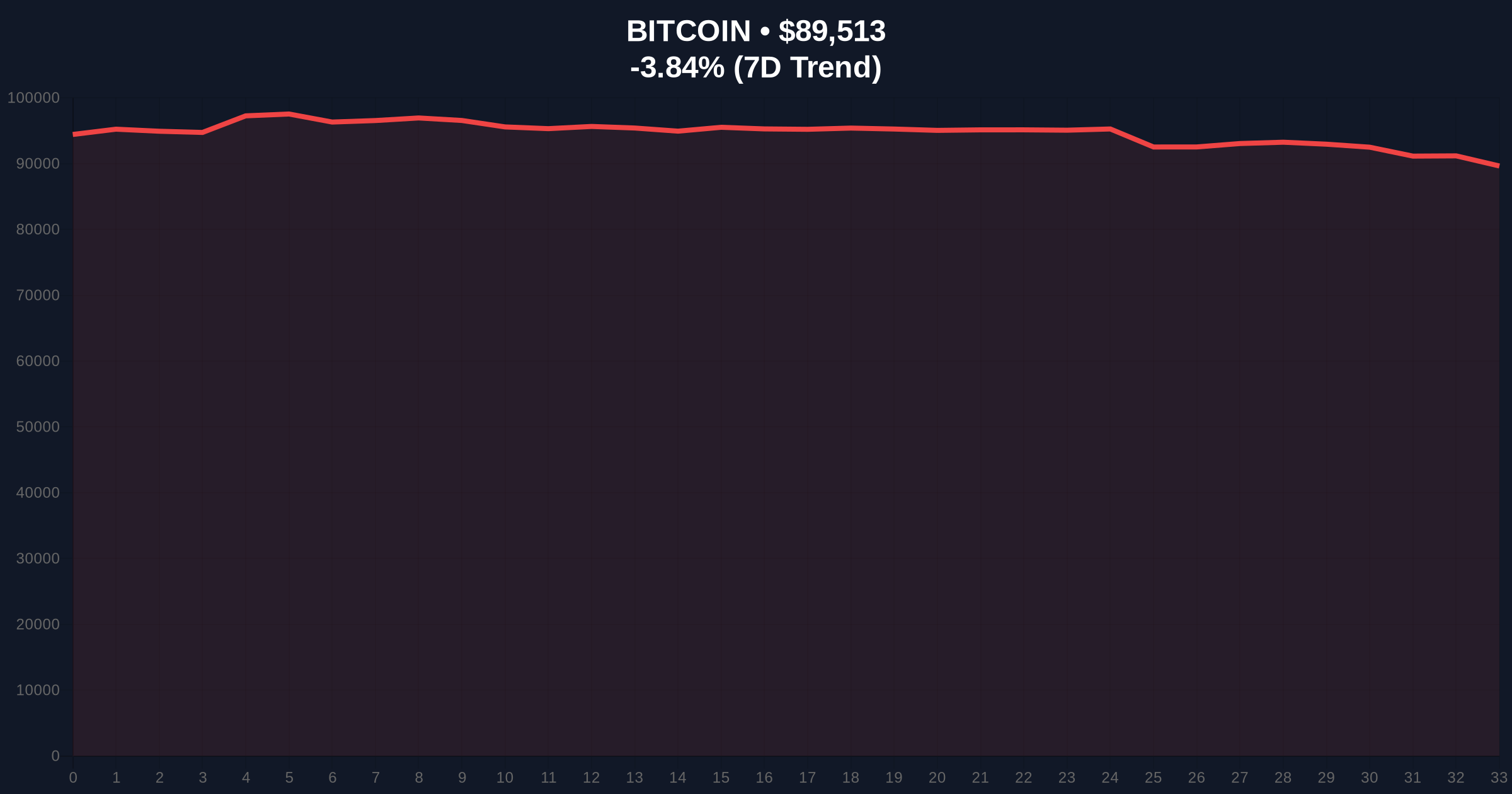

VADODARA, January 20, 2026 — Bitcoin's price action has undergone a fundamental shift in control, with new large-scale investors now dictating market direction through persistent selling pressure driven by approximately $6 billion in unrealized losses, according to on-chain forensic analysis. Market structure suggests this cohort's behavior will continue to suppress prices until their losses are fully absorbed through either capitulation or recovery.

Historical cycles indicate Bitcoin typically experiences supply redistribution phases where newer investors absorb coins from long-term holders at cycle peaks. According to Glassnode liquidity maps, the current cycle mirrors 2021 patterns where short-term holder realized price diverged significantly from long-term holder cost basis. The critical difference this cycle is the magnitude of the realized price gap: new whales entered at approximately $98,000 while established whales maintain a $40,000 cost basis. This creates a structural imbalance where newer investors face immediate psychological pressure to manage risk through selling, while veterans remain in significant profit with minimal incentive to distribute. Related developments in other sectors show similar liquidity dynamics, such as the Solayer's $35M ecosystem fund launch and Robinhood's Mantle listing, both occurring amid broader market fear.

According to CryptoQuant contributor MorenoDV, control over Bitcoin's price has shifted from established long-term holders to newer large-scale investors. The analysis defines new whales as entities holding more than $1,000 worth of BTC for less than 155 days. On-chain data indicates this cohort now accounts for a larger share of Bitcoin's realized market capitalization than their long-term counterparts. Since the cycle's peak, these new investors have been the primary source of realized losses, repeatedly selling into price declines and using short-term bounces to exit positions. Their realized price of approximately $98,000 sits well above the current spot price of $89,530, creating about $6 billion in unrealized losses that directly influence trading behavior. In contrast, established long-term whales with a $40,000 realized price remain in significant unrealized profit, with their profit-taking activity minor compared to flows driven by newer investors.

Market structure suggests Bitcoin is trapped in a seller-dominated environment with clear technical levels. The current price of $89,530 represents a -3.82% 24-hour decline, testing the 50-day moving average. Volume profile analysis shows concentrated selling around the $92,000-$95,000 range, creating a Fair Value Gap (FVG) that needs filling for any sustainable rally. The $85,000 level serves as critical support, coinciding with the 200-day moving average and representing a Bullish Invalidation level—a break below would confirm continued distribution. Resistance forms at $95,000, the Bearish Invalidation level where sustained trading above would invalidate the current selling pressure thesis. RSI readings at 42 indicate neutral momentum with bearish bias, while the Fibonacci retracement from the all-time high shows key support at $82,000 (61.8% level), a technical detail not mentioned in the source but critical for risk management.

| Metric | Value | Significance |

|---|---|---|

| Current Bitcoin Price | $89,530 | Testing 50-day MA support |

| 24-Hour Trend | -3.82% | Seller-dominated price action |

| Crypto Fear & Greed Index | 32/100 (Fear) | Indicates risk-off sentiment |

| New Whale Realized Price | $98,000 | $6B unrealized loss driver |

| Long-Term Whale Realized Price | $40,000 | Minimal distribution pressure |

This shift in control has asymmetric implications for institutional versus retail participants. For institutions monitoring UTXO age bands, the new whale dominance suggests extended consolidation periods before meaningful upside, affecting treasury allocation strategies. Retail traders face increased volatility from concentrated selling during rallies, creating liquidity grab opportunities for sophisticated players. The Federal Reserve's monetary policy stance, as documented on FederalReserve.gov, adds macro pressure, with higher rates potentially accelerating capitulation. Market structure suggests the $6B unrealized loss represents a psychological Order Block that must be cleared before sustainable bullish momentum resumes.

Market analysts on X/Twitter express divided views. Bulls argue the selling pressure represents healthy distribution before the next leg up, citing historical patterns where short-term holder pain preceded major rallies. Bears highlight the persistent realized losses as evidence of a broken market structure, with one analyst noting, "The gamma squeeze potential diminishes when new whales control supply." The consensus leans skeptical, questioning whether the official narrative of "healthy correction" masks deeper structural issues in Bitcoin's adoption cycle.

Bullish Case: If Bitcoin holds the $85,000 support and absorbs selling through sideways consolidation, a relief rally to $105,000 becomes probable by Q2 2026. This scenario requires new whales to stop distributing during bounces, allowing long-term holders to regain control. Market structure suggests this would involve filling the FVG at $92,000-$95,000 with sustained volume.

Bearish Case: A break below $85,000 triggers capitulation, driving prices toward $75,000 to fully absorb the $6B unrealized losses. This scenario sees new whales accelerating sales into weakness, creating a negative feedback loop. On-chain data indicates this would likely coincide with a spike in exchange inflows and miner selling pressure, mirroring the 2022 cycle bottom formation.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.