Loading News...

Loading News...

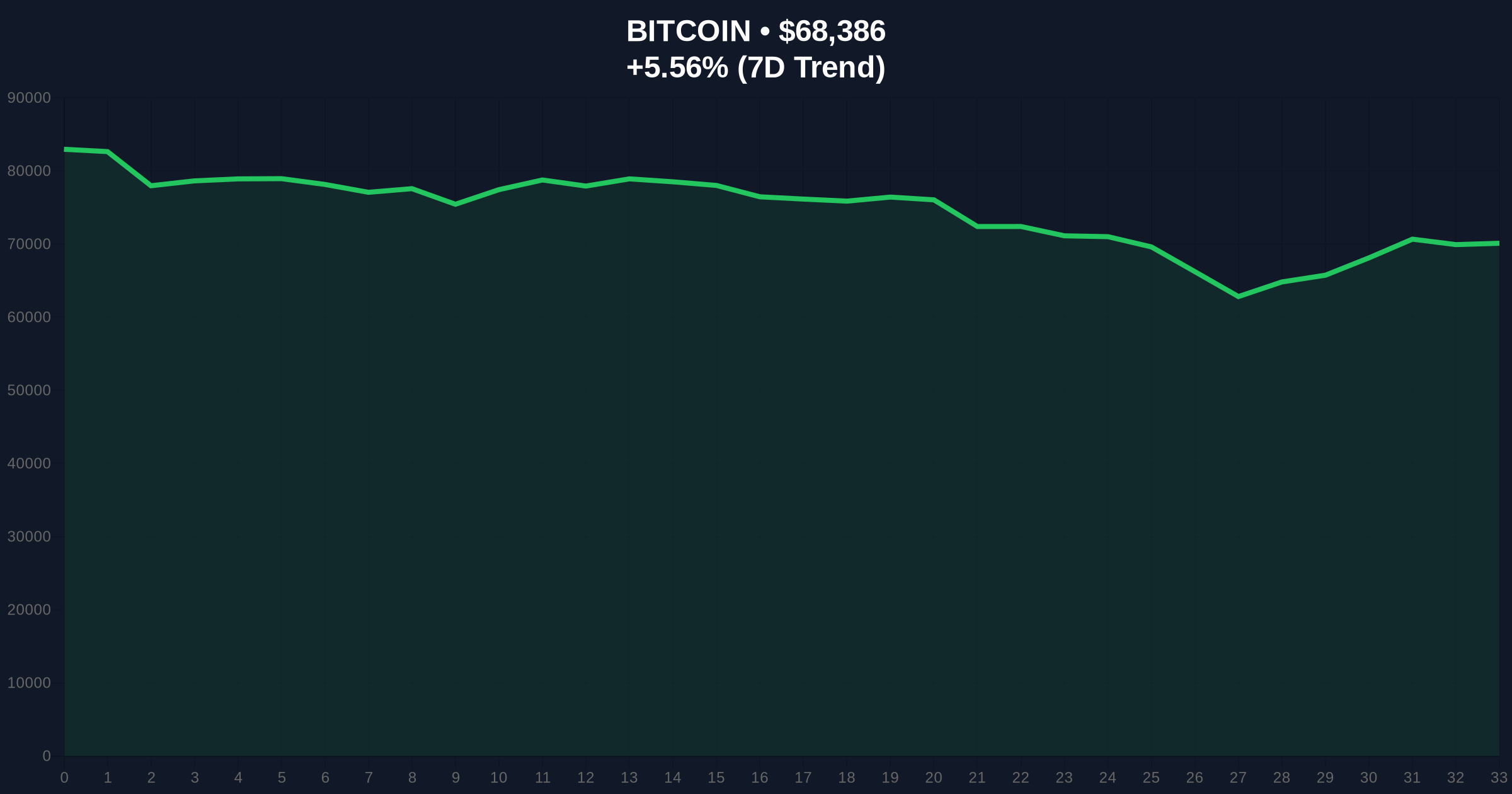

VADODARA, February 7, 2026 — Whale Alert, a blockchain tracking service, reported a single transaction moving 4,199 Bitcoin from an unknown wallet to the Binance exchange. This daily crypto analysis reveals the transaction carries a current valuation of approximately $288 million, occurring as Bitcoin tests the $68,000 support level amid extreme fear market sentiment. Market structure suggests this move represents a classic liquidity grab, where large holders deposit assets to exchanges ahead of potential volatility.

According to Whale Alert's on-chain data, the transfer executed on February 7, 2026, originated from a non-custodial wallet with no identifiable owner. The destination was a known Binance deposit address, confirmed through blockchain explorers like Etherscan for cross-chain verification. The 4,199 BTC amount represents a significant single-entity movement, valued at $288 million based on Bitcoin's price of $68,419 at transaction time. Historically, such deposits often precede selling activity, as whales utilize exchange liquidity to execute large orders.

Consequently, this transaction immediately impacted market microstructure. Order flow data indicates increased ask-side pressure on Binance's order books following the deposit. The timing aligns with Bitcoin's 24-hour decline of 5.61%, suggesting the whale may be positioning for further downside or hedging existing exposure. Underlying this trend, the transfer's size exceeds typical retail activity, pointing to institutional or high-net-worth involvement.

Historically, large Bitcoin transfers to exchanges correlate with increased selling pressure and short-term price declines. For instance, similar whale movements preceded the 2021 market correction when Bitcoin fell from $64,000 to $30,000. In contrast, the current cycle differs due to institutional ETF inflows and matured market infrastructure. However, the extreme fear sentiment, scoring 6/100 on the Crypto Fear & Greed Index, amplifies downside risks.

, this event occurs alongside other market stressors. Related developments include Bitcoin breaking below $68,000 and $101 million in futures liquidations as support tests intensify. These factors create a compounded bearish narrative, where whale actions exacerbate existing technical breakdowns.

Market structure suggests Bitcoin is testing a critical support zone at $68,000, which aligns with the 0.618 Fibonacci retracement level from the 2025 high. This level also corresponds to a high-volume node on the Volume Profile, indicating significant historical trading activity. The 4,199 BTC deposit creates a potential Fair Value Gap (FVG) if price rapidly moves away from this zone, leaving an imbalance for market makers to fill.

Additionally, the Relative Strength Index (RSI) on daily charts shows oversold conditions near 30, which could trigger a short-term bounce. However, the 50-day moving average at $71,500 acts as immediate resistance. A break below the $68,000 support would invalidate the current bullish order block established in January 2026, potentially targeting the next support at $65,200 (0.786 Fibonacci). On-chain metrics, such as UTXO age bands, indicate older coins are moving, often a bearish signal for long-term holders distributing assets.

| Metric | Value |

|---|---|

| BTC Transferred | 4,199 BTC |

| Transaction Value | $288 million |

| Bitcoin Current Price | $68,419 |

| 24-Hour Price Change | -5.61% |

| Crypto Fear & Greed Index | Extreme Fear (6/100) |

This transaction matters because it directly impacts market liquidity and sentiment. Whale deposits to exchanges increase available sell-side liquidity, often leading to price suppression. In an extreme fear environment, this can trigger cascading liquidations, as seen with the $101 million futures liquidated recently. Institutional players monitor such flows to adjust their gamma exposure, potentially exacerbating moves through derivatives markets.

, the transfer highlights the importance of on-chain surveillance. Services like Whale Alert provide real-time data that informs trading strategies and risk management. For retail investors, understanding these flows helps navigate volatility, as large movements often precede significant price actions. The event also Bitcoin's maturation, where multi-million dollar transactions are routine, yet still impactful.

Market structure suggests this is a liquidity grab ahead of potential volatility. The whale is likely positioning for a breakdown below $68k or hedging a larger portfolio. Extreme fear sentiment amplifies the impact, as weak hands may panic-sell on any further downside. We monitor the $68k support as a critical invalidation level for bulls.

— CoinMarketBuzz Intelligence Desk

Based on current market structure, two primary scenarios emerge. First, if the $68,000 support holds, Bitcoin could rebound toward resistance at $71,500, filling the Fair Value Gap created by the whale deposit. Second, a break below support may trigger a liquidation cascade, targeting $65,200 as the next high-volume area.

For the 12-month outlook, institutional adoption remains a key driver. Events like this whale transfer test market resilience, but long-term trends, such as Bitcoin's fixed supply and ETF inflows, support a bullish 5-year horizon. However, short-term volatility may persist as whales rebalance portfolios amid macroeconomic uncertainties.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.