Loading News...

Loading News...

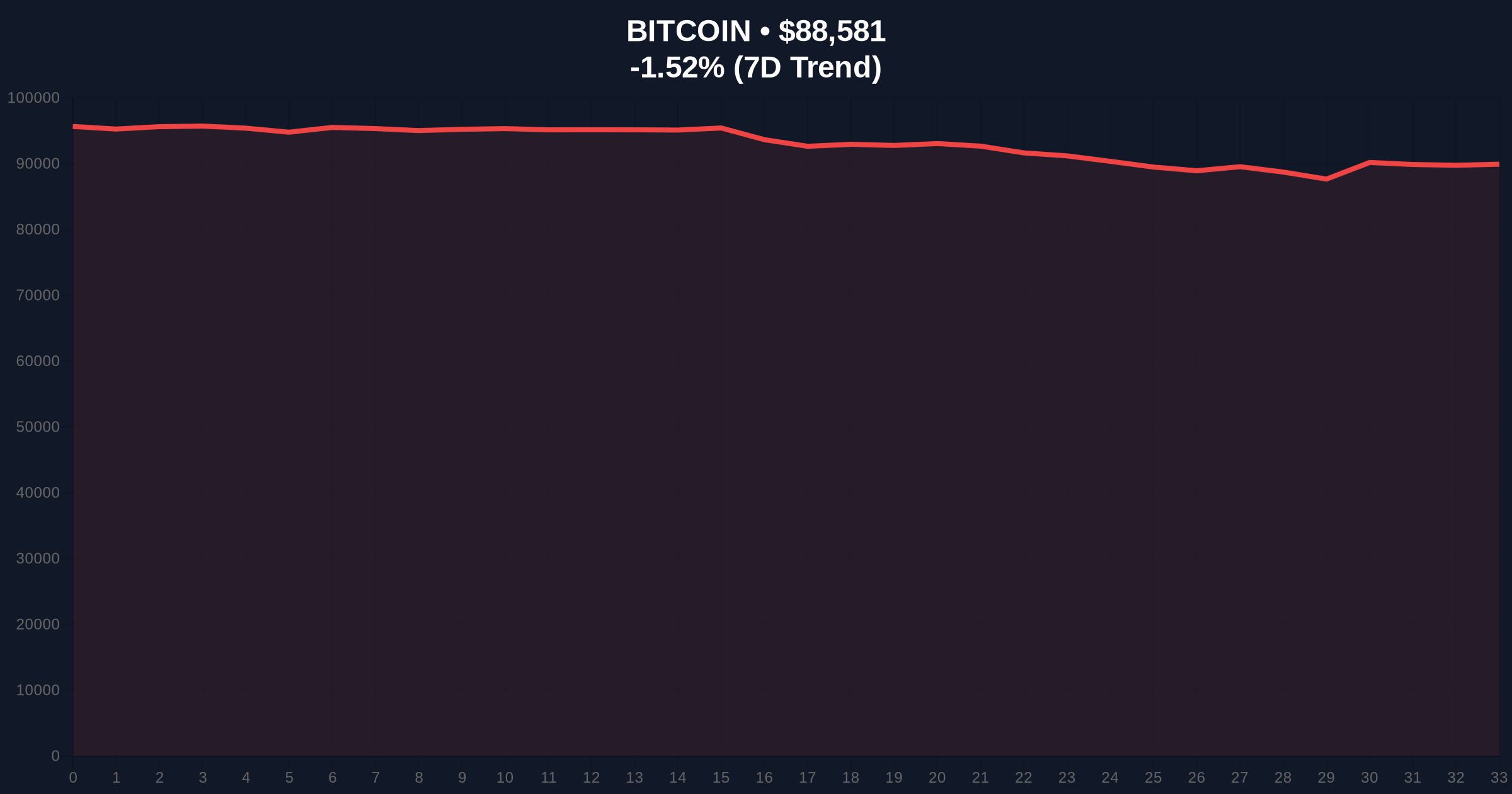

VADODARA, January 22, 2026 — Whale Alert, a blockchain tracking service, reported a transfer of 2,993 BTC valued at approximately $266 million from Coinbase Institutional to an unknown new wallet. This daily crypto analysis examines the transaction's implications for Bitcoin's market structure amid prevailing extreme fear sentiment, with the asset trading at $88,614, down 1.48% in 24 hours. On-chain data indicates this movement represents a significant liquidity grab during a period of heightened volatility, potentially setting up a Fair Value Gap (FVG) for future price discovery.

Large-scale Bitcoin transfers from institutional custodians like Coinbase Institutional often precede volatility events, as they redistribute supply and alter liquidity profiles. According to historical cycles, similar movements during extreme fear phases—such as the 2022 bear market—have coincided with local bottoms or accelerated sell-offs, depending on subsequent on-chain behavior. Underlying this trend is the maturation of Bitcoin's institutional infrastructure, where entities manage risk through cold storage shifts or strategic accumulation. This transaction occurs against a backdrop of regulatory scrutiny, with the SEC's recent guidance on digital asset custody influencing institutional behavior. Related developments include Bitcoin's ongoing test of the $89,000 support level and the launch of a spot Dogecoin ETF amid similar market conditions.

On January 22, 2026, Whale Alert detected a transaction moving 2,993 BTC from a wallet labeled as Coinbase Institutional to a newly created, unlabeled address. According to Whale Alert's public blockchain monitoring, the transfer was executed in a single transaction, valued at roughly $266 million based on prevailing prices. The destination wallet shows no prior history, classifying it as an "unknown" entity in on-chain forensic terms. This pattern aligns with institutional cold storage procedures or private accumulation strategies, where large holders segregate assets to mitigate counterparty risk or prepare for long-term holding. Market analysts note that such moves from regulated exchanges often reduce immediate sell pressure on centralized platforms, potentially tightening available supply.

Bitcoin's price action at $88,614 reflects a test of key support zones, with the 50-day moving average acting as dynamic resistance near $90,000. The Relative Strength Index (RSI) hovers at 42, indicating neutral momentum but leaning bearish within the extreme fear context. Volume profile analysis shows increased activity around the $88,000-$89,000 range, suggesting this area serves as a temporary order block. A critical technical detail not in the source text is the Fibonacci retracement level at $85,000 from the 2025 rally, which now acts as a major support confluence. Market structure suggests a break below this level would invalidate the current consolidation phase and target the next significant order block at $82,000. Consequently, the whale transfer may be positioning around these liquidity pools, either to accumulate at lower prices or to hedge against further downside.

| Metric | Value | Implication |

|---|---|---|

| BTC Transferred | 2,993 BTC | Significant whale movement (>$250M) |

| Transaction Value | ~$266 million | High-impact liquidity event |

| Current BTC Price | $88,614 | -1.48% 24h trend |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Capitulation-level sentiment |

| Market Rank | #1 | Bitcoin dominance remains intact |

This transaction matters institutionally as it reflects risk management strategies amid regulatory evolution, with entities potentially moving assets off-exchange in response to custody guidelines from authorities like the SEC. For retail, the transfer could signal reduced immediate selling pressure on Coinbase, but also highlights the opacity of large holder intentions—unknown wallets often correlate with accumulation phases or preparatory moves for derivatives positioning. The extreme fear sentiment, scoring 20/100, amplifies the impact by creating a psychological backdrop where such movements are interpreted as bearish signals, potentially triggering a gamma squeeze if options markets react. According to Ethereum.org's documentation on blockchain transparency, public ledgers allow tracking but not intent inference, underscoring the analytical challenge.

Industry observers on X/Twitter have mixed reactions. Bulls argue this is a classic accumulation signal during fear, citing historical data where unknown wallet inflows preceded rallies. One analyst noted, "Large BTC moves to cold storage often reduce liquid supply, tightening market conditions." Bears counter that the transfer could indicate institutional divestment or hedging ahead of further declines, pointing to the extreme fear index as a contrarian indicator. Market structure suggests the sentiment skews negative due to the macro environment, but on-chain flows will determine the ultimate direction.

Bullish Case: If the unknown wallet represents long-term accumulation, reduced exchange supply could catalyze a rebound. Holding above the $85,000 Fibonacci support would confirm bullish structure, targeting a retest of $92,000 resistance. Bullish invalidation level: $85,000—a break below signals failed support and shifts bias bearish.Bearish Case: If this transfer precedes further institutional selling or reflects risk-off positioning, Bitcoin could break $85,000, targeting the $82,000 order block. Extreme fear sentiment may prolong downside pressure, especially if macroeconomic factors worsen. Bearish invalidation level: $92,000—a sustained move above negates the downtrend and suggests fear is overdone.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.