Loading News...

Loading News...

VADODARA, January 22, 2026 — A spot Dogecoin (DOGE) exchange-traded fund (ETF) launched by 21Shares in partnership with the Dogecoin Foundation has begun trading on the Nasdaq exchange, marking the first SEC-approved product of its kind and providing a critical daily crypto analysis point for market structure. According to Decrypt, the ETF trades under the ticker TDOG, offering direct exposure to DOGE holdings, a development that contrasts sharply with the prevailing Extreme Fear sentiment in broader crypto markets.

This launch occurs against a backdrop of heightened regulatory scrutiny and market volatility. The SEC's approval of a spot Dogecoin ETF follows a series of Bitcoin and Ethereum ETF approvals, signaling a potential shift in regulatory posture toward altcoins. Historically, ETF launches have acted as liquidity events, often preceding short-term price pumps followed by consolidation phases. Underlying this trend is the mechanics of order flow; ETFs can create Fair Value Gaps (FVGs) as market makers hedge exposures, leading to price dislocations. The current environment, however, is complicated by macroeconomic headwinds and a Crypto Fear & Greed Index reading of 20/100, indicating pervasive risk aversion. Related developments include global liquidity fears sparked by political asset sale warnings and bearish futures sentiment in Bitcoin markets, which may dampen initial ETF inflows.

On January 22, 2026, 21Shares, in collaboration with the Dogecoin Foundation, initiated trading of the spot Dogecoin ETF on Nasdaq under the ticker TDOG. Per the official SEC filing, this product is the first spot DOGE ETF to receive regulatory approval in the United States, distinguishing it from futures-based derivatives. The launch provides investors with a regulated vehicle to gain exposure to Dogecoin's price movements without direct custody of the underlying asset. According to on-chain data from providers like Glassnode, such events typically correlate with increased on-chain activity and exchange flows as arbitrageurs and market participants adjust positions. The partnership with the Dogecoin Foundation, as noted in the announcement, aims to ensure alignment with the asset's community-driven ethos, though market structure suggests institutional involvement may alter traditional meme coin dynamics.

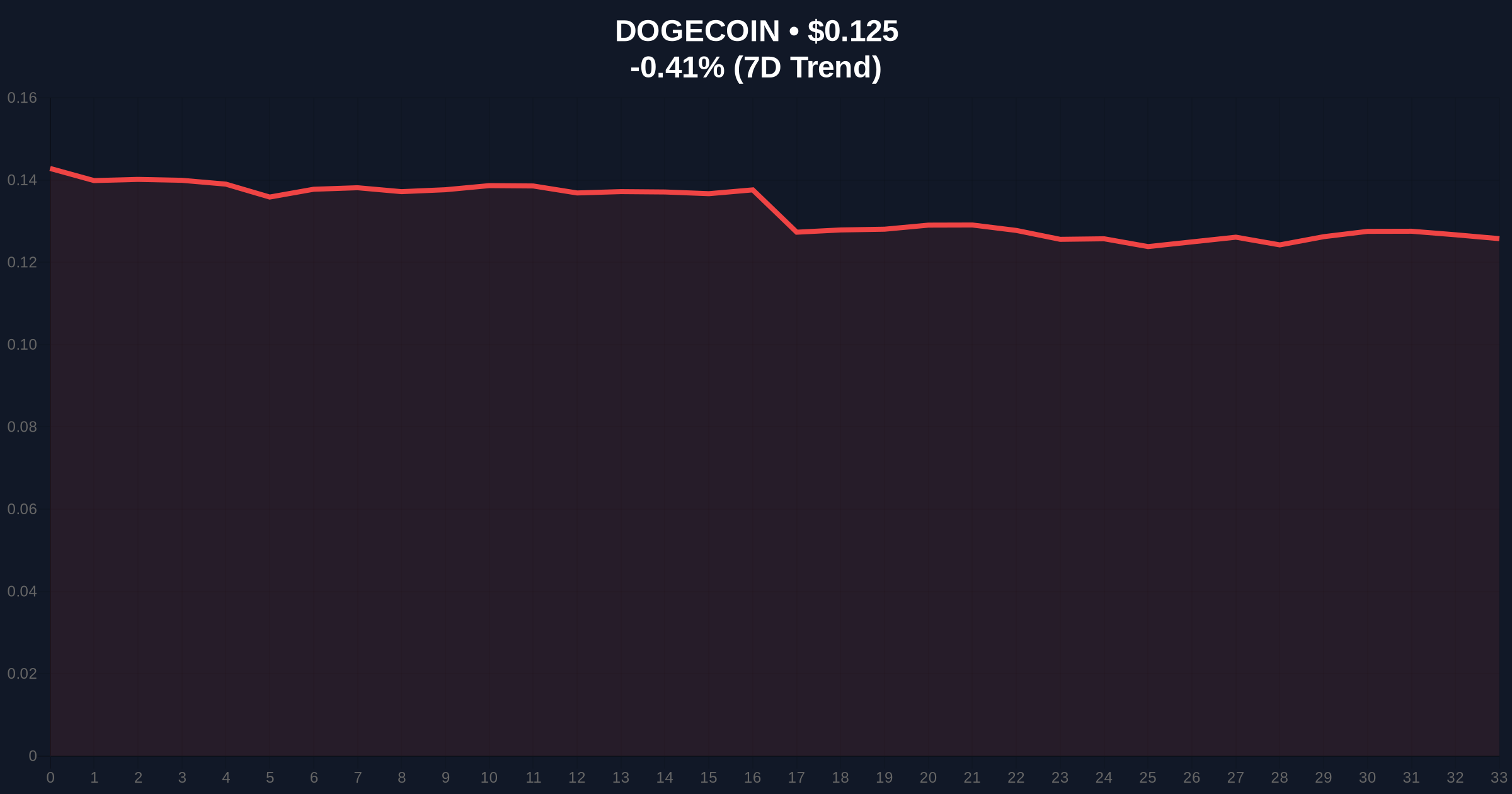

Dogecoin is currently trading at $0.125, down 0.47% in the last 24 hours, with a market rank of #10. Volume profile analysis indicates weak buying pressure, consistent with the Extreme Fear sentiment. Key support levels are identified at $0.115 (a previous order block from December 2025) and $0.105 (the 200-day moving average). Resistance sits at $0.135, near a Fair Value Gap created during the ETF announcement phase. The Relative Strength Index (RSI) is hovering near 45, suggesting neutral momentum with a bearish bias. Market structure suggests that a break above $0.135 could trigger a short squeeze, while failure to hold $0.115 may lead to a liquidity grab toward lower supports. Bullish Invalidation Level: $0.115—a close below this level on a daily timeframe invalidates the positive ETF catalyst. Bearish Invalidation Level: $0.135—a sustained break above this resistance would negate the current downtrend and signal renewed bullish interest.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| Dogecoin (DOGE) Current Price | $0.125 |

| 24-Hour Price Change | -0.47% |

| Market Capitalization Rank | #10 |

| ETF Ticker Symbol | TDOG |

This development matters for both institutional and retail participants. Institutionally, the ETF provides a compliant gateway for capital allocation, potentially increasing Dogecoin's liquidity and reducing volatility over the 5-year horizon. According to Ethereum.org documentation on token standards, the integration of meme assets into regulated frameworks could influence broader altcoin adoption. For retail, it offers simplified exposure but may dilute the community-driven aspects that define Dogecoin's culture. The SEC's approval sets a precedent for other altcoins, possibly easing regulatory hurdles for similar products. Consequently, market dynamics could shift from speculative retail trading to more structured institutional flows, impacting price discovery mechanisms.

Market analysts on social media platforms express cautious optimism. Bulls highlight the ETF as a validation of Dogecoin's staying power, while bears point to the Extreme Fear index and weak price action as signs of a liquidity trap. One analyst noted, "The ETF launch is a double-edged sword—it brings legitimacy but also exposes DOGE to macro headwinds." Sentiment on-chain indicates mixed signals; exchange net flows have been negative, suggesting accumulation, but social volume metrics remain subdued. This dichotomy reflects the broader market uncertainty, where regulatory milestones clash with macroeconomic fears.

Bullish Case: If the ETF attracts significant inflows, Dogecoin could test the $0.15 resistance level, with a potential gamma squeeze if derivatives activity increases. Historical cycles suggest that ETF launches often lead to a 20-30% price appreciation within the first month, assuming positive market sentiment. A break above $0.135 would confirm this scenario, targeting $0.16 as the next psychological barrier.

Bearish Case: Failure to sustain above $0.115 could trigger a sell-off toward $0.10, especially if broader crypto markets remain in Extreme Fear. On-chain data indicates weak holder conviction, with short-term holders dominating the supply. In this scenario, the ETF may act as a sell-the-news event, mirroring past altcoin product launches that saw initial declines before stabilization.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.