Loading News...

Loading News...

VADODARA, February 2, 2026 — An anonymous Ethereum whale executed a strategic withdrawal of 15,642 ETH (valued at $36.24 million) from major liquidity pools, according to on-chain data. This daily crypto analysis reveals a significant capital movement from crypto market maker Wintermute and exchange Coinbase into private custody, occurring against a backdrop of extreme fear gripping digital asset markets.

On-chain analytics provider Onchain Lens identified the transaction originating from address 0xFB7. The entity moved precisely 15,642 ETH alongside 10 cbBTC (worth $77,750) from Wintermute and Coinbase. Consequently, the whale's total holdings now stand at 135,822 ETH, with a portfolio valuation exceeding $313.55 million. This withdrawal represents a direct reduction of immediately sellable supply on centralized venues.

Market structure suggests this is not a routine transfer. The precision of the amount and the selection of a market maker as a source point to a deliberate liquidity grab. According to Etherscan data, the transaction finalized during a period of heightened volatility, with Ethereum's price testing key technical levels.

Historically, large-scale withdrawals from exchanges precede phases of supply compression. In contrast, deposits often signal impending selling pressure. Underlying this trend is a basic on-chain principle: assets moved to self-custody are less likely to be sold imminently. This event mirrors accumulation patterns observed during the 2018 bear market and the Q3 2022 capitulation.

, the current Extreme Fear sentiment, with a Crypto Fear & Greed Index score of 14/100, provides critical context. Sophisticated actors frequently accumulate during fear-driven sell-offs when retail sentiment turns negative. The whale's action aligns with this contrarian playbook.

Related Developments: This withdrawal occurs alongside other significant market movements, including LD Capital's $70M ETH liquidation signaling institutional de-leveraging and Bitcoin's struggle to hold above $78,000 amid the same fear-driven environment.

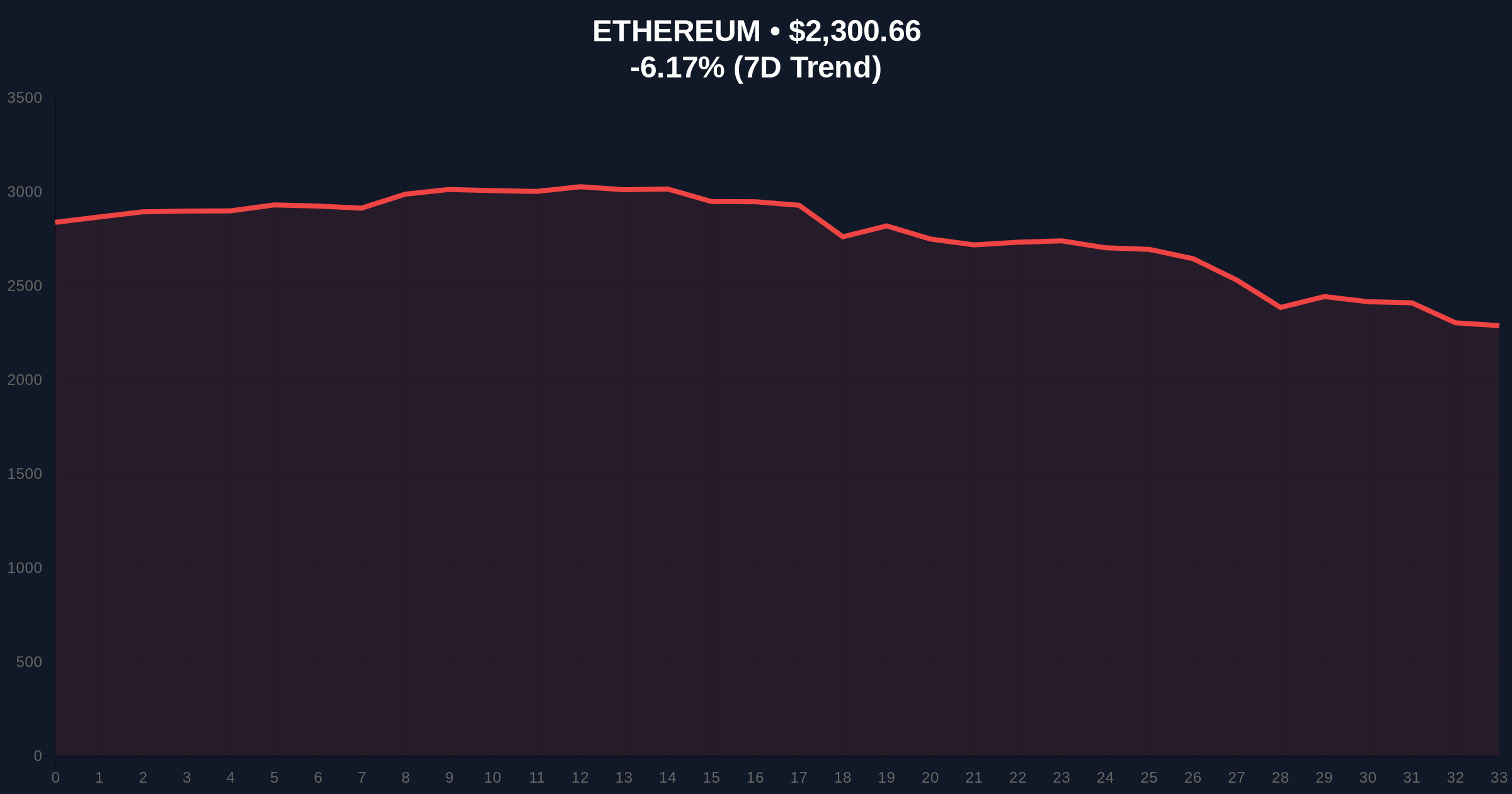

Ethereum's price action shows ETH trading at $2,304.27, down 6.03% over 24 hours. The withdrawal created a minor Fair Value Gap (FVG) on lower timeframes. Critical support now clusters between $2,150 and $2,200, a zone coinciding with the 0.618 Fibonacci retracement level from the last major swing high and the 200-day simple moving average.

Volume Profile analysis indicates thin liquidity below $2,200, increasing the risk of a swift move if that level breaks. The Relative Strength Index (RSI) sits at 32, approaching oversold territory but not yet at historical capitulation extremes seen in prior cycles. This technical setup suggests the market is in a distribution phase, where large players are repositioning rather than exiting entirely.

| Metric | Value |

|---|---|

| ETH Withdrawn | 15,642 ETH |

| USD Value Withdrawn | $36.24 Million |

| Whale's Total ETH Holdings | 135,822 ETH ($313.55M) |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Current ETH Price | $2,304.27 |

| 24-Hour Price Change | -6.03% |

This withdrawal matters because it directly impacts exchange supply metrics. A reduction in exchange reserves increases the illiquid supply ratio, a key on-chain indicator for potential future price appreciation. According to data from Ethereum.org, network fundamentals like staking yields and EIP-4844 adoption remain strong, creating a divergence between price action and underlying utility.

Institutional liquidity cycles often see market makers like Wintermute act as intermediaries for large block trades. Removing capital from their pools can tighten available liquidity for other large sellers, potentially amplifying upward volatility when demand returns. This move may signal that smart money views current prices as a long-term value area, despite the prevailing fear sentiment.

"When whales pull liquidity from market makers during extreme fear, it's a classic sign of accumulation, not distribution. The data suggests they are positioning for a supply shock once sentiment normalizes. The critical level to watch is the $2,150 support; holding that zone validates the accumulation thesis." – CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the invalidation of key technical levels.

The 12-month institutional outlook hinges on macroeconomic conditions and Ethereum's protocol upgrades. If the Federal Reserve's monetary policy, as tracked on FederalReserve.gov, shifts toward easing, it could provide a tailwind for risk assets like ETH. The convergence of on-chain accumulation, improving fundamentals, and a potential macro pivot could set the stage for the next cycle.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.