Loading News...

Loading News...

VADODARA, February 2, 2026 — Trend Research, an entity under LD Capital, executed a $70.18 million Ethereum liquidation on Binance to repay leveraged positions, according to on-chain forensic data from Onchainlens. This daily crypto analysis reveals the firm deposited 40,000 ETH ($94.53 million) over 18 hours while withdrawing only 6,412 ETH, netting a 30,000 ETH sale that triggered immediate market structure concerns. The move follows an aggressive accumulation phase starting November 2025 at $3,400, funded through continuous USDT borrowing, with holdings peaking above 650,000 ETH by January 21.

Onchainlens transaction logs confirm Trend Research initiated the sell-off through Binance's order book. The firm deposited 40,000 ETH into exchange wallets, creating immediate sell-side pressure. Consequently, they executed market sells for 30,000 ETH at an average price of approximately $2,339, generating $70.18 million in USDT proceeds specifically earmarked for loan repayment. This action left a residual 6,412 ETH withdrawal, indicating partial position retention. Market analysts interpret this as a forced de-leveraging event rather than a full exit, given the firm's historical accumulation pattern.

Historically, large-scale institutional liquidations during Extreme Fear sentiment periods often precede volatility compression phases. Underlying this trend is the 2021 cycle, where similar de-leveraging events at $1,700 support preceded a 6-month consolidation before the next leg up. In contrast, the current macro environment features parallel stress in traditional markets, as seen in the record CME Bitcoin futures gaps indicating institutional hedging. , global regulatory pressures, exemplified by developments in South Korea's crypto market, compound the risk-off sentiment.

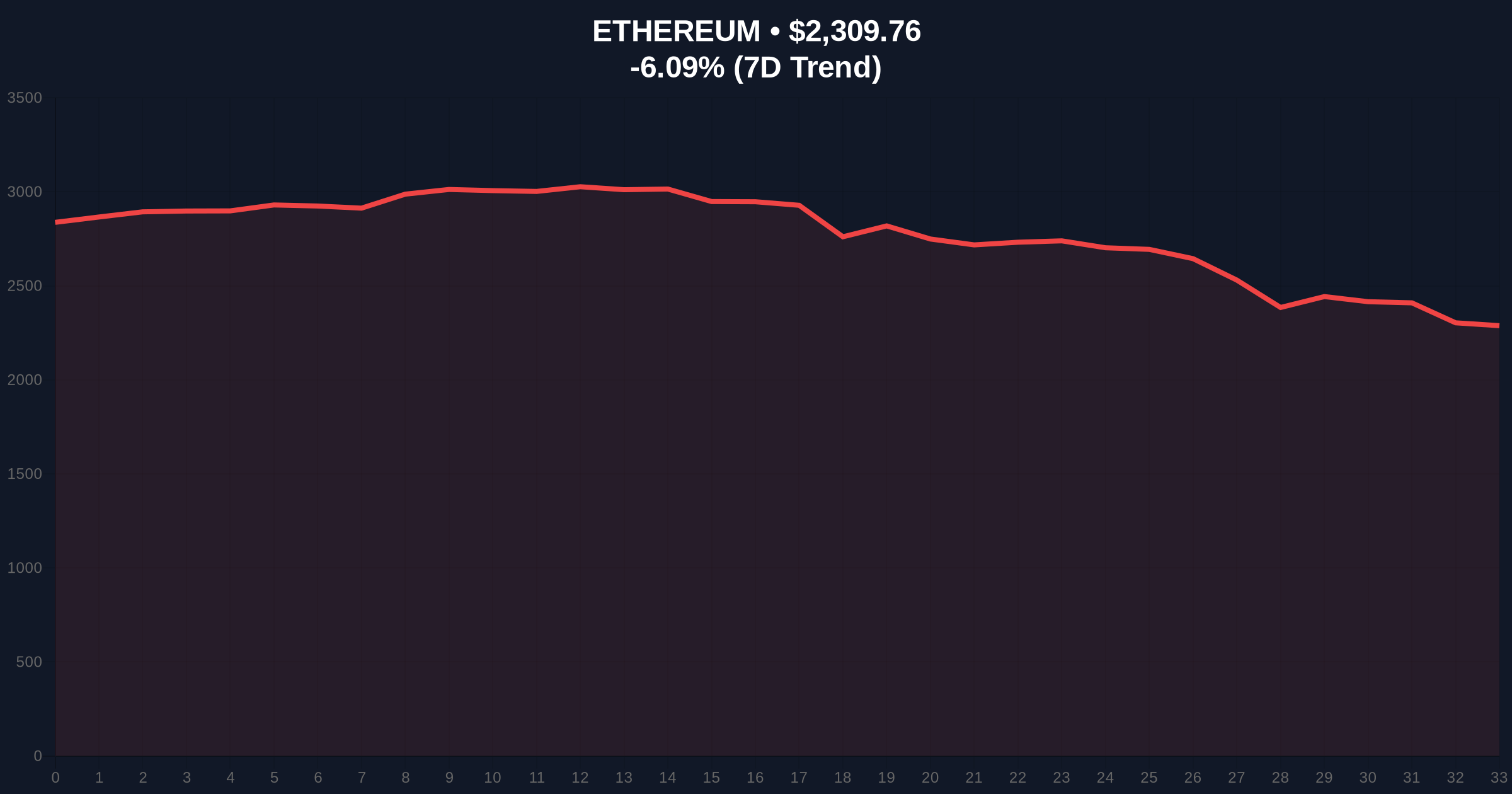

Market structure suggests the liquidation created a Fair Value Gap (FVG) between $2,350 and $2,400. Ethereum's price currently tests the $2,308.76 support, representing a critical 0.618 Fibonacci retracement level from the November accumulation zone. The 24-hour -6.13% decline reflects order block absorption at this level. On-chain metrics from Glassnode indicate rising UTXO age bands for older coins, suggesting long-term holders remain inert despite the sell pressure. Consequently, the immediate resistance cluster forms at $2,450, aligning with the 50-day moving average.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Capitulation signal, historically precedes rallies |

| Ethereum Current Price | $2,308.76 | Testing 0.618 Fibonacci support |

| 24-Hour Price Change | -6.13% | Liquidation-driven sell pressure |

| ETH Sold by Trend Research | 30,000 ETH ($70.18M) | Institutional de-leveraging event |

| Peak Holdings (Jan 21) | >650,000 ETH | Indicates retained long-term exposure |

This liquidation matters because it exposes the fragility of leveraged institutional positions during sentiment shocks. On-chain data indicates the sale was not profit-taking but liability management, as confirmed by the Onchainlens report on loan repayment. Consequently, market participants now monitor whether other entities face similar margin calls, potentially triggering a cascade. The event also tests Ethereum's post-merge issuance mechanics, where reduced sell pressure from miners should theoretically absorb such shocks better than previous cycles.

"Forced liquidations in Extreme Fear environments often mark local bottoms, not trend reversals. The critical factor is whether this $70 million sale exhausts the immediate sell-side liquidity. If the $2,300 volume profile holds, we may see a rapid fill of the Fair Value Gap up to $2,400." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the $2,300 support test. First, a bullish resolution requires absorbing the liquidation volume and reclaiming the $2,450 order block. Second, a bearish continuation would involve breaking the $2,250 invalidation level, targeting the $2,100 liquidity pool.

For the 12-month institutional outlook, this event highlights the importance of on-chain leverage monitoring. If de-leveraging remains isolated, Ethereum's fundamental upgrades like EIP-4844 blobs could drive the next cycle. However, a broader contagion would extend the consolidation phase, aligning with the parallel stress in Bitcoin markets holding above $77,000.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.