Loading News...

Loading News...

VADODARA, February 6, 2026 — The US government's strategic Bitcoin portfolio approaches $5 billion in unrealized losses, according to a Walter Bloomberg report. This latest crypto news reveals a 45% price decline from Bitcoin's all-time high has reduced the holdings' value from approximately $18.5 billion to $13.8 billion. Market structure suggests this represents one of the largest institutional paper losses in cryptocurrency history.

Walter Bloomberg data indicates the US government maintains significant Bitcoin holdings acquired through various enforcement actions and strategic purchases. The current market downturn has created a substantial Fair Value Gap between acquisition costs and present valuations. Consequently, the portfolio's unrealized losses now approach $5 billion, representing approximately 27% of its peak value.

The Trump administration continues its long-term holding strategy despite these paper losses. Official statements emphasize belief that long-term gains will offset short-term volatility. However, critics argue these losses demonstrate the inherent risks of allocating taxpayer funds to high-volatility digital assets. This debate mirrors broader institutional discussions about cryptocurrency allocation in sovereign wealth portfolios.

Historically, government Bitcoin holdings have followed confiscation cycles rather than strategic accumulation. The current approach represents a significant departure from previous enforcement-focused models. Underlying this trend is growing institutional acceptance of Bitcoin as a strategic reserve asset, despite recent price volatility.

In contrast to previous cycles where governments rapidly liquidated seized assets, the current strategy reflects a maturation in institutional cryptocurrency management. This parallels developments in private sector institutional adoption, where long-term holding strategies have increasingly replaced short-term trading approaches. The sustained holding despite substantial paper losses suggests a fundamental shift in how sovereign entities value digital assets.

Related developments in the current extreme fear market include significant futures liquidations signaling capitulation and positive Coinbase premium indicating US investor accumulation above key psychological levels.

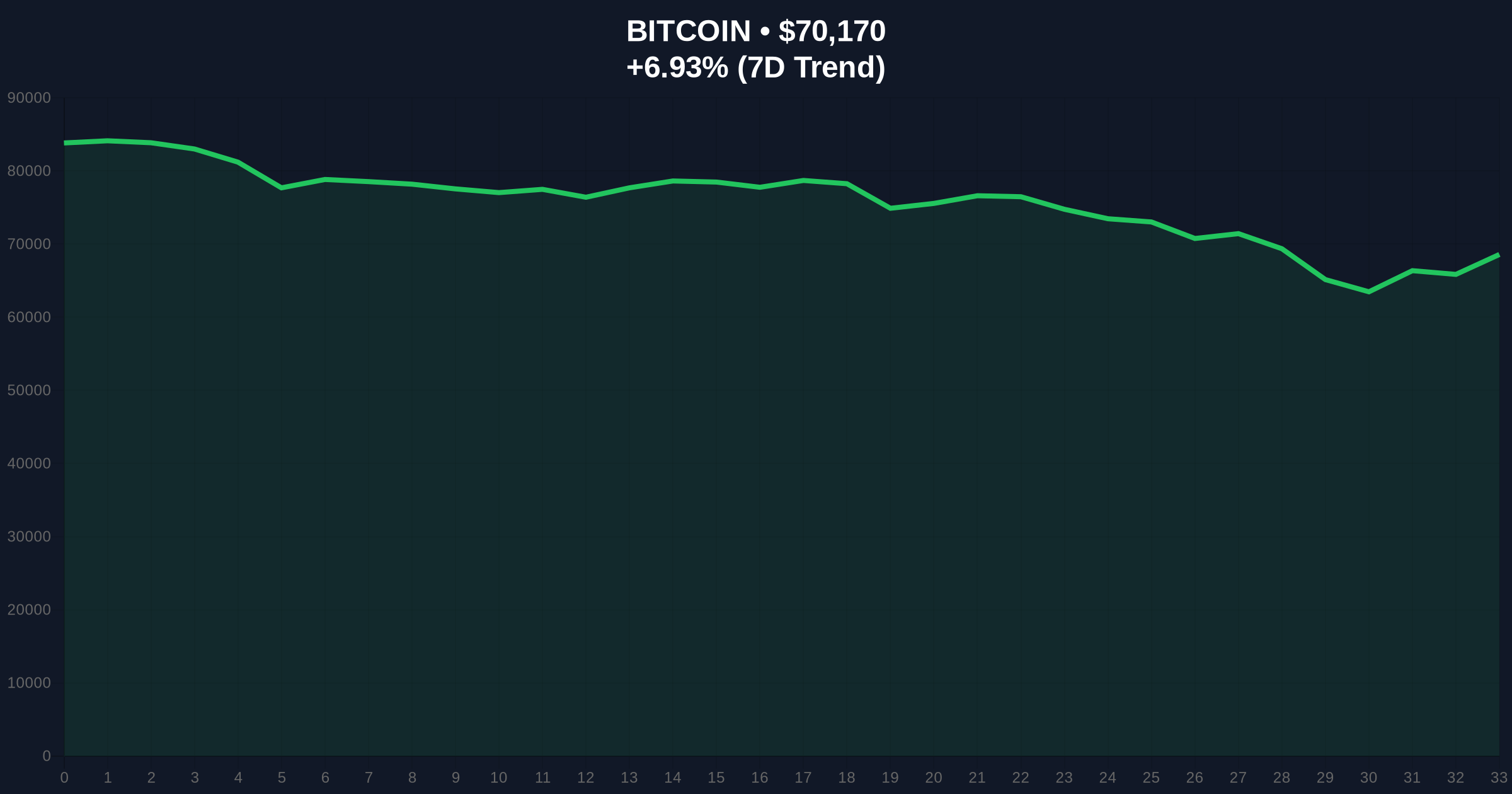

Bitcoin's current price of $70,174 represents a critical juncture in market structure. The 45% decline from all-time highs has created multiple Fair Value Gaps that require filling. Technical analysis reveals strong support at the Fibonacci 0.618 retracement level of $68,500, which aligns with previous Order Block accumulation zones.

On-chain data from Glassnode indicates reduced exchange outflows despite the price decline, suggesting institutional holders maintain conviction. The Volume Profile shows significant liquidity accumulation between $65,000 and $72,000, creating a potential springboard for price recovery. Market structure suggests the current extreme fear sentiment often precedes significant trend reversals when combined with institutional accumulation patterns.

The Relative Strength Index (RSI) currently sits at 32, indicating oversold conditions without reaching extreme capitulation levels. The 200-day moving average at $67,800 provides additional technical support. A break below this level would invalidate the current bullish market structure and potentially trigger further downside toward $62,000 support.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Indicates maximum capitulation sentiment |

| Bitcoin Current Price | $70,174 | 45% below all-time high |

| 24-Hour Price Change | +6.94% | Potential relief rally in extreme fear |

| US Government Unrealized Loss | ~$4.7 billion | 27% of peak portfolio value |

| Portfolio Value Decline | $18.5B → $13.8B | Strategic holding test |

The US government's substantial unrealized losses test the fundamental thesis of Bitcoin as a strategic reserve asset. This development carries implications for institutional adoption timelines and regulatory approaches. , it provides a real-world stress test of long-term holding strategies during significant market downturns.

Market structure suggests sovereign Bitcoin holdings create additional layers of market support during corrections. The government's decision to maintain its position despite paper losses signals conviction that could influence other institutional players. Consequently, this event may accelerate the maturation of cryptocurrency as an asset class within traditional finance frameworks.

"The US government's decision to maintain strategic Bitcoin holdings despite approaching $5 billion in paper losses represents a watershed moment for institutional cryptocurrency adoption. This demonstrates a shift from viewing digital assets as purely speculative to recognizing their potential as long-term strategic reserves. The current extreme fear market conditions provide the ultimate stress test for this thesis." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current technical levels and institutional behavior. The Fibonacci 0.618 support at $68,500 represents the critical pivot point for determining medium-term direction.

The 12-month institutional outlook remains cautiously optimistic despite current extreme fear conditions. Historical cycles suggest government accumulation during downturns often precedes significant bull markets. The sustained holding strategy indicates belief in Bitcoin's long-term value proposition, potentially setting the stage for the next institutional adoption wave once market sentiment normalizes.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.