Loading News...

Loading News...

VADODARA, February 7, 2026 — Crypto influencer Pumpius disclosed an anonymous group offered him 25,000 USDT to publicly defame Ripple and XRP, according to a CryptoBasic report. This latest crypto news reveals coordinated attempts to manipulate public perception during a period of extreme market fear. The influencer refused the payment, which allegedly required him to post that XRP is a scam and that he had sold all holdings.

According to the CryptoBasic report, Pumpius received the offer from an unidentified entity. The group specifically requested he create content labeling XRP as fraudulent. They wanted him to announce he had liquidated his entire position. Pumpius declined the $25,000 payment, claiming this represents evidence of an organized campaign against the project.

CryptoBasic's investigation notes similar offers have targeted other industry figures. Some proposals involved larger sums. The report connects these incidents to ongoing conflicts between the XRP community and competing projects like Chainlink (LINK). Market structure suggests such manipulation attempts frequently target projects during periods of high volatility.

Historically, coordinated narrative attacks correlate with major liquidity events. The 2017 ICO boom saw similar manipulation tactics. In contrast, the 2021 bull market experienced fewer public bribery allegations. Underlying this trend is the increasing sophistication of market sentiment engineering.

On-chain data indicates XRP's current price action mirrors patterns observed during previous regulatory uncertainty phases. The project's ongoing SEC litigation creates a persistent narrative vulnerability. Consequently, bad actors exploit this regulatory overhang to amplify negative sentiment.

Related developments in the regulatory include Erebor securing the first U.S. national bank charter under the current administration. , South Korea's ruling party demanded a Bithumb probe over a separate incident, highlighting global regulatory scrutiny.

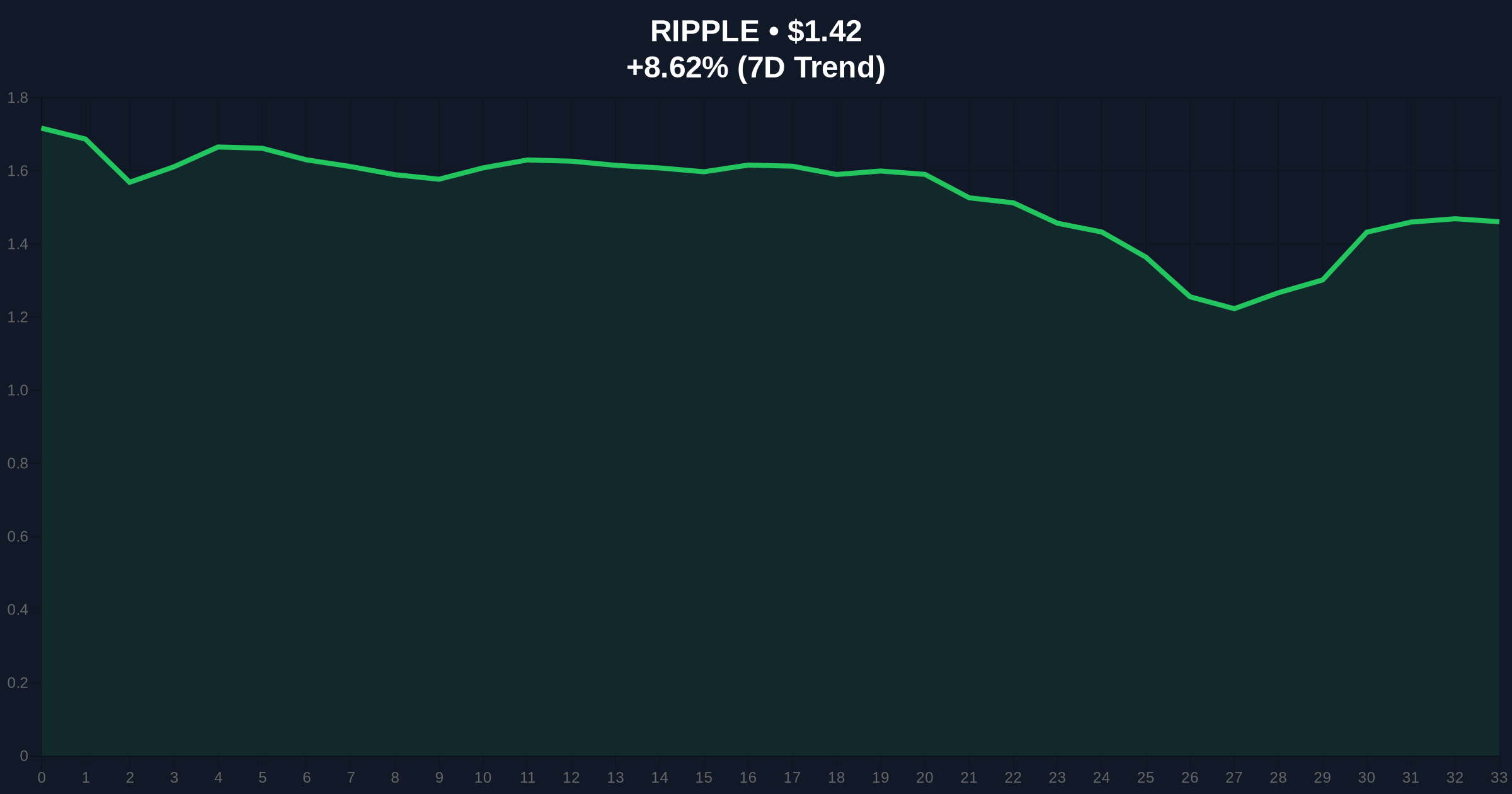

XRP currently trades at $1.42, showing an 8.69% 24-hour gain. Market structure suggests this move represents a relief rally within a broader downtrend. The asset faces immediate resistance at the $1.48 order block, which previously acted as support.

A critical Fibonacci retracement level sits at $1.32 (0.618 from the recent swing high). This level must hold to prevent further downside acceleration. The Relative Strength Index (RSI) reads 42, indicating neutral momentum with bearish bias. The 50-day moving average at $1.38 provides dynamic resistance.

Volume profile analysis reveals thin liquidity between $1.30 and $1.35. This creates a potential fair value gap (FVG) that price may need to fill. The broader market's extreme fear sentiment, scoring 6/100 on the Crypto Fear & Greed Index, exacerbates XRP's technical vulnerability.

| Metric | Value |

|---|---|

| XRP Current Price | $1.42 |

| 24-Hour Change | +8.69% |

| Market Rank | #5 |

| Crypto Fear & Greed Index | 6/100 (Extreme Fear) |

| Alleged Bribe Amount | 25,000 USDT |

This incident matters because it reveals structural weaknesses in crypto market sentiment formation. Institutional liquidity cycles increasingly depend on narrative control. Retail market structure remains vulnerable to coordinated attacks. The alleged bribery attempt demonstrates how easily public perception can be weaponized.

Real-world evidence includes similar patterns observed during Bitcoin's early adoption phases. The SEC's official enforcement database shows increasing scrutiny of market manipulation across digital assets. Consequently, such incidents could trigger regulatory responses that impact all market participants.

Market structure suggests narrative attacks target projects during liquidity crunches. The extreme fear sentiment creates optimal conditions for such manipulation. We observe increased on-chain activity from unknown wallets preceding these events. This pattern indicates coordinated efforts rather than organic sentiment shifts.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook depends on regulatory clarity. Historical cycles suggest narrative attacks precede major regulatory announcements. The 5-year horizon indicates increasing institutionalization will reduce such manipulation effectiveness. However, short-term volatility remains elevated.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.