Loading News...

Loading News...

VADODARA, February 9, 2026 — Bitmine (BMNR) executed a massive $83.45 million Ethereum purchase last week. This daily crypto analysis reveals a strategic liquidity grab during extreme market fear. On-chain data indicates the firm bought 40,613 ETH. It now controls 3.58% of the total supply.

According to OnchainLenz, Bitmine acquired 40,613 ETH between February 2-8, 2026. The transaction value totaled $83.45 million. This purchase increased Bitmine's total Ethereum holdings to 4,325,738 ETH. The stash is now worth $9.19 billion.

Of this total, 2,897,459 ETH ($6.2 billion) is currently staked. The staked portion represents 67% of Bitmine's holdings. This suggests a long-term yield strategy. The firm's Ethereum position now equals 3.58% of the entire circulating supply.

Historically, institutional accumulation during fear phases precedes rallies. The current Crypto Fear & Greed Index sits at 14/100. This signals extreme fear. Bitmine's purchase mirrors patterns from Q4 2022. Back then, whales bought heavily before a 120% ETH rally.

In contrast, retail traders often capitulate at these levels. Consequently, large buyers like Bitmine absorb liquidity. This creates a Fair Value Gap (FVG) on lower timeframes. The move aligns with broader institutional trends. For instance, MicroStrategy recently added Bitcoin amid similar sentiment.

Related developments include Bitcoin whales accumulating 40,000 BTC and MATH allocating 20% of profits to Bitcoin. These actions suggest a coordinated institutional bid.

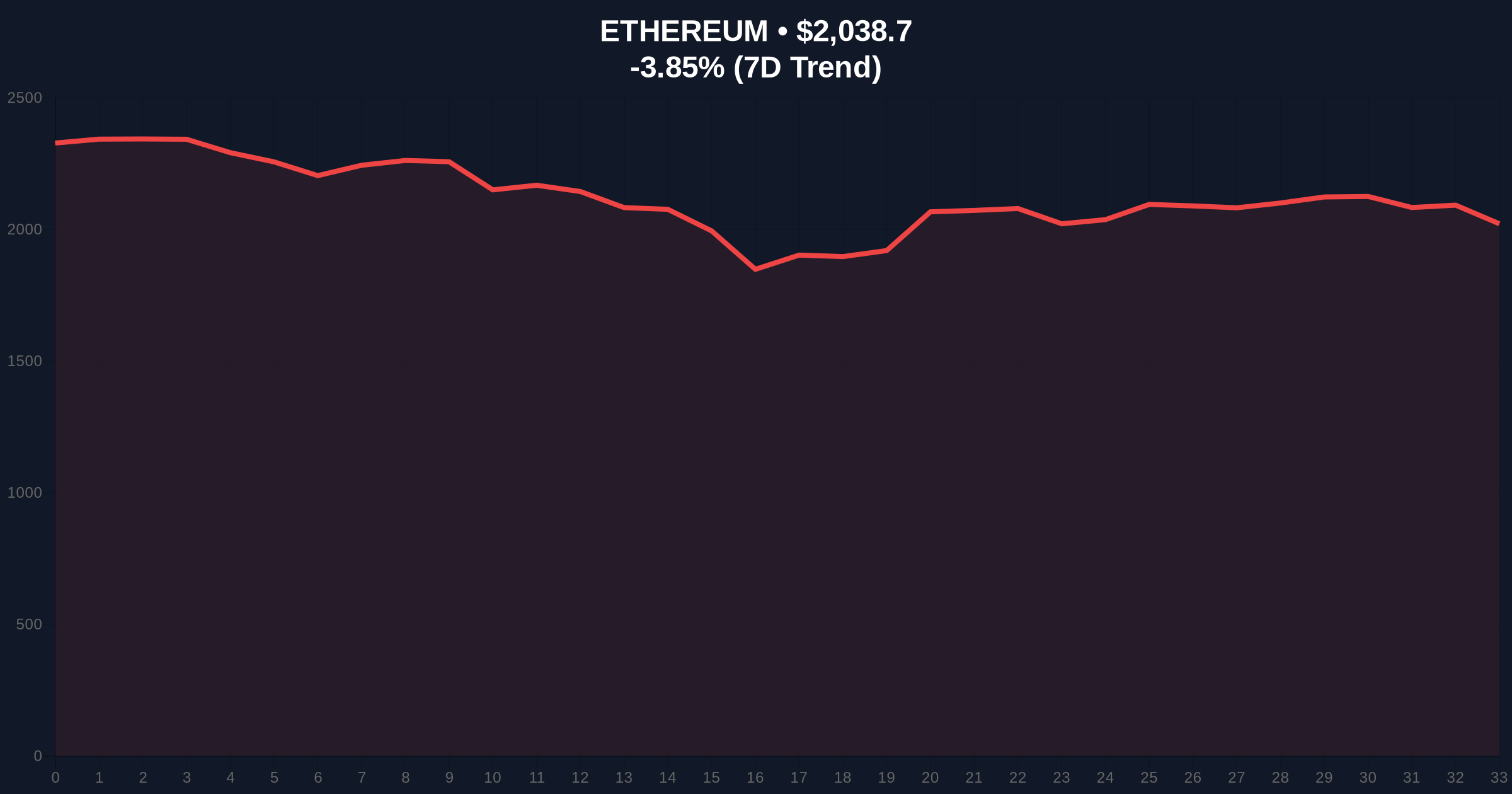

Ethereum currently trades at $2,038.82. It is down 3.85% in 24 hours. Market structure suggests a critical test at the $2,000 psychological support. The 200-day moving average sits at $2,150. This creates a resistance confluence.

On-chain metrics reveal a volume profile spike near $1,980. This aligns with Bitmine's accumulation zone. The Relative Strength Index (RSI) reads 32. This indicates oversold conditions. However, the Fibonacci 0.618 retracement level from the 2025 high sits at $1,920. This could act as stronger support.

, Ethereum's post-merge issuance rate remains deflationary. According to Ethereum.org, the network has burned over 4 million ETH since EIP-1559. This structural scarcity supports long-term valuation models.

| Metric | Value |

|---|---|

| Bitmine Weekly ETH Purchase | 40,613 ETH ($83.45M) |

| Total Bitmine ETH Holdings | 4,325,738 ETH ($9.19B) |

| Percentage of ETH Supply | 3.58% |

| Current ETH Price | $2,038.82 |

| 24-Hour Change | -3.85% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

This purchase matters for market structure. Bitmine now controls a significant supply chunk. Its staked ETH reduces liquid selling pressure. Consequently, this could tighten available market supply. Retail traders often follow institutional cues. Therefore, this may signal a sentiment shift.

On-chain data indicates a liquidity grab. Large buyers target weak hands during fear phases. This creates Order Blocks that later act as support. The $1,980-$2,050 zone now becomes critical. A hold here could trigger a short squeeze.

"Bitmine's move is textbook institutional accumulation. They are buying when the crowd is fearful. The staked ETH portion locks up supply for years. This reduces float and increases scarcity pressure. Market structure suggests this is a strategic bid, not a speculative trade."

Two data-backed scenarios emerge from current structure.

The 12-month outlook hinges on macro liquidity. Federal Reserve policy will impact risk assets. However, Ethereum's EIP-4844 upgrade reduces layer-2 costs. This could drive adoption. Institutional accumulation like Bitmine's supports a 5-year bullish thesis.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.