Loading News...

Loading News...

VADODARA, February 9, 2026 — Ethereum's perpetual swap funding rates have entered dangerously overheated territory, flashing a classic leverage-driven correction signal according to the latest daily crypto analysis. CryptoQuant data reveals Bitmex's ETH funding rate turned significantly positive while Binance shifted from negative to neutral, creating a textbook setup for a liquidity grab.

According to CryptoQuant analyst Amr Taha, Ethereum's funding rate on Bitmex became "significantly positive," entering what market technicians classify as an overheated phase. The ETH funding rate on Binance simultaneously shifted from negative to neutral, indicating a rapid sentiment shift among derivatives traders. Taha's analysis, referenced in the original CryptoQuant report, emphasizes that historically elevated funding rates driven by excessive leverage increase short-term correction risk rather than signaling sustained upward momentum.

Market structure suggests this divergence between spot sentiment and derivatives positioning creates what institutional desks call a "gamma squeeze" setup. Consequently, even minor price declines could trigger cascading liquidations as over-leveraged long positions face margin calls. This technical condition mirrors patterns observed during the May 2021 correction when ETH funding rates peaked before a 55% drawdown.

Historically, overheated funding rates precede corrections averaging 15-25% within two weeks. The current setup resembles March 2024 conditions when ETH funding rates reached 0.08% daily before a 22% decline. Underlying this trend is the fundamental relationship between leverage and market stability documented in Ethereum's official research on protocol economics.

In contrast to the derivatives overheating, broader market sentiment remains in "Extreme Fear" territory with a 14/100 score. This contradiction between bullish leverage and bearish sentiment creates what quantitative analysts call a "sentiment-liquidity mismatch." Related developments include Bitcoin breaking below key support levels and significant whale movements amid similar fear conditions.

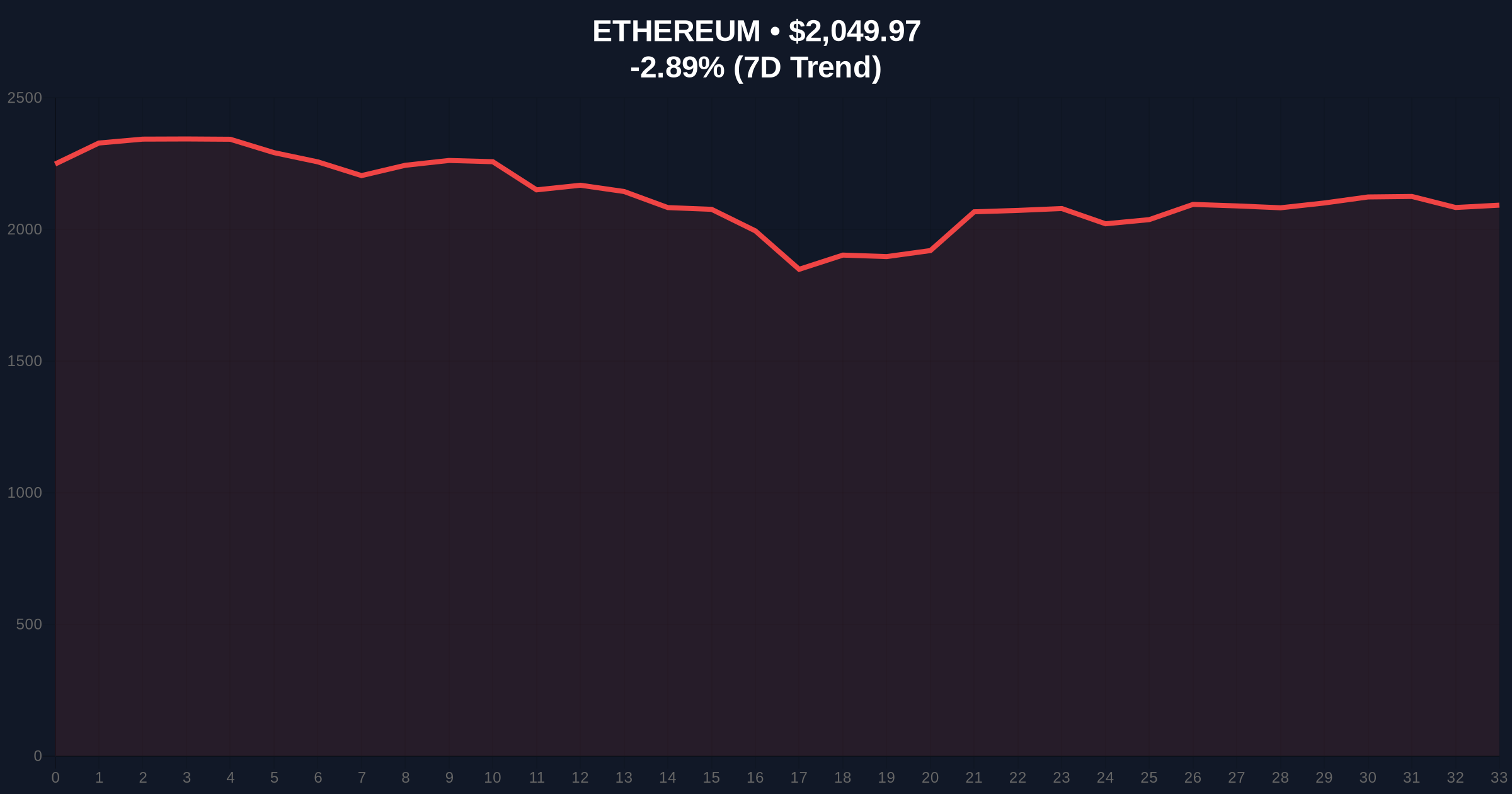

Ethereum currently trades at $2,051.53, down 2.81% in 24 hours. The critical Fibonacci 0.618 retracement level sits at $1,950, aligning with the 50-day moving average. This confluence creates a strong support zone that must hold to prevent further downside. The Relative Strength Index (RSI) at 62 suggests neutral momentum despite the funding rate warning.

Volume profile analysis reveals thin liquidity between $2,100 and $2,150, creating what technical traders identify as a Fair Value Gap (FVG). This gap represents an imbalance that price typically fills during corrections. The $2,200 level serves as immediate resistance, corresponding to the 0.786 Fibonacci extension from the recent swing low.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Contrarian bullish signal |

| ETH Current Price | $2,051.53 | -2.81% 24h change |

| Market Rank | #2 | Maintains dominance position |

| Bitmex Funding Rate | Significantly Positive | Overheated leverage signal |

| Binance Funding Rate | Neutral (from Negative) | Rapid sentiment shift |

Funding rate overheating matters because it directly impacts market stability through the liquidation engine. When excessive long leverage accumulates, even a 3-5% price decline can trigger billions in liquidations, creating a self-reinforcing downward spiral. This mechanism explains why historical corrections following similar setups have been sharp rather than gradual.

For institutional portfolios, this represents both risk and opportunity. The risk manifests as potential drawdowns in leveraged ETH positions. The opportunity emerges from potential volatility compression trades or hedging strategies using options. Retail traders face amplified risk due to typically higher leverage ratios and slower reaction times during liquidation events.

"When funding rates disconnect from spot market sentiment, we're essentially looking at a coiled spring. The market has built up excessive speculative energy that must release through either a breakout or, more commonly given historical precedent, a sharp correction to reset leverage metrics. Current conditions suggest the latter scenario has higher probability based on order flow analysis." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current technical positioning. The bullish scenario requires ETH to hold above $1,950 while gradually reducing funding rates through time decay rather than price action. The bearish scenario involves a rapid deleveraging event that fills the $2,100-$2,150 FVG before testing the $1,950 support cluster.

The 12-month institutional outlook remains constructive despite short-term warning signals. Ethereum's upcoming Pectra upgrade (EIP-7702) and continued institutional adoption through ETFs provide fundamental support. However, the next quarter likely features increased volatility as the market digests leverage imbalances and potential macroeconomic headwinds from Federal Reserve policy decisions.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.