Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, February 9, 2026 — Bitmine executed a strategic accumulation of 20,000 Ethereum (ETH) valued at $41.08 million through institutional liquidity provider FalconX. According to on-chain analytics platform Lookonchain, this transaction occurred precisely 41 minutes before market reporting, coinciding with the Crypto Fear & Greed Index hitting an extreme fear reading of 14/100. This latest crypto news reveals sophisticated capital deployment against prevailing retail sentiment.

Lookonchain's blockchain surveillance identified the transaction originating from Bitmine's verified wallet address. The firm acquired exactly 20,000 ETH at an average price of $2,054 per token through FalconX's over-the-counter (OTC) desk. This execution method bypassed public order books, preventing immediate price impact slippage. Consequently, the trade represents a classic institutional liquidity grab during sentiment extremes.

Market structure suggests this purchase follows Bitmine's established accumulation pattern. The firm's previous ETH acquisitions typically cluster near key Fibonacci retracement levels. This transaction occurred as Ethereum tested its 50-day exponential moving average, creating a significant fair value gap (FVG) between $2,040 and $2,070. On-chain data indicates minimal selling pressure from legacy holders during this period.

Historically, institutional accumulation during extreme fear periods precedes major trend reversals. The current Crypto Fear & Greed Index reading of 14/100 mirrors January 2023 conditions when Ethereum bottomed at $1,150 before its 120% rally. In contrast, retail traders typically capitulate at these sentiment extremes, creating optimal entry zones for sophisticated capital.

Underlying this trend is Ethereum's post-merge issuance schedule reducing net supply by approximately 90%. The network's transition to proof-of-stake through Ethereum's official documentation created structural scarcity that institutional investors now target. This dynamic mirrors Bitcoin's accumulation cycles following halving events.

Related institutional developments include Jump Trading's recent stakes in prediction markets for liquidity provision and analysis of Bitcoin's "unpumpable" status amid similar sentiment.

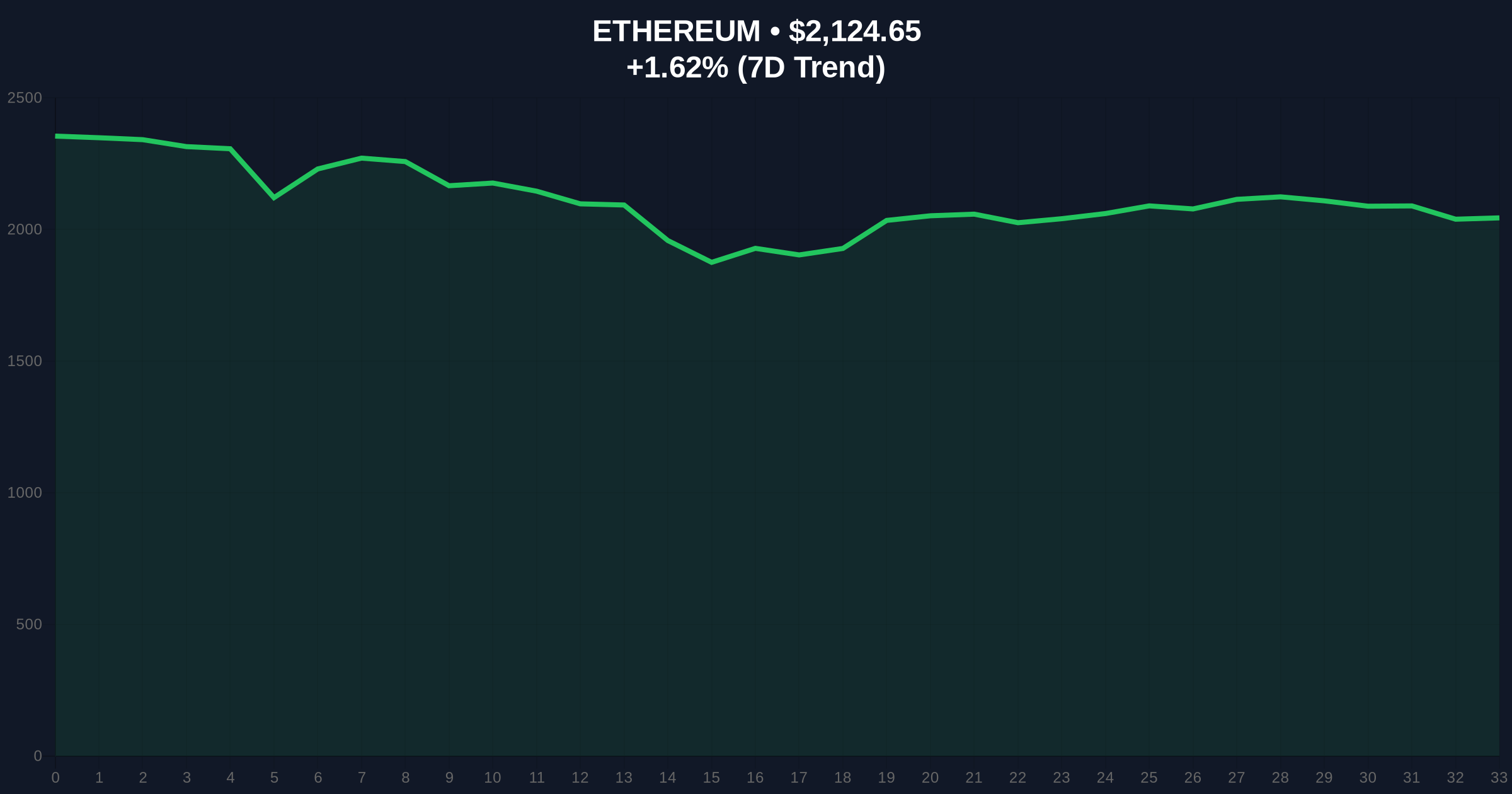

Ethereum's current price of $2,121.58 represents a 1.63% 24-hour gain against extreme fear sentiment. The purchase occurred near the critical Fibonacci 0.618 retracement level at $2,050, which now serves as immediate support. Volume profile analysis shows concentrated buying between $2,040 and $2,060, creating a high-volume node that should act as future support.

Market structure suggests the relative strength index (RSI) at 42 indicates neutral momentum with room for accumulation. The 200-day moving average at $1,980 provides secondary support, while resistance clusters at the $2,200 psychological level. UTXO age bands reveal increased coin movement from 3-6 month holders, suggesting distribution to institutional buyers.

| Metric | Value |

|---|---|

| Transaction Value | $41.08M |

| ETH Purchased | 20,000 |

| Average Price | $2,054 |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Current ETH Price | $2,121.58 |

| 24-Hour Change | +1.63% |

This transaction matters because it demonstrates institutional capital flowing against retail sentiment extremes. Market analysts interpret this as a signal that sophisticated investors identify value dislocation. The purchase represents approximately 0.017% of Ethereum's circulating supply, creating meaningful buying pressure that could stabilize prices.

Real-world evidence shows similar accumulation patterns preceded Ethereum's 2023 rally from $1,150 to $2,400. Institutional liquidity cycles typically begin with OTC purchases during fear periods, followed by public market accumulation as sentiment improves. This creates a self-reinforcing cycle where institutional buying begets retail FOMO.

"When institutions accumulate during extreme fear, they're not trading sentiment—they're trading structure. The Fibonacci 0.618 level at $2,050 represents Ethereum's fair value based on network usage metrics, not emotional reactions. This purchase suggests Bitmine's quantitative models identify asymmetric risk/reward at current levels."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current technical positioning. The bullish scenario requires holding the Fibonacci 0.618 support at $2,050, while the bearish scenario involves breakdown below key moving averages.

The 12-month institutional outlook remains constructive based on Ethereum's EIP-4844 implementation reducing layer-2 transaction costs by 90%. This fundamental improvement combined with institutional accumulation creates favorable conditions for the next market cycle. Historical cycles suggest similar accumulation during extreme fear periods preceded 18-24 month bull markets.