Loading News...

Loading News...

VADODARA, February 3, 2026 — Trend Research deposited an additional 20,000 ETH, valued at $46.54 million, to Binance. According to Onchain Lens, the firm has now moved a total of 93,588 ETH to the exchange. Market structure suggests this daily crypto analysis reveals a potential liquidation event rather than a strategic reallocation.

Onchain Lens data confirms the deposit occurred on February 3, 2026. Trend Research transferred 20,000 ETH in a single transaction. The firm reportedly sold previous deposits to repay a loan. This pattern indicates a consistent liquidity grab over multiple transactions.

Market analysts question the narrative of voluntary selling. The sequential nature of deposits aligns with margin call protocols. Consequently, this activity may reflect underlying financial stress rather than calculated profit-taking.

Historically, large exchange inflows precede volatility spikes. The current Extreme Fear sentiment, with a score of 17/100, amplifies this signal. In contrast, accumulation phases typically show off-exchange movements to cold storage.

This event mirrors the 2022-2023 cycle where over-leveraged entities faced similar liquidations. Underlying this trend is the persistent pressure from rising global interest rates, as detailed in Federal Reserve monetary policy statements. The market now watches for contagion risk.

Related Developments:

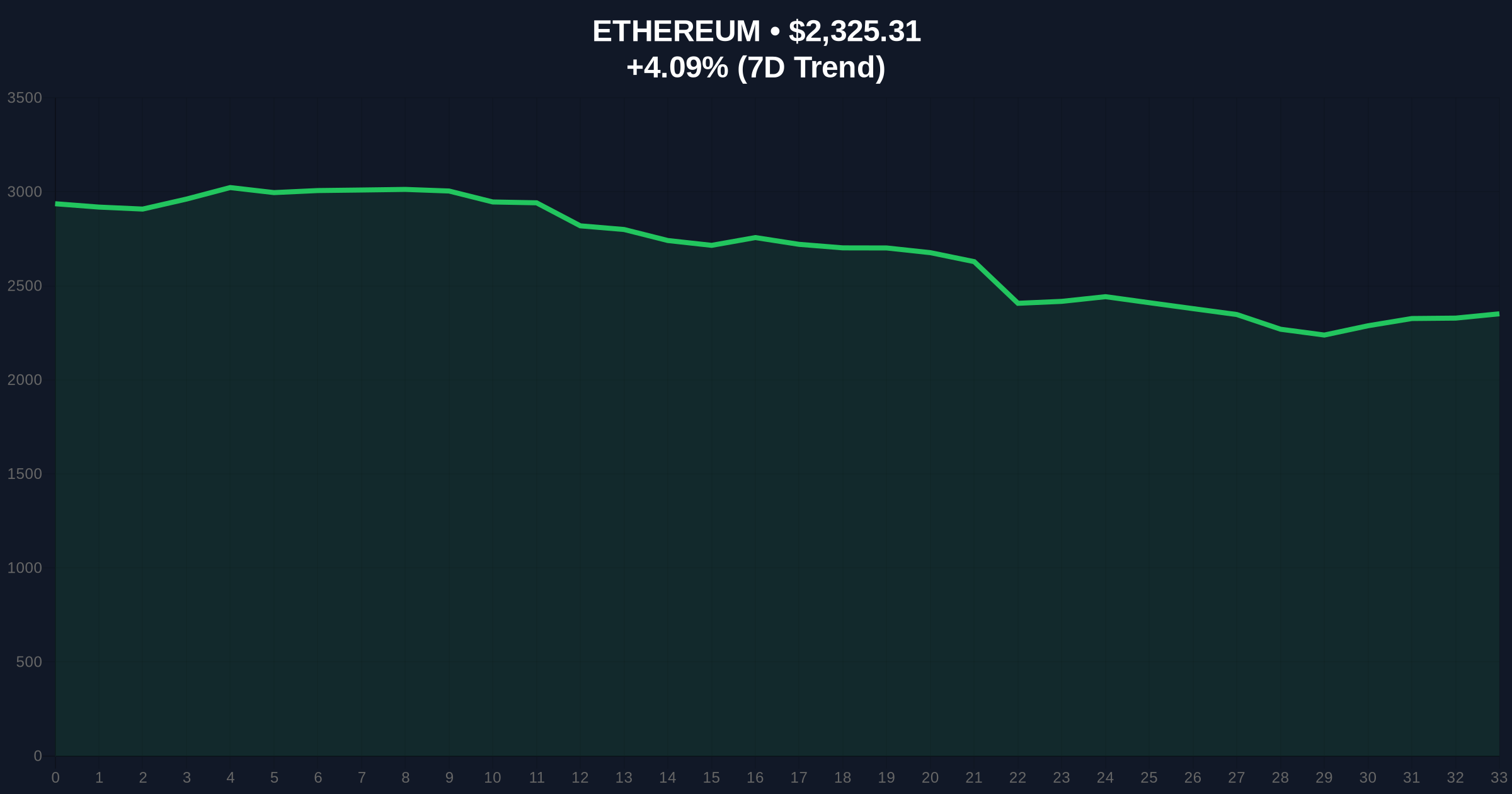

Ethereum currently trades at $2,322.26, up 3.96% in 24 hours. Market structure suggests this bounce faces resistance at the $2,400 order block. The Volume Profile indicates thin liquidity above this level.

A critical Fibonacci support level at $2,250 (0.618 retracement from recent highs) must hold. The RSI at 45 shows neutral momentum, but on-chain selling pressure may create a Fair Value Gap (FVG) below. The 50-day moving average at $2,350 acts as dynamic resistance.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

| Ethereum Current Price | $2,322.26 |

| 24-Hour Change | +3.96% |

| Trend Research Total ETH Deposited | 93,588 ETH |

| Latest Deposit Value | $46.54 Million |

This deposit matters for institutional liquidity cycles. Large sell-side pressure can trigger cascading liquidations in derivative markets. Retail market structure often misinterprets such moves as buying opportunities.

On-chain data indicates a net outflow of smart money. The deposit represents approximately 0.016% of Ethereum's circulating supply. While seemingly small, it signals sentiment among sophisticated players. Market analysts watch for similar behavior from other funds.

"The sequential deposit pattern suggests a structured unwind, not discretionary selling. Market participants should monitor Binance's order book depth for absorption levels. This activity often precedes a volatility expansion phase." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautious. If this deposit reflects broader deleveraging, Ethereum may face headwinds despite positive fundamentals like EIP-4844 adoption. The 5-year horizon still favors network growth, but short-term price discovery hinges on macro liquidity.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.