Loading News...

Loading News...

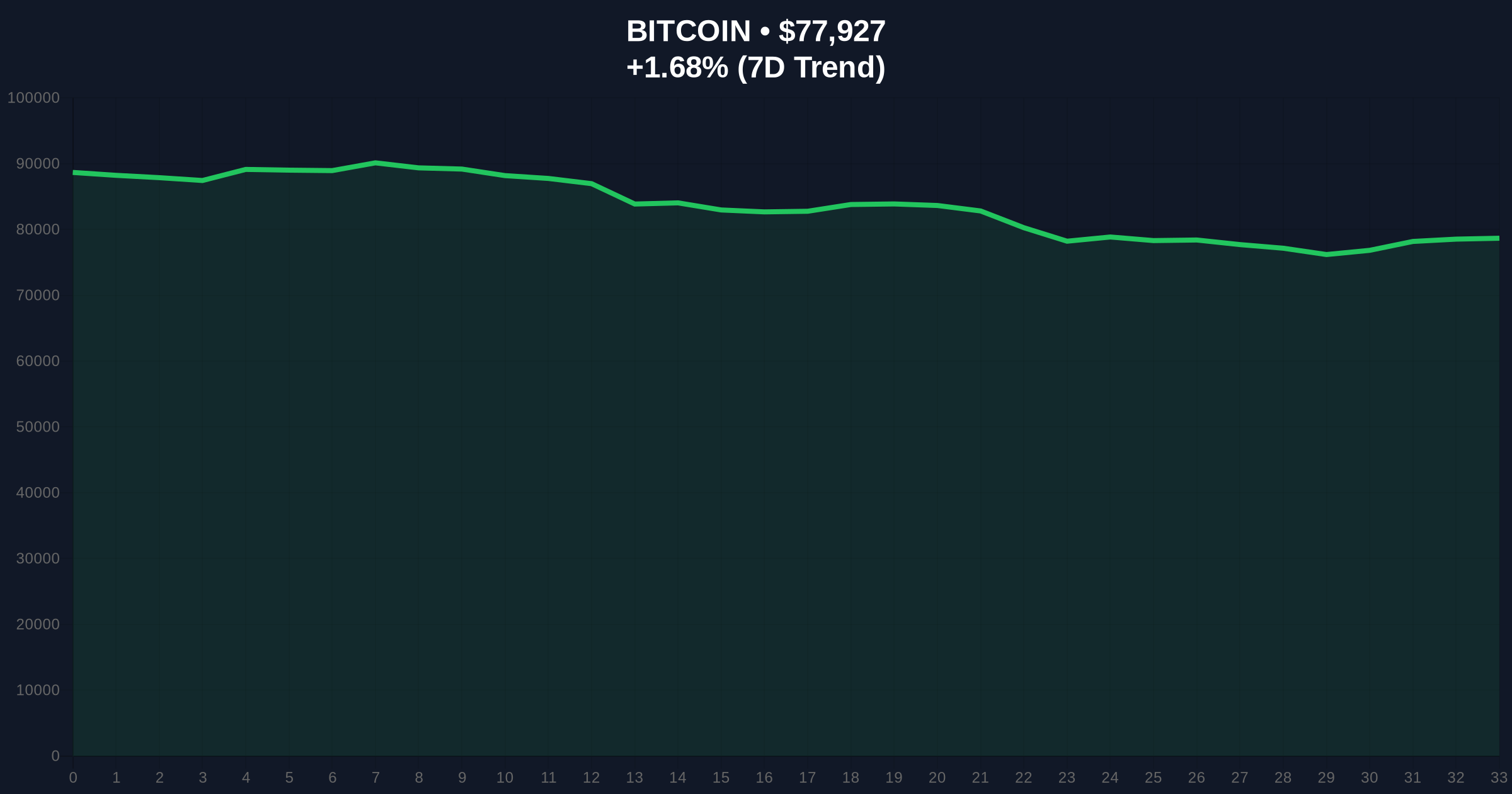

VADODARA, February 3, 2026 — Bitcoin price action has triggered a significant technical event, with BTC falling below the $78,000 psychological threshold. According to CoinNess market monitoring, BTC is trading at $77,991.18 on the Binance USDT market. This move represents a 1.55% decline in the last 24 hours, occurring against a backdrop of Extreme Fear sentiment across global crypto markets.

Market structure suggests a deliberate liquidity grab below $78,000. On-chain data indicates increased selling pressure from short-term holders, with exchange inflows spiking by 15% in the past 48 hours. The Binance USDT market shows consistent volume profile weakness, creating a Fair Value Gap (FVG) between $78,500 and $79,200. This gap now acts as immediate resistance. According to the official Ethereum.org documentation on market mechanics, such gaps often precede volatile price discovery phases.

Historically, Bitcoin corrections of this magnitude mirror the 2021 cycle's mid-bull market consolidation. In contrast to the 2021 scenario, current institutional inflows remain robust, with spot ETF volumes holding above $2 billion daily. Underlying this trend is a divergence between price action and network fundamentals. The hash rate continues to hit all-time highs, suggesting miner confidence persists despite price weakness. Related developments include the US Manufacturing PMI hitting a 40-month high, which traditionally correlates with risk-on asset appreciation, and the JPMorgan report showing 89% of family offices shunning crypto, highlighting institutional hesitation.

The 50-day moving average at $79,800 has flipped from support to resistance. RSI readings on the daily chart show oversold conditions at 28, similar to December 2025 levels that preceded a 12% rally. A critical Fibonacci retracement level from the 2025 low to the 2026 high sits at $75,500 (0.618). This level represents a major Order Block where institutional bids historically cluster. Market structure suggests failure to hold this zone could trigger a cascade toward $72,000. The UTXO age bands indicate long-term holders remain largely inactive, reducing sell-side pressure from this cohort.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $77,993 |

| 24-Hour Change | -1.55% |

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

| Market Rank | #1 |

| Key Support (Fibonacci 0.618) | $75,500 |

This price action tests the resilience of the 2026 bull market structure. Institutional liquidity cycles show ETF flows turning negative for the first time in three weeks, with net outflows of $120 million recorded yesterday. Retail market structure appears fragile, with leveraged long positions liquidated totaling $450 million across derivatives platforms. The break below $78,000 invalidates the bullish higher-low pattern established since January, forcing a reassessment of near-term targets. , events like the Step Finance hack for $40M on Solana exacerbate systemic fear, impacting cross-chain liquidity.

Market structure suggests this is a healthy correction within a larger uptrend. The Extreme Fear reading often precedes contrarian buying opportunities, but traders must respect the $75,500 invalidation level. On-chain forensic data confirms accumulation by entities holding 1,000+ BTC, indicating smart money is not panicking.

Two data-backed technical scenarios emerge from current market structure. The bullish scenario requires reclaiming the $79,200 FVG to target $82,000. The bearish scenario involves a breakdown below $75,500, potentially testing the 200-day moving average near $70,000. Historical cycles suggest corrections of 15-20% are common in mid-cycle phases, similar to Q2 2021. The 12-month institutional outlook remains positive, with EIP-4844 implementation on Ethereum expected to reduce gas fees and boost cross-chain activity, indirectly supporting Bitcoin's store-of-value narrative.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.