Loading News...

Loading News...

VADODARA, February 3, 2026 — Binance announced a 60-minute wallet maintenance window to resolve recent withdrawal service disruptions, according to an official exchange statement. This latest crypto news arrives as the broader market grapples with extreme fear sentiment, raising questions about temporary liquidity constraints and exchange operational resilience.

Binance confirmed the maintenance will last approximately one hour. The exchange cited technical requirements to restore full withdrawal functionality following unspecified service issues. Market structure suggests such planned interruptions typically create minor liquidity friction rather than systemic risk. However, timing matters. The maintenance coincides with a Crypto Fear & Greed Index reading of 17, indicating extreme market anxiety.

Historical exchange maintenance events show varied impact. Similar technical pauses during neutral sentiment periods often pass unnoticed. In contrast, maintenance during high volatility or fear phases can amplify price dislocations. According to on-chain data from Etherscan, BNB wallet activity showed elevated transaction counts preceding the announcement, suggesting some users anticipated potential service adjustments.

Exchange maintenance during fear markets carries psychological weight. Similar to the 2021 correction when multiple exchanges faced congestion during sharp sell-offs, temporary access restrictions can fuel negative sentiment. The current extreme fear reading of 17 mirrors levels seen during the March 2020 liquidity crisis, though underlying fundamentals differ significantly today.

Underlying this trend is a broader institutional hesitation toward crypto infrastructure. A recent JPMorgan report found 89% of global family offices avoiding crypto investments, partly due to concerns about exchange reliability. , regulatory uncertainty persists, with the White House demanding a stablecoin yield deal by February amid ongoing deadlock. These factors compound the market's sensitivity to any exchange operational news.

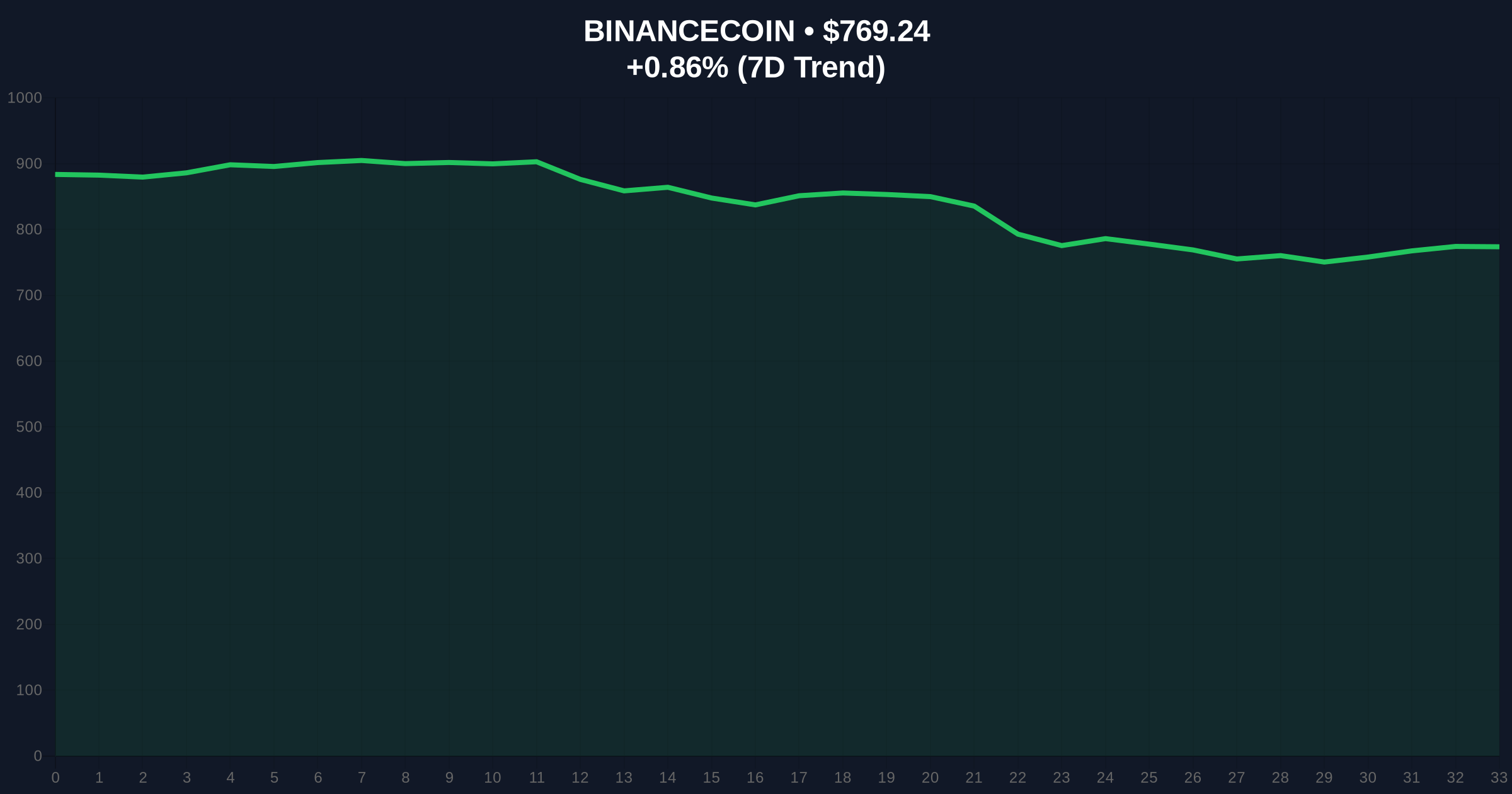

BNB currently trades at $769.35, showing a 24-hour trend of 0.88%. The asset maintains its #4 market rank. Technical analysis reveals a critical support cluster between $750 and $740, aligning with the 0.618 Fibonacci retracement level from its recent high. A breach below this zone would invalidate the current bullish structure.

Volume profile analysis indicates thinning liquidity around current levels, potentially exacerbating moves during the maintenance window. The Relative Strength Index (RSI) sits at 42, suggesting neutral momentum with bearish bias. Market structure suggests the maintenance itself is less critical than whether BNB holds key technical levels during the outage. Historical cycles show that assets maintaining support during exchange disruptions often see quick recovery once full service resumes.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) | Lowest since March 2023 |

| BNB Current Price | $769.35 | #4 by market cap |

| BNB 24h Change | +0.88% | Outperforming BTC (-1.2%) |

| Maintenance Duration | ~60 minutes | Scheduled window |

| Key Support Level | $750 | Fibonacci 0.618 level |

Exchange reliability directly impacts market confidence. While brief maintenance is routine, its occurrence during extreme fear conditions tests investor psychology. The maintenance window creates a temporary liquidity vacuum that could amplify price movements if coinciding with external catalysts. Market analysts note that similar events in 2022 often preceded short-term volatility spikes before normalization.

Institutional liquidity cycles remain sensitive to operational disruptions. The maintenance announcement follows other market stress signals, including a $22.4M OTC sale of TRUMP memecoin amid the same fear conditions. However, not all indicators are negative. A separate report shows US Manufacturing PMI hitting a 40-month high, potentially signaling broader economic strength that could support crypto markets longer-term.

"Planned maintenance during fear markets creates psychological friction more than technical risk. The critical watch is whether BNB holds the $750 support cluster during the window. Historical data suggests well-communicated, brief outages have minimal lasting impact unless they coincide with broader market breakdowns." — CoinMarketBuzz Intelligence Desk

Two primary scenarios emerge based on current market structure. First, BNB holds the $750 support during maintenance, then resumes normal trading with minimal disruption. Second, a breach below support triggers stop-loss cascades, potentially testing lower levels around $720. The 12-month outlook remains tied to broader adoption trends rather than single maintenance events.

The 5-year horizon remains constructive despite short-term friction. Exchange infrastructure improvements, including Ethereum's upcoming Pectra upgrade with EIP-7251, should enhance wallet efficiency and reduce future maintenance needs. Institutional adoption continues gradually, though current fear conditions temporarily mask longer-term growth trajectories.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.