Loading News...

Loading News...

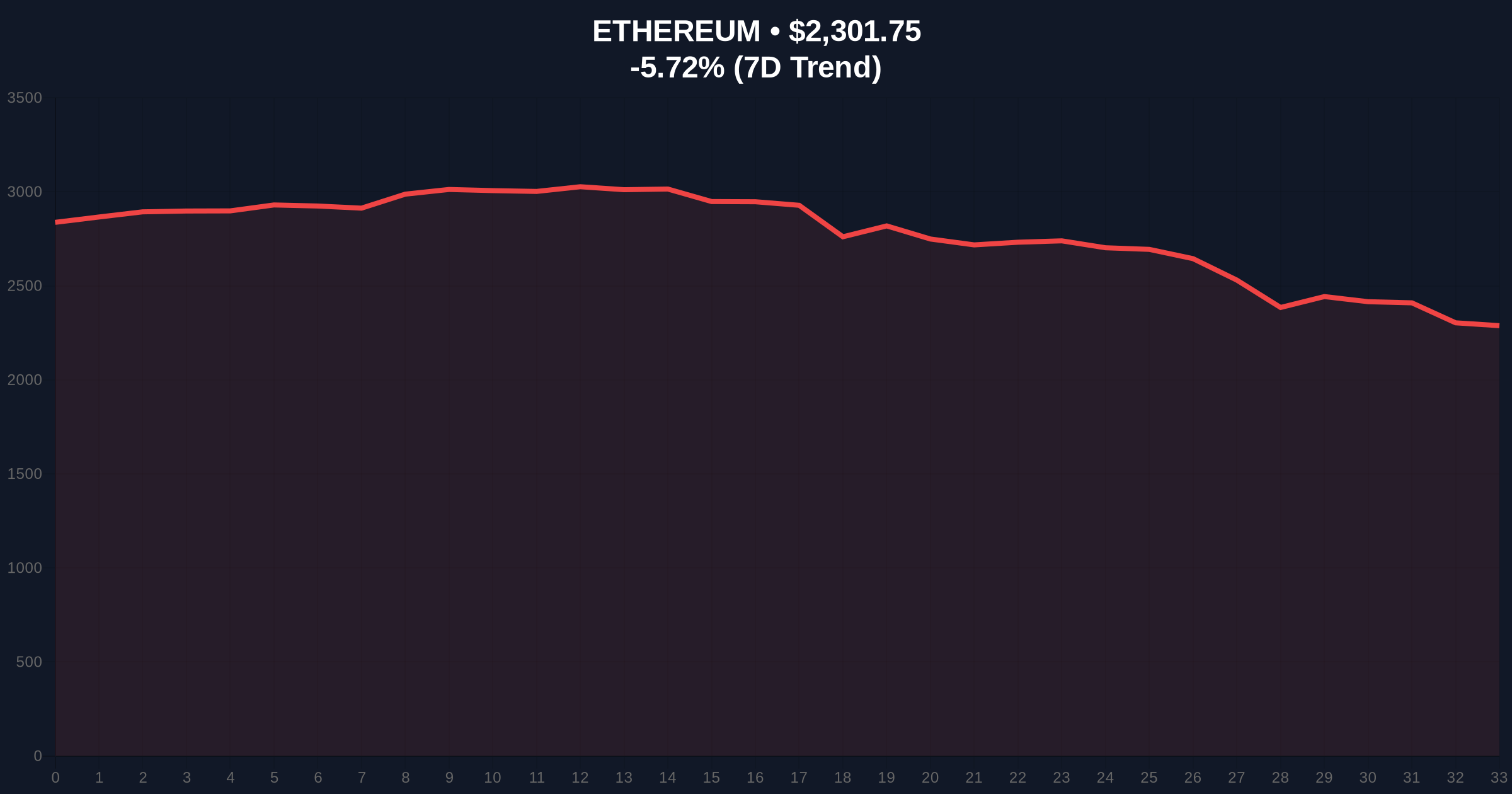

VADODARA, February 2, 2026 — Trend Research, a subsidiary of LD Capital, reveals a $1,830 liquidation price on its $1.43 billion Ethereum position. This latest crypto news exposes severe institutional leverage amid market turmoil. According to AmberCN data, the firm holds 618,000 ETH with $534 million in unrealized losses.

Trend Research accumulated Ethereum since November 2025. Their average purchase price sits at $3,180. The firm recently sold 33,589 ETH worth $79.12 million. This sale generated a realized loss of $27.71 million.

The primary purpose was loan repayment. Trend Research holds approximately $941 million in loans from crypto lending protocols like Aave. This deleveraging move aimed to lower their liquidation threshold. Market structure suggests forced selling may continue.

Historically, large institutional liquidations trigger cascading effects. The 2022 Three Arrows Capital collapse demonstrated this pattern. In contrast, current ETH price action shows persistent selling pressure.

Underlying this trend is extreme market fear. The Crypto Fear & Greed Index registers 14/100. This indicates panic-level sentiment. Consequently, liquidity across DeFi protocols remains strained.

Related developments highlight similar institutional stress. LD Capital's recent $70 million ETH liquidation signals broader deleveraging. , BlackRock's IBIT ETF shows negative average returns, reflecting widespread pressure.

Ethereum currently trades at $2,300.84. This represents a -5.76% 24-hour decline. The critical liquidation level sits at $1,830. A break below this triggers automatic margin calls.

Market structure suggests weak support between $2,300 and $1,830. The Fibonacci 0.618 retracement level from the 2024 low aligns near $1,900. This creates a potential Fair Value Gap (FVG). Volume Profile analysis shows thin liquidity below $2,200.

On-chain data from Etherscan confirms increased ETH movement to exchanges. This typically precedes selling. The UTXO age band for 3-6 month holders shows significant distribution. This indicates long-term holders are capitulating.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Ethereum Current Price | $2,300.84 |

| 24-Hour Change | -5.76% |

| Trend Research ETH Holdings | 618,000 ETH ($1.43B) |

| Liquidation Price | $1,830 |

| Unrealized Loss | $534 million |

This situation matters for multiple reasons. First, it exposes systemic risk in DeFi lending. Aave and similar protocols face collateral shortfalls. Second, it signals institutional capitulation. Large players are reducing leverage amid volatility.

Third, it impacts Ethereum's network security. Post-merge issuance relies on validator economics. Significant price drops could affect staking yields. According to Ethereum.org documentation, validator exit queues may lengthen during stress events.

Fourth, it creates a potential liquidity grab. If $1,830 breaks, stop-loss orders cluster below. This could accelerate declines. Market analysts watch for a gamma squeeze scenario if volatility spikes.

The $1,830 liquidation level represents a critical Order Block. A breach invalidates the current market structure and likely triggers further deleveraging across DeFi. Historical cycles suggest these events create long-term buying opportunities, but only after volatility subsides.

— CoinMarketBuzz Intelligence Desk

Two primary scenarios emerge from current data.

The 12-month institutional outlook remains cautious. Regulatory clarity from the SEC.gov website on ETH classification could provide tailwinds. However, current leverage unwinding suggests continued pressure. The 5-year horizon depends on Ethereum's Pectra upgrade execution and adoption of EIP-4844 blobs for scaling.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.