Loading News...

Loading News...

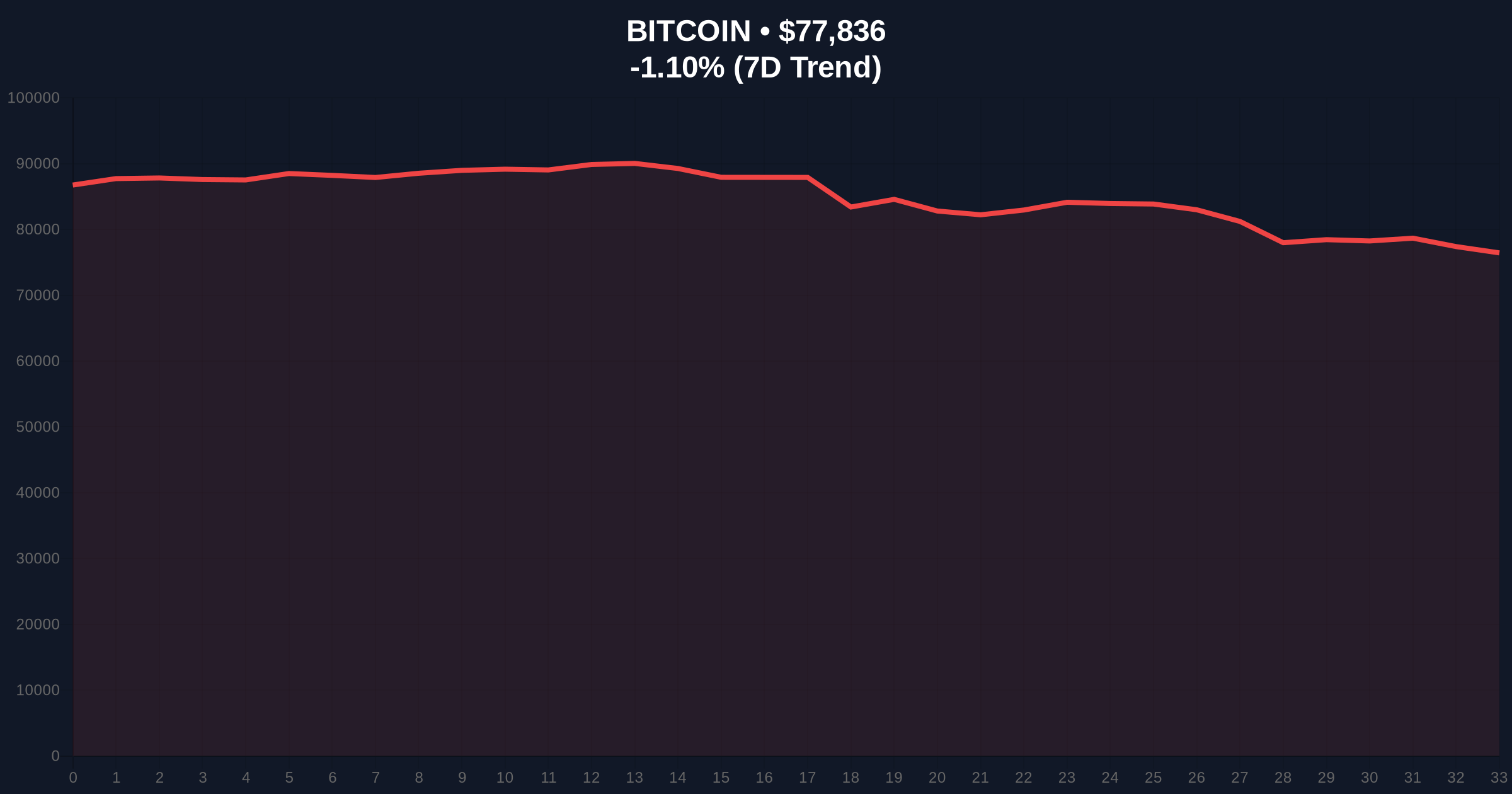

VADODARA, February 2, 2026 — BlackRock's iShares Bitcoin Trust (IBIT) average investor return has turned negative. This daily crypto analysis reveals a critical shift in institutional market structure. Bitcoin's sharp decline last Saturday pushed prices below the average entry point for IBIT investors. According to Cointelegraph, former Bridgewater executive Bob Elliott confirmed the drop to the mid-$70,000s triggered this inversion.

Bitcoin price action collapsed last Saturday. It breached the mid-$70,000s threshold. This level represented the average cost basis for IBIT investors. Bob Elliott, cited by Cointelegraph, attributed the negative return to capital inflows at Bitcoin's peak. Those inflows diluted the average return. Early investors remain profitable. However, the cumulative dollar-weighted return now shows a loss.

IBIT's dollar-weighted return peaked at approximately $35 billion last October. Bitcoin reached its all-time high then. Returns have declined steadily since. This creates mounting pressure on investor portfolios. The trend mirrors broader institutional de-leveraging seen in other markets.

Historically, ETF average return inversions precede volatile phases. The 2021 cycle saw similar patterns with Grayscale's GBTC. Capital dilution during peaks often leads to extended consolidation. In contrast, the current market exhibits Extreme Fear sentiment. This amplifies the psychological impact of negative returns.

, this event coincides with other institutional stress signals. For instance, LD Capital's $70 million ETH liquidation highlights parallel de-leveraging. Market structure suggests a synchronized institutional pullback.

Bitcoin currently trades at $77,803. It faces immediate resistance at the $80,000 psychological level. The 50-day moving average sits near $82,500. A break above that would signal trend recovery. Support clusters around $75,000. This aligns with the 0.618 Fibonacci retracement from the recent high.

On-chain data indicates increased UTXO (Unspent Transaction Output) movement below cost basis. This often precedes capitulation. The Fair Value Gap (FVG) between $70,000 and $72,000 remains a critical liquidity zone. A breach of $75,000 could trigger a rapid fill of that gap.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $77,803 |

| 24-Hour Price Change | -1.14% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| IBIT Peak Dollar-Weighted Return | $35 billion (Oct 2025) |

| Critical Support Level | $75,000 |

Negative average returns for a flagship ETF like IBIT matter profoundly. They reflect poor timing by late institutional capital. This erodes confidence in "buy-and-hold" ETF strategies. It also increases redemption pressure. If sustained, it could force BlackRock to sell Bitcoin holdings to meet outflows.

Market structure suggests a liquidity grab is underway. Weak hands are exiting at a loss. This creates a potential base for stronger accumulation. However, the Extreme Fear sentiment indicates panic is not yet exhausted. Retail investors often capitulate after institutional signals turn negative.

"The dilution effect from peak inflows is a classic market structure flaw. It turns ETFs into a momentum trap rather than a value vehicle. This dynamic pressures prices until the cost basis resets lower," stated the CoinMarketBuzz Intelligence Desk.

Two primary technical scenarios emerge from current data.

The 12-month institutional outlook hinges on Bitcoin's ability to stabilize above cost basis. Historical cycles suggest 6-8 months of consolidation after such events. However, adoption drivers like Ethereum's upcoming Pectra upgrade could provide cross-asset support. The 5-year horizon remains bullish if Bitcoin holds above $70,000.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.