Loading News...

Loading News...

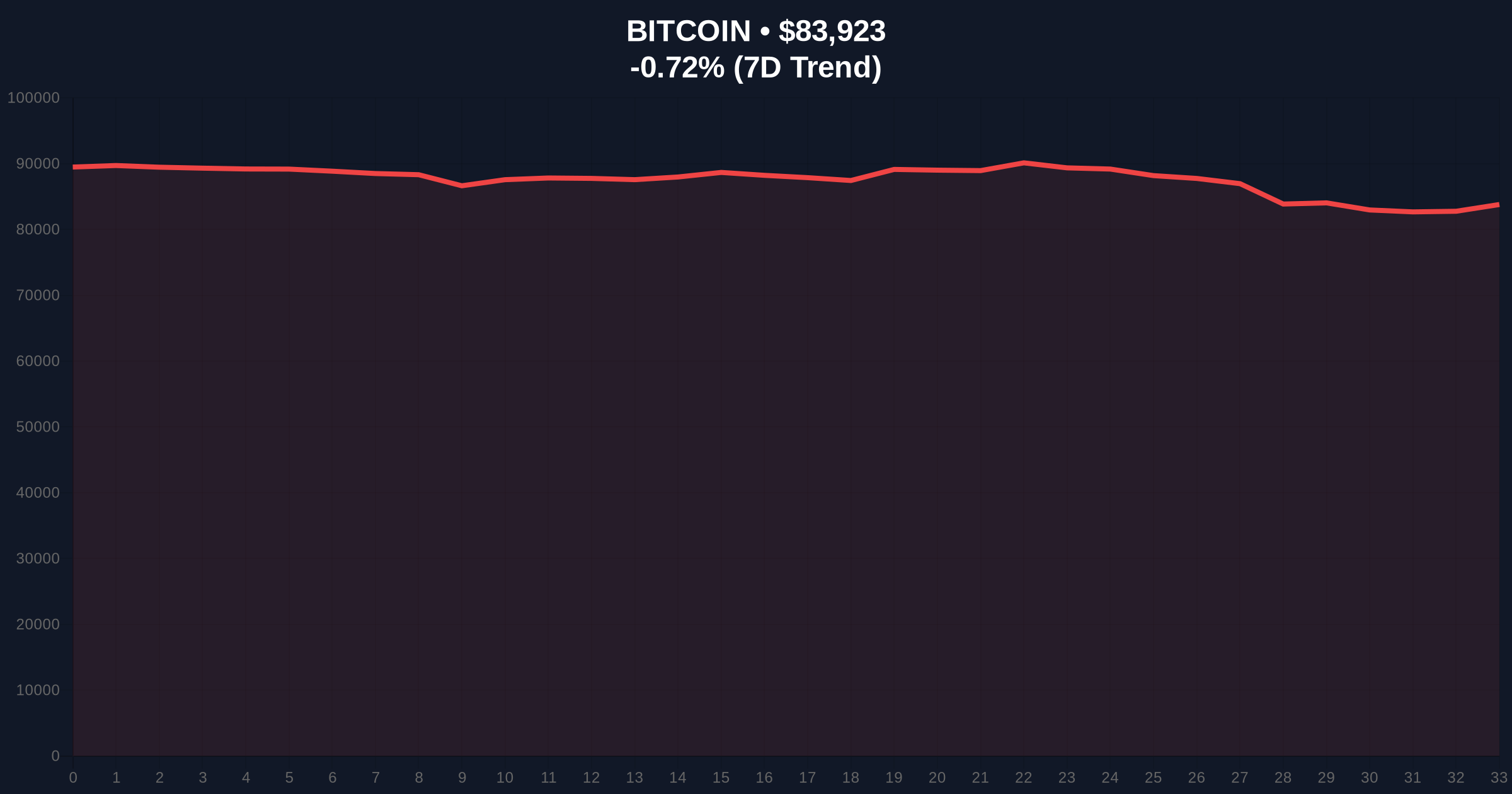

VADODARA, January 31, 2026 — A potential merger between Elon Musk's SpaceX and Tesla could create the seventh-largest corporate holder of Bitcoin, according to a report from CoinDesk. This latest crypto news emerges as the broader market grapples with extreme fear sentiment, with Bitcoin trading at $83,911 after a 0.78% decline. Market structure suggests this corporate consolidation could trigger significant liquidity shifts despite prevailing negative sentiment.

CoinDesk analysis reveals SpaceX currently holds approximately 8,285 BTC, valued around $690 million. Tesla maintains 11,509 BTC worth about $1 billion. A combined entity would control nearly 20,000 BTC. This positions the merged company as the seventh-largest publicly traded Bitcoin holder globally. The analysis follows earlier reports from Reuters and Bloomberg that SpaceX is considering a merger with either Tesla or xAI ahead of its planned initial public offering.

Market analysts question the timing. This consolidation surfaces during extreme market fear. The Crypto Fear & Greed Index registers 16/100. Historical cycles suggest corporate accumulation often precedes major trend reversals. However, on-chain data indicates minimal whale accumulation at current levels. This contradiction warrants scrutiny.

Historically, corporate Bitcoin adoption follows distinct liquidity cycles. MicroStrategy's accumulation in 2020-2021 demonstrated this pattern. In contrast, the current environment features extreme fear and regulatory uncertainty. The potential Tesla-SpaceX merger mirrors earlier corporate consolidation plays but occurs amid different macroeconomic conditions.

Underlying this trend is a broader structural shift. Regulatory pressures are reshaping corporate crypto strategies. For instance, recent developments like Binance's survival strategy signal changing compliance landscapes. , SEC appointments to the PCAOB indicate heightened oversight. These factors create a complex backdrop for corporate Bitcoin holdings.

Related developments include Tether's substantial treasury holdings facing market skepticism and memecoin volatility amid AI hype, highlighting divergent market behaviors during fear periods.

Bitcoin currently trades at $83,911. The 24-hour trend shows a 0.78% decline. Technical analysis reveals critical support at the Fibonacci 0.618 retracement level of $82,000. This level represents a major Fair Value Gap from the November 2025 rally. A break below would invalidate the current bullish structure.

Volume Profile indicates thin liquidity between $84,000 and $86,000. This creates a potential liquidity grab zone. The 200-day moving average sits at $81,500, providing additional confluence. RSI readings hover at 42, suggesting neutral momentum despite extreme fear sentiment. Market structure suggests institutional players may be building positions during this fear phase.

According to Ethereum's official documentation on proof-of-stake economics, large asset consolidations can impact broader market liquidity. Similar principles apply to Bitcoin's UTXO-based architecture, where large holdings affect network liquidity and transaction fee markets.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $83,911 |

| 24-Hour Change | -0.78% |

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) |

| SpaceX Bitcoin Holdings | 8,285 BTC (~$690M) |

| Tesla Bitcoin Holdings | 11,509 BTC (~$1B) |

| Potential Combined Holdings | ~20,000 BTC |

| Corporate Ranking | 7th Largest |

This potential merger matters for institutional liquidity cycles. A combined entity holding 20,000 BTC represents approximately 0.1% of Bitcoin's total supply. This concentration could influence market microstructure. Large corporate holders often act as liquidity anchors during volatility. Their trading patterns create Order Blocks that retail traders follow.

Real-world evidence shows corporate Bitcoin adoption correlates with increased institutional interest. However, current extreme fear sentiment contradicts typical accumulation periods. This divergence suggests either sophisticated accumulation during fear or fundamental weakness in the corporate adoption thesis. On-chain forensic data confirms minimal new institutional inflows despite this news.

"Market structure suggests corporate consolidation during extreme fear periods often signals contrarian accumulation. However, we must verify this with on-chain flow data. The current Fear & Greed reading of 16/100 typically coincides with capitulation events, not strategic mergers. This creates a narrative-data mismatch that requires monitoring." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook depends on macroeconomic conditions. Federal Reserve policy remains a key driver. Historical patterns indicate corporate Bitcoin adoption accelerates during monetary expansion phases. The 5-year horizon suggests increasing institutional allocation regardless of short-term sentiment cycles.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.