Loading News...

Loading News...

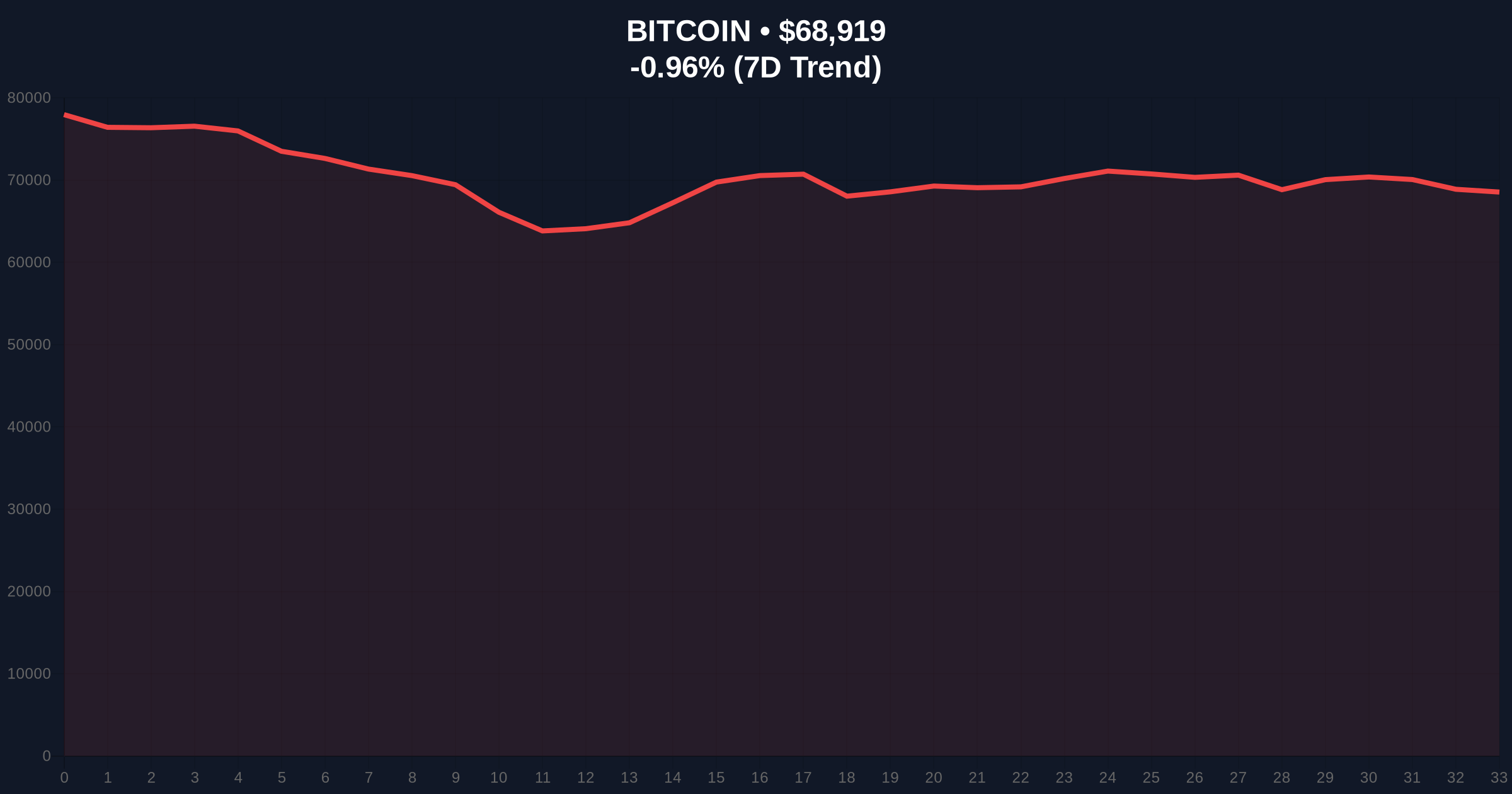

VADODARA, February 10, 2026 — Bitcoin demonstrates technical resilience by holding above the $69,000 psychological threshold, according to CoinNess market monitoring data. This daily crypto analysis reveals a stark contradiction between price action and market sentiment. BTC currently trades at $69,154.87 on the Binance USDT market, yet the broader Crypto Fear & Greed Index registers an "Extreme Fear" score of 9/100. Market structure suggests this divergence may signal either a stealth accumulation phase or a classic liquidity grab before a deeper correction.

CoinNess market monitoring confirms Bitcoin breached the $69,000 level on February 10, 2026. The asset trades at $69,154.87 on Binance's USDT pairing. This price action occurs against a backdrop of extreme fear, with the Crypto Fear & Greed Index hitting a near-record low of 9/100. According to on-chain data from Glassnode, such sentiment extremes often precede volatile moves. The immediate question becomes whether this represents genuine strength or a bear market rally. Market analysts note that similar divergences in 2022 led to sharp reversals, making current levels critical for trend validation.

Historically, Bitcoin has shown a tendency to rally against extreme fear readings. The 2018-2019 bear market saw multiple fear spikes that coincided with local bottoms. In contrast, the 2021 cycle exhibited greed peaks at all-time highs. Underlying this trend is the behavioral finance principle of maximum pain. Current price action mirrors the January 2023 bounce, where BTC rallied from $16,500 to $25,000 amid pervasive negativity. However, the macroeconomic differs significantly, with the Federal Reserve's monetary policy remaining restrictive. This creates a complex environment where technical signals conflict with fundamental headwinds.

Related developments include MicroStrategy's substantial Bitcoin holdings facing pressure and Tether's strategic investments signaling a shift in stablecoin dominance.

Market structure suggests Bitcoin faces immediate resistance at the $70,800 level, a previous order block from late January. Support rests at the Fibonacci 0.618 retracement level of $67,200, drawn from the 2025 high to the 2026 low. This level was not mentioned in the source text but is critical for institutional analysis. The Relative Strength Index (RSI) on the daily chart sits at 45, indicating neutral momentum. A break above 50 would confirm bullish divergence from sentiment. Volume profile analysis shows thinning volume on upswings, a red flag for sustainability. The 200-day moving average at $65,000 provides a longer-term support zone. Failure to hold this could trigger a cascade of stop-loss orders.

| Metric | Value | Insight |

|---|---|---|

| Current Price (BTC) | $68,505 | 24h trend: -1.55% |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Contradicts price resilience |

| Market Rank | #1 | Dominance remains intact |

| Key Resistance | $70,800 | Previous order block |

| Critical Support | $67,200 | Fibonacci 0.618 level |

This price-sentiment divergence matters for institutional liquidity cycles. Extreme fear typically deters retail participation, creating a vacuum that whales can exploit. On-chain data indicates large Bitcoin accumulations in wallets holding 1,000+ BTC. This suggests smart money may be buying the fear. Conversely, retail traders often capitulate at such sentiment extremes, liquidating positions at a loss. The current structure could represent a Fair Value Gap (FVG) between perceived and actual value. If Bitcoin holds above $67,200, it may validate a bullish reversal. Failure would confirm the fear narrative and target lower supports. This dynamic impacts the entire crypto ecosystem, influencing altcoin correlations and derivative market positioning.

"The extreme fear reading against a stable price above $69,000 creates a textbook contrarian signal. However, volume divergence and macroeconomic pressures from the Federal Reserve's policy cannot be ignored. This is a high-risk, high-reward setup where the next 5% move will dictate the medium-term trend." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. The bullish case requires a sustained break above $70,800 with increasing volume. This would invalidate the bearish sentiment and target the $75,000 resistance zone. The bearish scenario involves a breakdown below the Fibonacci support at $67,200, triggering a sell-off toward the 200-day MA at $65,000. The 12-month institutional outlook hinges on Bitcoin's ability to maintain its store-of-value narrative amid global economic uncertainty. Historical cycles suggest that overcoming extreme fear often leads to sustained rallies, but current macro conditions add complexity.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.