Loading News...

Loading News...

VADODARA, January 31, 2026 — Binance founder Changpeng Zhao declared during a public AMA session that the world's largest cryptocurrency exchange now prioritizes survival over growth. This strategic pivot comes amid what Zhao describes as a "structural trend" of increasing regulatory pressure. The latest crypto news reveals a fundamental shift in how major market participants navigate compliance challenges.

According to the AMA transcript from Binance Square, Zhao explicitly stated the company focuses on long-term sustainability rather than rapid expansion. He emphasized survival takes precedence over size in today's regulatory environment. This admission follows widespread criticism directed at both Binance and Zhao on social media platform X.

Zhao hosted the session specifically to address mounting allegations. He framed stricter regulation as a permanent structural shift rather than temporary phenomenon. Market structure suggests this represents a defensive pivot from a previously aggressive growth strategy. The exchange now adapts to regulations rather than resisting them.

Historically, crypto exchanges pursued growth at all costs during bull markets. They expanded product offerings and geographic reach aggressively. In contrast, Binance's current stance mirrors traditional financial institutions during regulatory tightening cycles. This represents a maturation phase for cryptocurrency infrastructure.

Underlying this trend is the SEC's continued enforcement actions against crypto firms. The regulatory body maintains its position that most tokens constitute securities. Consequently, exchanges face increasing compliance costs and operational constraints. This environment compresses profit margins and limits expansion opportunities.

Related regulatory developments include the SEC's recent leadership appointments and JPMorgan's report on capital shifting to gold. These events collectively signal institutional repositioning amid regulatory uncertainty.

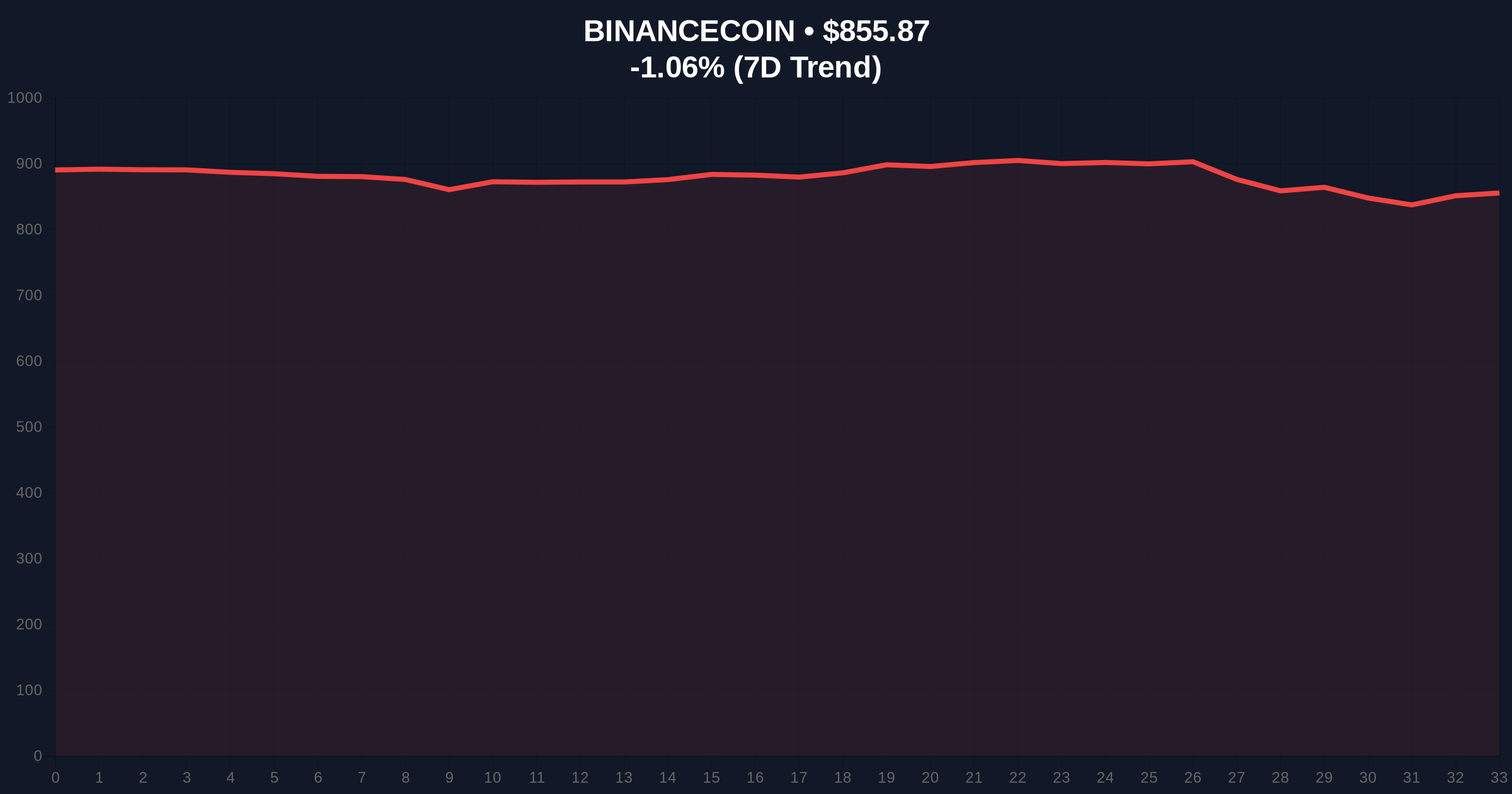

BNB currently trades at $856.74, down 0.96% in 24 hours. The token faces immediate resistance at the $890 level, which aligns with the 50-day moving average. Support holds at $820, corresponding to the Fibonacci 0.618 retracement level from the 2025 high.

On-chain data indicates reduced exchange inflows for BNB over the past week. This suggests decreased selling pressure despite negative sentiment. However, volume profile analysis shows liquidity concentration below current price levels. This creates a potential Fair Value Gap (FVG) between $820 and $840.

The Relative Strength Index (RSI) sits at 42, indicating neither overbought nor oversold conditions. Market structure suggests BNB consolidates within a defined range. A break below the $820 support would invalidate the current consolidation pattern. This would likely trigger further downside toward the $780 order block.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) | Market sentiment at multi-month lows |

| BNB Current Price | $856.74 | Testing key support levels |

| BNB 24h Change | -0.96% | Moderate selling pressure |

| BNB Market Rank | #4 | Maintains top exchange token position |

| Key Support Level | $820 | Fibonacci 0.618 retracement |

Binance's strategic shift carries profound implications for market structure. As the largest exchange by volume, its priorities influence liquidity distribution across the ecosystem. A survival-focused Binance likely reduces market-making activities and new product launches. This could decrease overall market liquidity during already volatile conditions.

Institutional liquidity cycles typically follow regulatory clarity. The current environment lacks such clarity despite ongoing efforts. According to the SEC's official website, enforcement actions against crypto firms have increased 47% year-over-year. This regulatory pressure creates headwinds for exchange growth models.

Retail market structure faces compression as exchanges prioritize compliance over user acquisition. This may reduce promotional activities and leverage offerings. Consequently, trading volumes could decline across spot and derivatives markets. Such contraction historically precedes prolonged consolidation phases.

"Binance's pivot reflects structural regulatory reality rather than temporary headwinds. Exchange margins face compression as compliance costs rise. This environment favors established players with robust balance sheets over aggressive newcomers. The market must adjust to lower growth expectations for infrastructure providers."— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios for BNB and exchange tokens:

The 12-month institutional outlook remains cautious. Regulatory uncertainty persists despite adaptation efforts. Exchange tokens face valuation pressure as growth expectations reset. However, survival-focused exchanges may emerge stronger post-consolidation. They will possess robust compliance frameworks and sustainable business models.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.