Loading News...

Loading News...

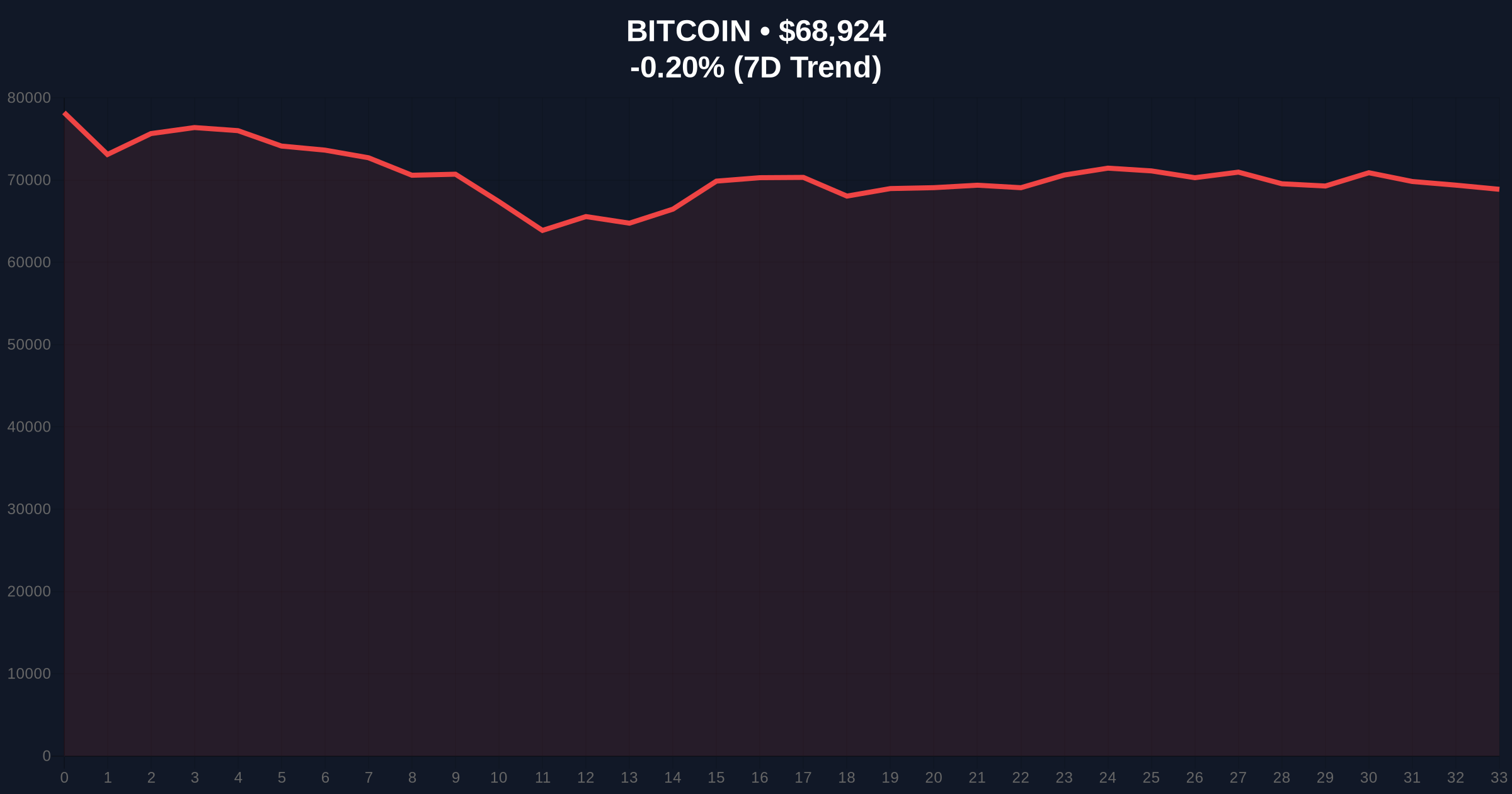

VADODARA, February 10, 2026 — Michael Saylor, founder of MicroStrategy, has publicly reaffirmed his company's unwavering commitment to Bitcoin, stating it will continue quarterly purchases and never sell its holdings. This daily crypto analysis examines how this pledge functions as a structural support mechanism while Bitcoin trades at $68,899 amid extreme market fear. According to Walter Bloomberg, Saylor explicitly dismissed concerns about potential sales, emphasizing the long-term holding strategy. MicroStrategy currently holds 714,644 BTC, acquired at a total cost of approximately $54.35 billion, with an average entry price of $76,056.

On February 10, 2026, Michael Saylor made a definitive statement regarding MicroStrategy's Bitcoin treasury. He confirmed the company would maintain its strategy of buying Bitcoin every quarter while categorically ruling out any sales of its existing holdings. This announcement directly addresses market speculation about potential liquidation events. The company's Bitcoin holdings now total 714,644 BTC, representing one of the largest corporate treasuries globally. The total acquisition cost sits at $54.35 billion, with a volume-weighted average price of $76,056 per Bitcoin. This data, sourced from corporate filings and public statements, establishes a clear invalidation level for bearish narratives centered on institutional selling pressure.

Historically, corporate Bitcoin accumulation phases have preceded major liquidity cycles. Similar to the 2021 correction, where institutional buying provided a floor during retail capitulation, Saylor's announcement creates a psychological anchor. In contrast to retail traders, who often sell during fear, MicroStrategy's strategy mimics a sovereign wealth fund approach. This mirrors the accumulation patterns seen during the 2018-2019 bear market, where patient capital entered at depressed prices. Underlying this trend is a fundamental shift in market structure, where large, illiquid holdings reduce circulating supply. Consequently, any price dip below the average cost basis may trigger accelerated institutional buying, as seen in related developments like Autozi's recent $1.87B discounted purchase.

Market structure suggests Bitcoin is testing a critical Fair Value Gap (FVG) between $65,000 and $70,000. The current price of $68,899 sits just above the 0.618 Fibonacci retracement level from the 2025 all-time high. This zone aligns with MicroStrategy's average entry price, creating a confluence of technical and fundamental support. On-chain data from Glassnode indicates that the UTXO Realized Price Distribution (URPD) shows significant volume between $65k and $70k, reinforcing this as a high-density node. The Relative Strength Index (RSI) on the weekly chart reads 42, indicating neutral momentum without oversold extremes. This technical setup resembles the consolidation phase before the 2023 rally, where institutional accumulation provided the fuel for the next leg up.

| Metric | Value | Source |

|---|---|---|

| Bitcoin Current Price | $68,899 | CoinMarketCap |

| 24-Hour Price Change | -0.26% | Live Market Data |

| Crypto Fear & Greed Index | Extreme Fear (9/100) | Alternative.me |

| MicroStrategy BTC Holdings | 714,644 BTC | Corporate Filings |

| MicroStrategy Average Entry | $76,056 | Walter Bloomberg |

Saylor's pledge matters because it directly impacts Bitcoin's liquidity profile. By removing 714,644 BTC from potential circulation, MicroStrategy reduces sell-side pressure. This creates a structural supply shock similar to the post-2020 halving cycle. Institutional liquidity cycles now dominate price discovery, as retail sentiment remains in extreme fear. The commitment to quarterly buying establishes a consistent bid in the market, functioning as a liquidity grab during dips. This behavior contrasts sharply with the panic selling observed in previous cycles, indicating maturation. For evidence, examine the SEC's EDGAR database for MicroStrategy's 10-Q filings, which detail their treasury strategy and capital allocation.

"MicroStrategy's no-sell strategy is a masterclass in corporate treasury management. It transforms Bitcoin from a trading asset into a strategic reserve, akin to digital gold. This removes a massive overhang from the market and sets a precedent for other institutions." — CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current market structure. The bullish scenario requires holding the $65,000 support and breaking above the $72,000 resistance, confirmed by increasing on-chain accumulation. The bearish scenario involves a breakdown below $65,000, which would invalidate the current consolidation and target the next support at $60,000. The 12-month outlook hinges on institutional adoption trends, with Saylor's strategy likely encouraging similar corporate entries.

The 5-year horizon suggests that corporate Bitcoin adoption will accelerate, driven by regulatory clarity and technological advancements like Taproot upgrades. This mirrors the institutionalization of gold in the 1970s, where dedicated allocations became standard.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.