Loading News...

Loading News...

VADODARA, February 10, 2026 — A Bitcoin whale dormant for seven years executed a 2,043 BTC transaction as the cryptocurrency trades below $70,000, according to on-chain data from CryptoQuant. This latest crypto news event represents one of the largest dormant wallet activations in 2026, occurring during a period of extreme market fear. The whale originally acquired the Bitcoin on February 19, 2019, when prices hovered around $3,900, creating an unrealized profit exceeding $130 million at current valuations.

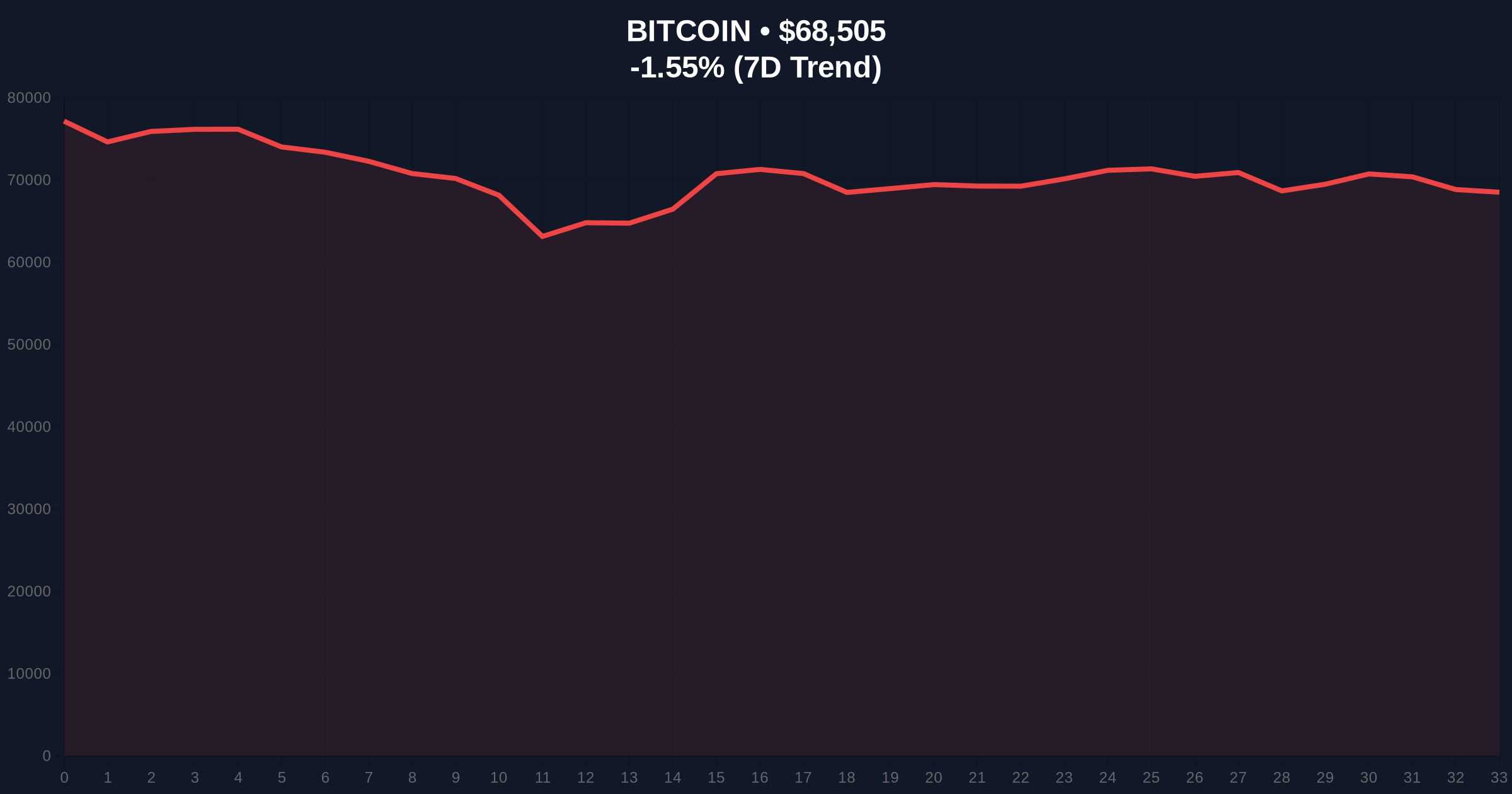

According to CryptoQuant's on-chain forensic tools, the whale's wallet remained completely inactive from February 2019 until February 10, 2026. The 2,043 BTC transaction represents approximately $140 million at current prices. Market structure suggests this movement creates a significant liquidity event. The timing coincides with Bitcoin trading at $68,508, down 1.55% in 24 hours. Historical UTXO age bands indicate coins aged 5-7 years represent the most profitable cohort, with an average cost basis below $10,000.

Consequently, this activation represents a potential supply shock. The whale's dormancy period aligns with Bitcoin's entire post-2018 bear market recovery and subsequent bull cycles. On-chain data indicates similar dormant wallet activations preceded major volatility events in 2017 and 2021. In contrast, the current market context features extreme fear sentiment, creating contradictory signals about the whale's intent.

Historically, dormant whale movements during fear periods have signaled either capitulation bottoms or distribution tops. The 2019 acquisition date places this whale in the accumulation phase following Bitcoin's 2018 bear market low of $3,200. Market analysts note that 7-year dormancy represents the second-longest age band for profitable UTXOs, behind only the 10+ year cohort.

, this event occurs amid broader market stress. Related developments include MicroStrategy's corporate Bitcoin strategy facing liquidity tests and Tether making strategic LayerZero investments during extreme fear. These parallel movements suggest institutional repositioning rather than isolated retail action.

Bitcoin currently tests critical Fibonacci retracement levels from its 2025 all-time high. The $65,200 level represents the 0.618 Fibonacci support, a zone where previous cycle corrections found structural footing. Market structure suggests a break below this level would invalidate the current consolidation pattern. The Relative Strength Index (RSI) sits at 38, indicating oversold conditions but not extreme capitulation.

Volume profile analysis reveals thin liquidity between $68,000 and $72,000, creating a Fair Value Gap (FVG) that price must eventually fill. The whale's movement likely targets this liquidity void. Order block theory identifies the $70,500-$71,200 zone as a previous resistance-turned-support area that failed last week, now acting as a supply zone.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) |

| Bitcoin Current Price | $68,508 |

| 24-Hour Price Change | -1.55% |

| Whale BTC Movement | 2,043 BTC |

| Whale Dormancy Period | 7 years (since Feb 2019) |

| Estimated Acquisition Price | ~$3,900 (Feb 2019) |

This whale movement matters because it represents supply that was effectively removed from circulation for seven years suddenly becoming active. According to Bitcoin's official monetary policy documentation on bitcoin.org, long-term holding reinforces Bitcoin's store-of-value narrative. The reactivation challenges this narrative during a fear period. Market structure suggests such movements create psychological pressure on other long-term holders.

Institutional liquidity cycles typically see dormant coin movements precede major trend changes. The 2,043 BTC represents approximately 0.01% of Bitcoin's total supply, enough to impact spot market depth but not cause systemic failure. Retail market structure appears fragile, with exchange outflows increasing despite price declines, indicating either accumulation or preparation for further downside.

"Dormant supply activation during extreme fear creates contradictory signals. Either we're witnessing smart money exiting at local tops, or old hands redistributing to stronger entities. The 7-year dormancy suggests this whale survived multiple cycles, making their timing statistically significant. Market participants should watch whether this transaction hits exchanges or moves to cold storage." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on this whale movement and current technical levels.

The 12-month institutional outlook remains cautiously bearish until Bitcoin reclaims $75,000. Historical cycles suggest 7-year dormancy breaks often precede 6-12 month consolidation periods. For the 5-year horizon, such events typically mark mid-cycle redistribution rather than cycle tops, assuming macroeconomic conditions support risk assets.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.