Loading News...

Loading News...

VADODARA, February 10, 2026 — MicroStrategy Chairman Michael Saylor publicly dismissed concerns about his company's $8 billion debt exposure during Bitcoin's sharpest correction since 2022, stating the firm would "refinance the debt" even if BTC fell 90% over four years. This latest crypto news comes as Bitcoin plunged to $60,062 on Thursday, marking a 50% decline from its all-time high and testing the viability of corporate debt-backed accumulation strategies.

During a CNBC "Squawk Box" interview on Tuesday, Saylor revealed MicroStrategy's contingency plan for sustained Bitcoin weakness. According to the executive, the company maintains 2.5 years of cash reserves for dividend coverage and would simply "roll forward" its debt obligations. MicroStrategy currently holds 714,644 bitcoins worth approximately $49 billion at current prices, making it the largest corporate Bitcoin treasury globally.

The company's debt strategy relies heavily on convertible note issuances specifically earmarked for Bitcoin purchases. Market structure suggests this approach created a concentrated liquidity position vulnerable to volatility spikes. Consequently, MicroStrategy stock fell 2% on Tuesday as Bitcoin broke below $70,000, extending a three-month decline of over 40%.

Historically, corporate Bitcoin accumulation during bull markets faced minimal scrutiny. In contrast, the current 50% drawdown from all-time highs represents the first true stress test for debt-backed strategies. Underlying this trend is a broader reassessment of Bitcoin's utility among institutional investors, mirroring the 2018 bear market's sentiment shift.

, the extreme fear sentiment (9/100) reflects similar conditions to previous capitulation phases. According to on-chain data from Glassnode, long-term holder distribution patterns resemble the 2022 cycle bottom formation. This parallel suggests the market may be approaching a liquidity washout phase.

Related developments in institutional crypto include JPMorgan's recent downgrade of Coinbase amid similar market conditions and Blockchain.com securing UK regulatory approval despite the fear-dominated environment.

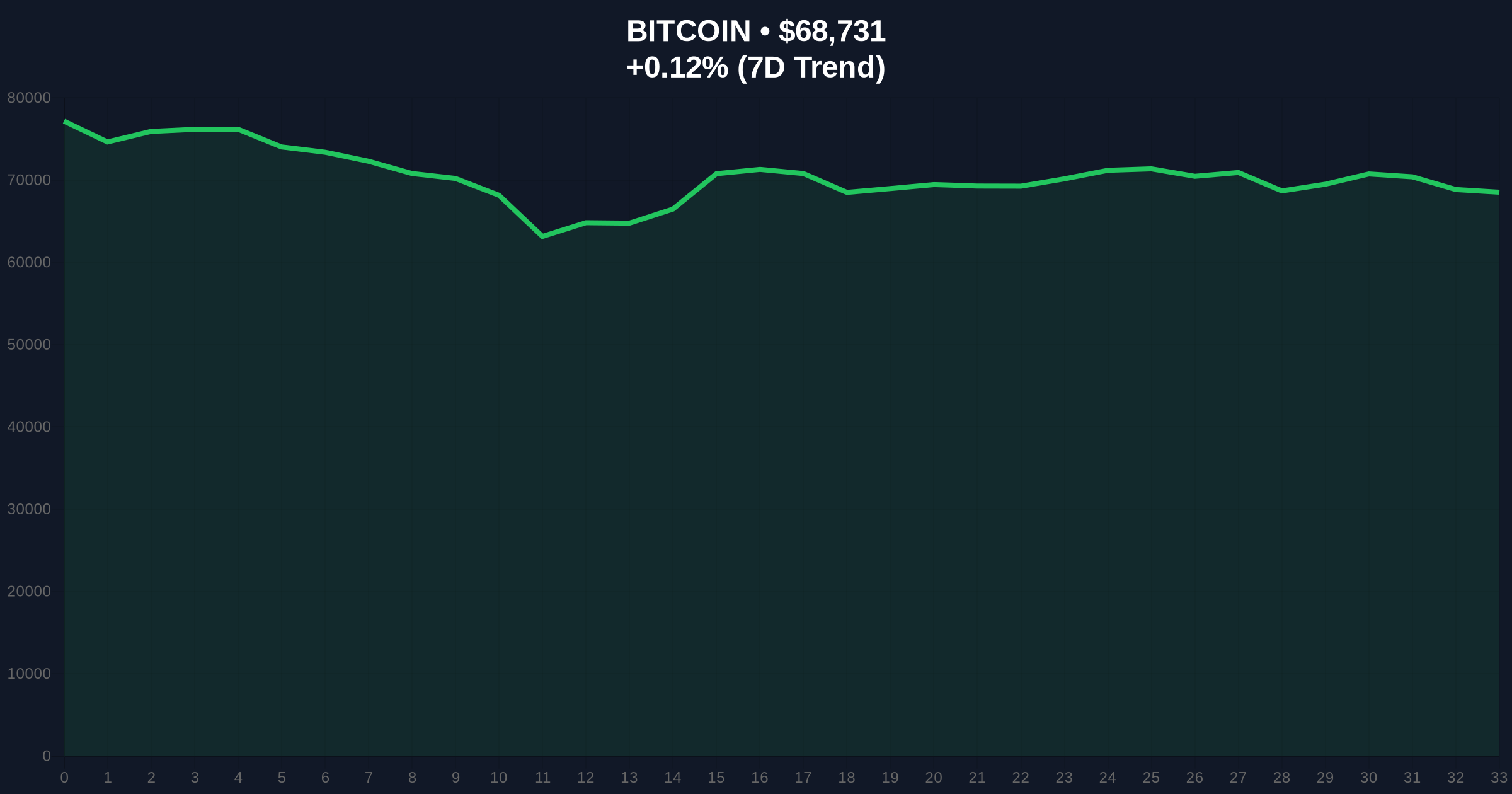

Bitcoin's breakdown below the critical $70,000 psychological level triggered a cascade toward the $60,062 Thursday low. Technical analysis indicates this level represents the 0.618 Fibonacci retracement from the 2023 cycle low to the 2025 all-time high. Market structure suggests this zone must hold to prevent further downside toward the $52,000 volume profile point of control.

The 9% five-day decline created a significant fair value gap between $68,970 and $72,500. This gap now acts as immediate resistance. Additionally, the relative strength index (RSI) on weekly charts approaches oversold territory at 32, historically signaling potential reversal zones during previous bear cycles.

From a blockchain fundamentals perspective, Bitcoin's hash rate remains near all-time highs despite the price decline, indicating miner commitment to network security. This divergence between price and network strength often precedes bullish reversals, as documented in Ethereum's official proof-of-stake documentation regarding security-price relationships.

| Metric | Value | Significance |

|---|---|---|

| Bitcoin Current Price | $69,048 | Testing 16-month support zone |

| 24-Hour Trend | +0.58% | Minor bounce from extreme lows |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Historically correlated with market bottoms |

| MicroStrategy Bitcoin Holdings | 714,644 BTC (~$49B) | Largest corporate treasury position |

| MicroStrategy Total Debt | $8 billion | Convertible notes for BTC accumulation |

MicroStrategy's debt strategy represents a bellwether for corporate Bitcoin adoption. The company's ability to refinance $8 billion in obligations during a 50% drawdown tests institutional confidence in cryptocurrency as collateral. Market analysts note that successful refinancing could validate debt-backed accumulation models, while failure might trigger broader corporate treasury reassessments.

, the concentration risk in MicroStrategy's position creates potential systemic implications. A forced liquidation scenario could exacerbate downside momentum through liquidity grabs across exchanges. On-chain data indicates increased movement from long-term holder wallets to exchanges, suggesting some distribution is already occurring.

"MicroStrategy's refinancing capability during this drawdown will set precedent for corporate treasury models. The market watches whether debt markets treat Bitcoin as viable collateral at 50% below ATH. Historical cycles suggest successful navigation here could accelerate institutional adoption post-recovery."— CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current market structure. The bullish case requires Bitcoin to reclaim the $72,500 fair value gap and establish higher lows. The bearish scenario involves breakdown below the $60,062 Thursday low, potentially targeting the $52,000 volume node.

The 12-month institutional outlook hinges on MicroStrategy's refinancing success. According to market analysts, successful debt management during this drawdown could position Bitcoin as legitimate corporate collateral for the next five years. Conversely, refinancing difficulties might delay institutional adoption until clearer regulatory frameworks emerge.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.