Loading News...

Loading News...

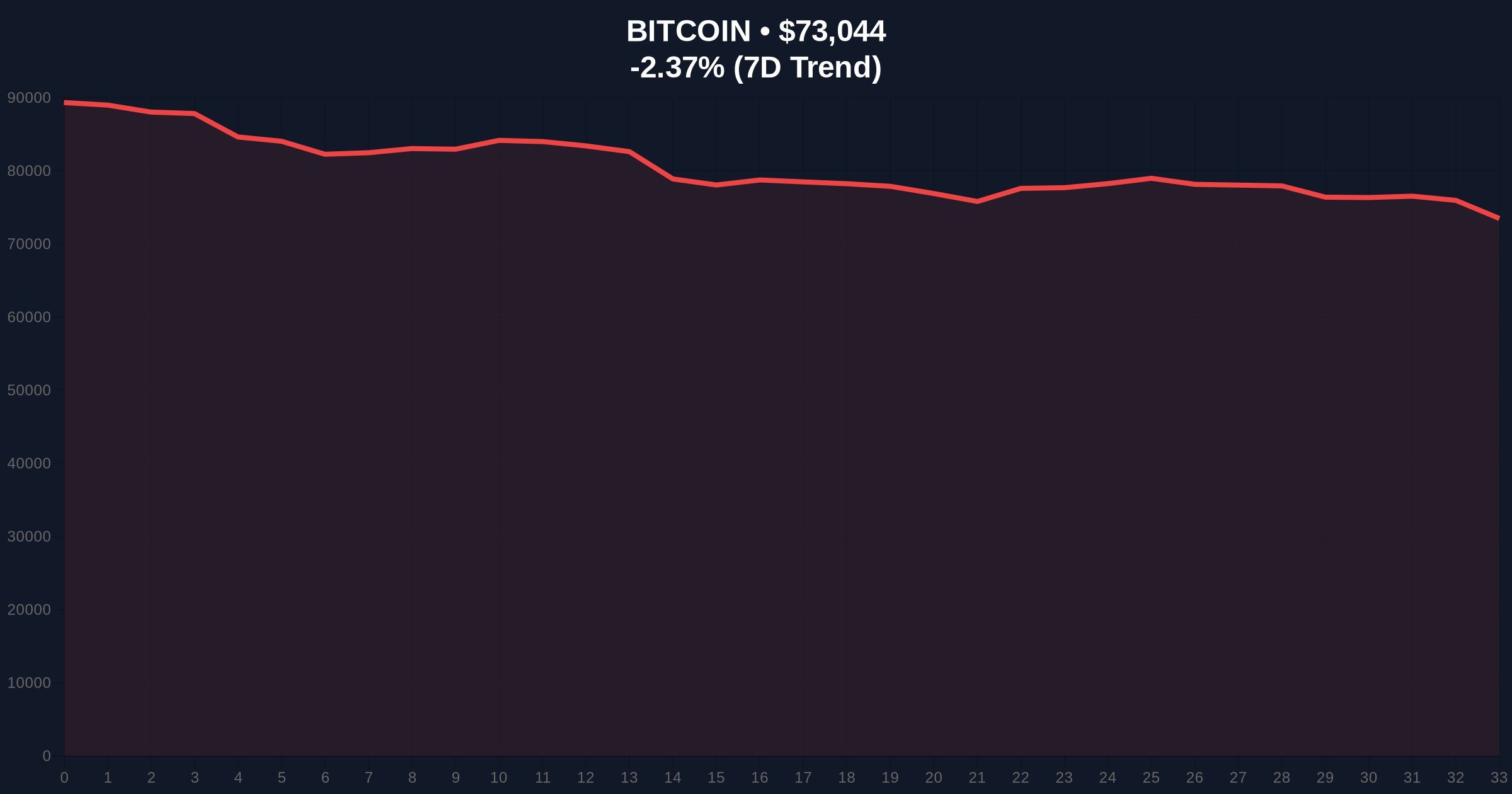

VADODARA, February 4, 2026 — Investment bank Stifel has issued a stark warning that Bitcoin could decline to $38,000, according to a report by Walter Bloomberg. This latest crypto news analysis cites Federal Reserve monetary tightening, regulatory slowdowns, and substantial ETF outflows as primary catalysts. Market structure suggests this target aligns with historical cycle retracement patterns.

Stifel's analysis, reported by Walter Bloomberg, identifies four interconnected pressure points. The Federal Reserve's ongoing quantitative tightening directly reduces systemic liquidity available for risk assets. Concurrently, a deceleration in U.S. crypto regulatory clarity creates institutional uncertainty. Large-scale ETF outflows, visible in on-chain data, compound the selling pressure. Finally, the bank notes market sentiment has entered a stage of extreme fear, indicating waning interest from both retail and institutional participants.

Historically, Bitcoin corrections of 40-50% are common within bull market structures. The 2021 cycle, for instance, saw a 53% drawdown from its April high before resuming its uptrend. Stifel's $38,000 target represents an approximate 48% decline from the recent all-time high near $73,800. This mirrors the depth of the mid-2021 correction. In contrast, the 2017 bull market experienced sharper but shorter-lived pullbacks. Underlying this trend is the maturation of Bitcoin's market structure, now heavily influenced by ETF flows and macro liquidity conditions.

Related developments in this environment of extreme fear include significant whale movements of USDT to exchanges and prediction markets pricing high odds of a break below $70K.

The current price of $73,027 sits precariously above critical support. Market structure suggests the $70,000 level is a major psychological and technical Order Block. A breakdown here would open a Fair Value Gap (FVG) targeting the $65,000 region, which coincides with the 0.618 Fibonacci retracement from the 2023 low. The weekly Relative Strength Index (RSI) is declining from overbought territory, a pattern typical of major trend reversals. On-chain metrics, such as Spent Output Profit Ratio (SOPR), indicate increased selling from profitable addresses.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Matches Q2 2022 capitulation levels |

| Bitcoin Current Price | $73,027 | -2.40% (24h) |

| Stifel Price Target | $38,000 | ~48% drawdown from ATH |

| Market Rank | #1 | Dominance: ~52% |

| Key Support (Immediate) | $70,000 | Psychological & technical level |

This warning matters because it tests the institutional thesis for Bitcoin. The convergence of Fed policy, ETF flows, and regulation represents a macro stress test. According to on-chain data from Glassnode, exchange net outflows have recently reversed, indicating potential distribution. Reduced liquidity, as cited by Stifel, exacerbates volatility and increases the risk of a liquidity grab below key supports. The Federal Reserve's official monetary policy stance remains the primary external variable influencing capital allocation.

"Stifel's analysis is a quantitative assessment of cycle dynamics, not a prophecy. The $38K target aligns with a full retracement to the previous cycle's high, a common technical phenomenon. However, current on-chain holder behavior and the structural demand from spot ETFs create a fundamentally different liquidity profile than 2022." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on the $70,000 support. Historical cycles indicate that holding this level could lead to a consolidation phase before another attempt at highs. Conversely, a breakdown likely triggers accelerated selling toward lower targets.

The 12-month institutional outlook hinges on the resolution of these technical levels and macro liquidity conditions. A return to quantitative easing or accelerated regulatory clarity could rapidly shift sentiment, as seen in late 2023.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.