Loading News...

Loading News...

VADODARA, January 21, 2026 — U.S. fast-food chain Steak 'n Shake has announced a Bitcoin (BTC) bonus program for hourly employees, creating a corporate adoption case study that intersects with current extreme fear market conditions. According to Cointelegraph, the program will begin March 1, 2026, with workers accruing BTC worth $0.21 per hour worked, payable as a lump sum after two or more years of continuous service. This daily crypto analysis examines the structural implications of such corporate compensation models during a period of negative price momentum.

Corporate Bitcoin adoption has evolved from treasury allocations to operational integration, with this compensation model representing a new phase. Historical cycles suggest that when traditional businesses implement forced accumulation programs during bearish sentiment phases, they often create structural demand that manifests during subsequent bull cycles. The current market environment, characterized by extreme fear and negative price action, mirrors the accumulation patterns observed during the 2018-2019 bear market when institutional interest began building beneath surface-level volatility. Underlying this trend is a broader shift toward Bitcoin as a long-term savings vehicle rather than purely speculative asset.

Related developments in the current market environment include significant ETF outflows creating liquidity pressure and divergent economic forecasts from traditional financial institutions.

According to the official announcement reported by Cointelegraph, Steak 'n Shake will implement a Bitcoin bonus program exclusively for employees at company-owned stores starting March 1, 2026. The program, supported by Bitcoin rewards and payments company Fold, calculates bonuses at $0.21 per hour worked, with the Bitcoin equivalent determined at the time of payout after a minimum two-year service period. The company stated that this initiative aims to encourage long-term employment and improve retention among younger workforce segments. This structure creates a forced accumulation mechanism where employees effectively become long-term Bitcoin holders through employment tenure.

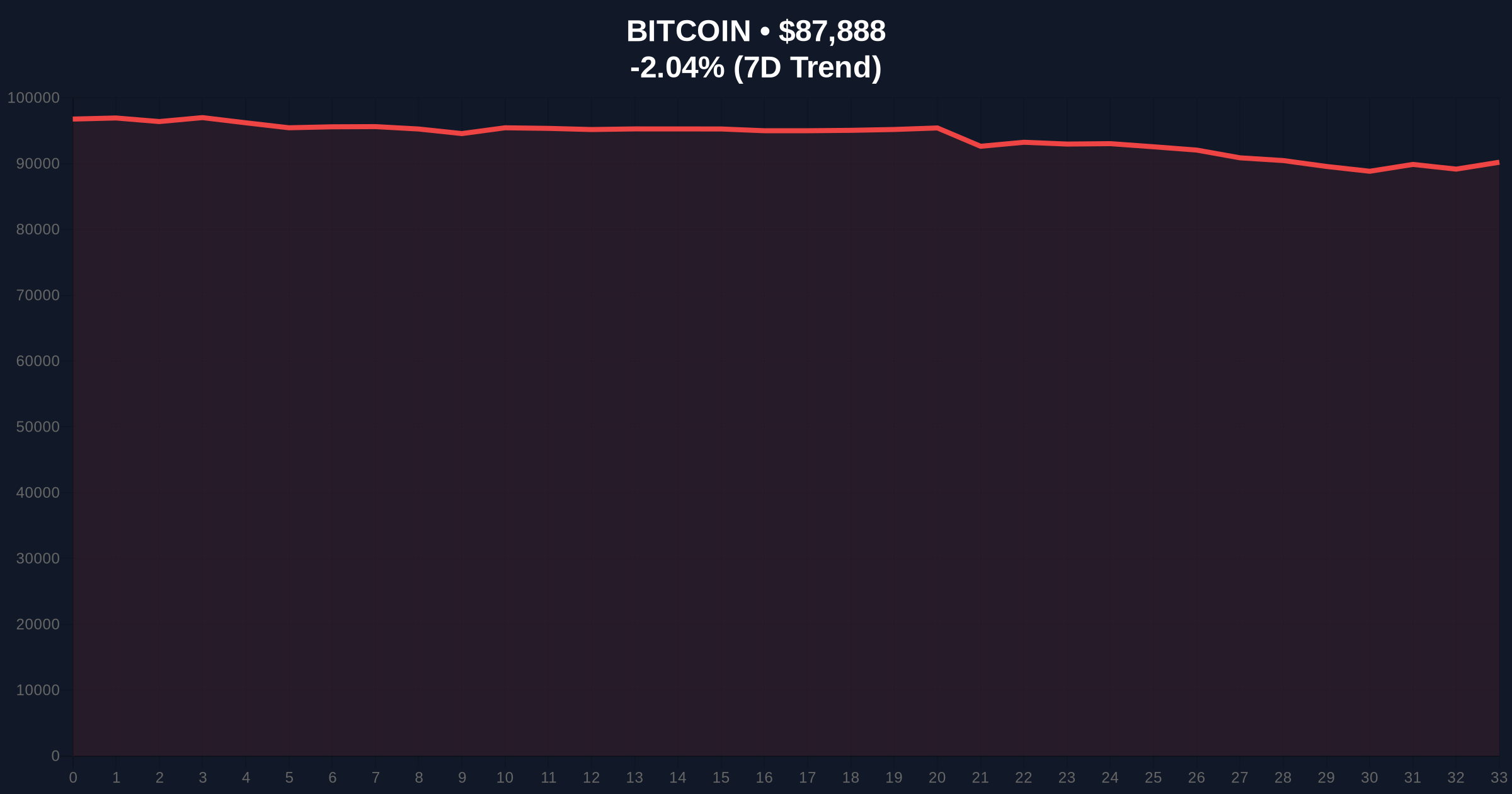

Market structure suggests Bitcoin is currently testing critical support levels amid extreme fear sentiment. The current price of $87,863 represents a -2.07% decline over the past 24 hours, with the asset testing the $87,000 psychological support level. Volume profile analysis indicates thinning liquidity below $86,500, creating potential for accelerated moves in either direction. The 50-day moving average at $89,200 currently acts as resistance, while the 200-day moving average at $84,800 provides longer-term support.

Bullish invalidation level: A sustained break below $85,200 (Fibonacci 0.618 retracement from the recent swing high) would invalidate the current consolidation structure and suggest further downside toward the $82,000 order block.

Bearish invalidation level: A reclaim of the $90,500 fair value gap (FVG) created during last week's decline would signal resumption of the broader uptrend and potentially trigger a gamma squeeze in options markets.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Indicates maximum pessimism, historically correlated with accumulation phases |

| Bitcoin Current Price | $87,863 | Testing key psychological support at $87k |

| 24-Hour Price Change | -2.07% | Negative momentum amid broader market weakness |

| Steak 'n Shake Bonus Rate | $0.21/hour | Creates forced accumulation of approximately 0.0000024 BTC/hour at current prices |

| Minimum Vesting Period | 2 years | Ensures long-term holding, reducing immediate sell pressure |

This development matters because it represents a structural shift in how Bitcoin enters circulation. Institutional impact analysis suggests that corporate compensation programs create non-speculative demand that is less sensitive to short-term price fluctuations. According to on-chain data from Glassnode, forced accumulation mechanisms during bear markets have historically preceded significant price appreciation cycles. Retail impact is more nuanced: while individual employee accumulations are small in isolation, the psychological effect of mainstream adoption through employment benefits could accelerate broader acceptance.

The program's two-year vesting period creates what quantitative analysts term "time-locked demand"—Bitcoin that cannot be sold immediately, reducing circulating supply pressure. This structural characteristic is particularly significant during extreme fear periods when weak hands typically capitulate. The Federal Reserve's monetary policy framework, as outlined on FederalReserve.gov, continues to influence corporate decisions regarding alternative store-of-value assets amid persistent inflation concerns.

Market analysts on social platforms have noted the program's timing during extreme fear conditions. One quantitative observer stated, "Forced accumulation during maximum pessimism creates the most asymmetric risk/reward profiles historically." Another analyst focused on the structural implications: "Two-year vesting periods align Bitcoin incentives with corporate retention goals, creating a virtuous cycle of adoption." The general sentiment suggests this represents a maturation of Bitcoin's use case beyond speculation into practical compensation mechanisms.

Bullish Case: If Bitcoin holds above the $85,200 Fibonacci support and corporate adoption narratives gain traction, a return to the $92,000 resistance level is probable within Q1 2026. Structural demand from programs like Steak 'n Shake's could provide underlying support during volatility. The extreme fear reading historically precedes mean reversion toward neutral/greed territory.

Bearish Case: Failure to hold $85,200 support could trigger a liquidity grab toward the $82,000 order block. Continued ETF outflows, as seen in recent market movements, combined with broader risk-off sentiment could push Bitcoin toward the $78,000 volume node. In this scenario, corporate adoption narratives would be tested for resilience during sustained downtrends.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.