Loading News...

Loading News...

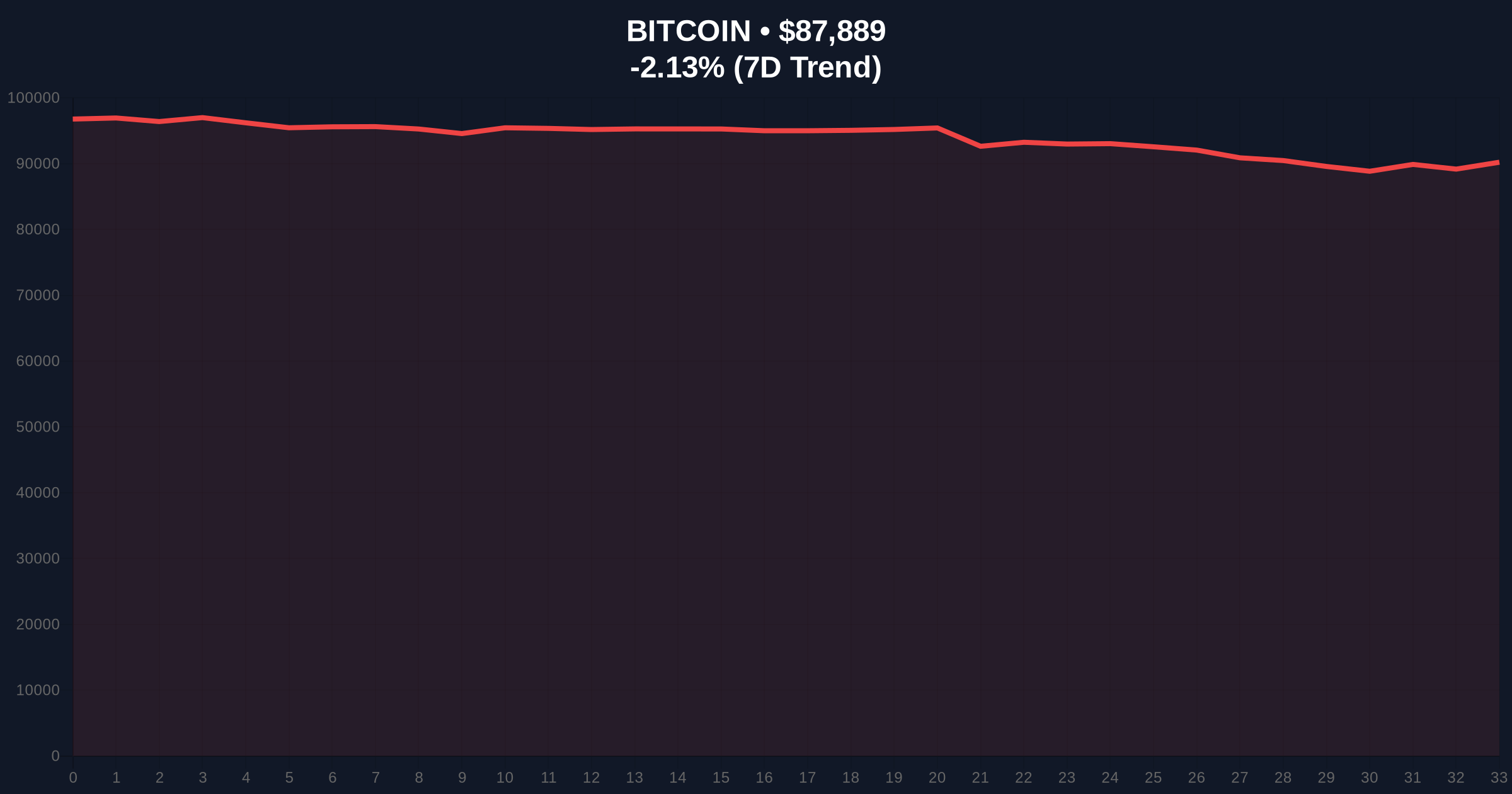

VADODARA, January 21, 2026 — Bitcoin has collapsed to $87,000, wiping out all 2026 gains in a sharp reversal that coincides with nearly $490 million in single-day ETF outflows. This daily crypto analysis examines the structural breakdown and liquidity dynamics behind the move. Market structure suggests this represents a classic liquidity grab below key psychological levels.

Bitcoin entered 2026 with 12% year-to-date gains, building on institutional adoption momentum. The approval of spot Bitcoin ETFs in January 2024 created a new liquidity paradigm. Historical cycles suggest post-ETF approval periods experience volatility compression followed by expansion phases. The current decline mirrors the March 2023 banking crisis selloff in velocity, though with different fundamental drivers. Related developments include recent futures liquidations exceeding $100 million and diverging economic forecasts amid extreme fear sentiment.

According to Walter Bloomberg, Bitcoin plunged from yearly highs above $97,000 to current levels around $87,000. The catalyst: $490 million in net outflows from U.S.-listed spot Bitcoin ETFs in a single trading session. This represents the largest single-day redemption since ETF inception. The outflows coincided with spreading risk-off sentiment across global markets. Geopolitical tensions and volatility spikes accelerated the move. Market warnings now indicate BTC could test the $80,000-$84,000 support band.

The breakdown below $90,000 created a significant Fair Value Gap (FVG) between $89,500 and $91,200. This FVG now acts as immediate resistance. Volume Profile analysis shows high-volume nodes clustered at $84,500, suggesting potential support. The 200-day moving average at $82,300 provides additional structural support. RSI readings have plunged to 28, indicating oversold conditions but not yet extreme capitulation. The $87,000 level represents a previous Order Block from December 2025 that failed to hold. Bullish Invalidation: A sustained break below $80,000 would invalidate the current bull market structure. Bearish Invalidation: A reclaim above $91,500 would fill the FVG and suggest the liquidity grab is complete.

| Metric | Value |

|---|---|

| Current Bitcoin Price | $87,819 |

| 24-Hour Change | -2.20% |

| Single-Day ETF Outflows | $490 million | Crypto Fear & Greed Index | Extreme Fear (24/100) |

| Year-to-Date Gain/Loss | 0% (all gains erased) |

| Key Support Zone | $80,000-$84,000 |

Institutional impact: ETF outflows of this magnitude signal potential rotation from Bitcoin to traditional safe havens. According to the Federal Reserve's financial stability reports, such flows can indicate broader risk reassessment. Retail impact: Margin calls and liquidations accelerate as support levels break. The $490 million outflow represents approximately 0.5% of total ETF AUM, testing the product's liquidity resilience. For the 5-year horizon, this event tests whether ETF structures provide stabilization or amplification during stress periods.

Market analysts on X/Twitter highlight the confluence of technical and fundamental factors. One quant trader noted: "The ETF outflow velocity suggests institutional profit-taking, not structural abandonment." Another analyst pointed to "increased UTXO age bands moving to exchanges" as a bearish on-chain signal. The dominant narrative centers on whether this is a healthy correction or trend reversal. Sentiment aligns with the Extreme Fear reading, creating potential contrarian opportunities.

Bullish Case: Bitcoin finds support in the $80,000-$84,000 zone. ETF flows stabilize or reverse as dip-buying emerges. The FVG between $89,500-$91,200 gets filled, leading to a retest of yearly highs. EIP-4844 implementation on Ethereum could create positive spillover effects. Target: $95,000-$97,000 retest within 30 days.

Bearish Case: The $80,000 support fails. ETF outflows continue, triggering a cascade of liquidations. Price tests the 200-week moving average near $75,000. Risk-off sentiment persists amid geopolitical tensions. Target: $70,000-$75,000 range within 60 days.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.