Loading News...

Loading News...

VADODARA, February 10, 2026 — U.S. spot Bitcoin exchange-traded funds (ETFs) recorded $144.9 million in net inflows on February 9, according to data from Farside Investors. This marks the second consecutive day of positive flows, defying a broader market sentiment of extreme fear. The latest crypto news reveals a critical divergence: institutional products attract capital while retail sentiment plummets.

Farside Investors' compiled data shows specific fund performances. Grayscale's Mini BTC product led with +$130.5 million in inflows. Ark Invest's ARKB followed with +$14.1 million. VanEck's HODL added +$12 million. Franklin's EZBC saw +$6.1 million. Fidelity's FBTC posted a modest +$3.1 million. In contrast, BlackRock's IBIT experienced outflows of -$20.9 million. This distribution indicates selective institutional positioning rather than broad-based buying.

Historically, ETF inflow streaks during fear phases have preceded significant rallies. Similar to the 2021 correction, where accumulation occurred below the 200-day moving average, current flows suggest smart money is building positions. Market structure now mirrors late 2023, when institutional inflows began before retail participation returned. Underlying this trend is a classic liquidity grab during panic.

Related developments in this fear environment include significant stablecoin burns and exchange maintenance events affecting liquidity. For instance, Tether's recent 3.5 billion USDT burn tightened supply, while Binance TRX wallet maintenance raised short-term liquidity concerns. These events compound the extreme fear sentiment measured by the Crypto Fear & Greed Index.

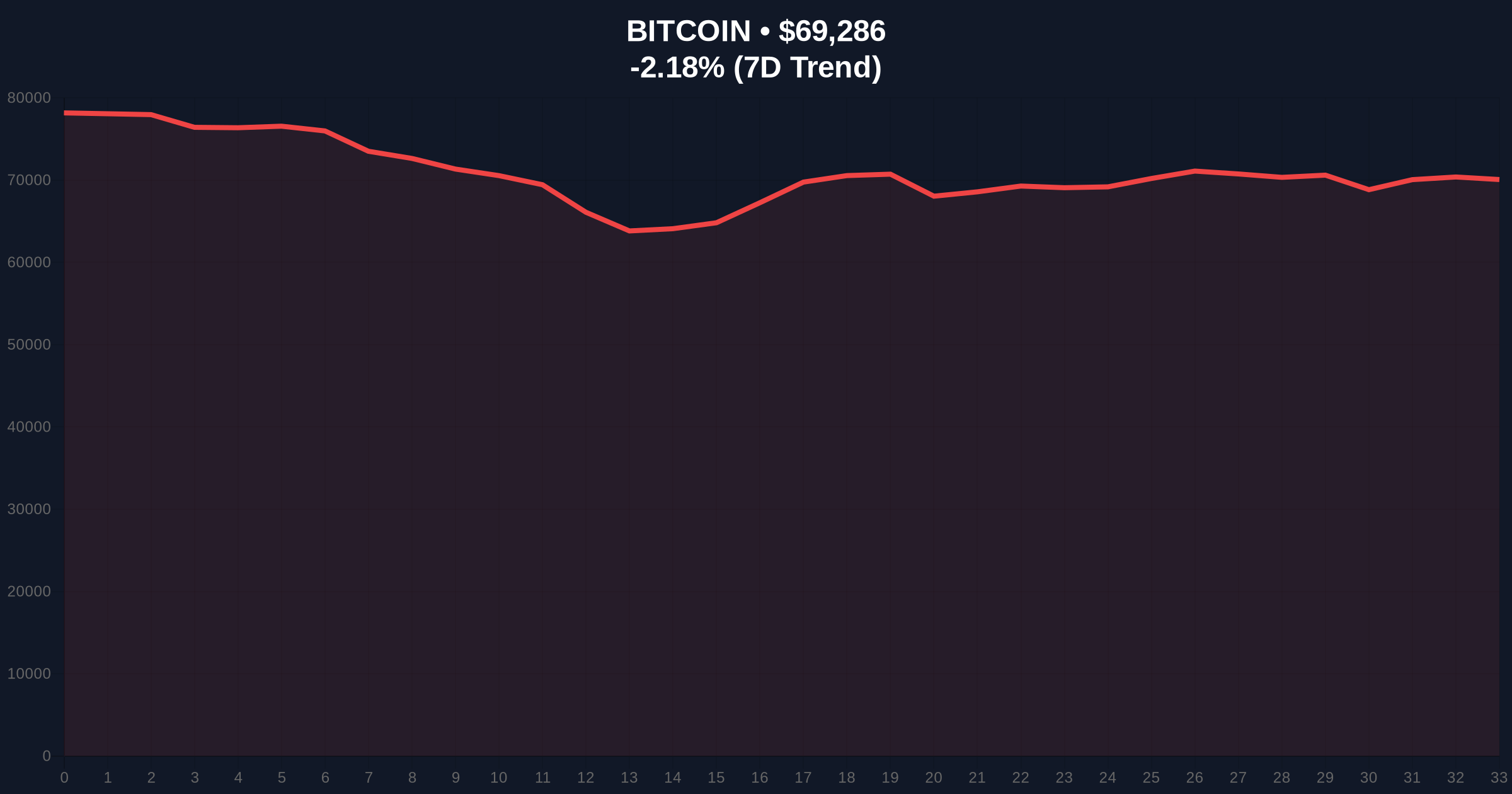

Bitcoin currently trades at $69,341, down 2.10% in 24 hours. On-chain data indicates strong support at the Fibonacci 0.618 retracement level of $67,500. The Relative Strength Index (RSI) sits at 38, suggesting oversold conditions without extreme capitulation. A Fair Value Gap (FVG) exists between $70,200 and $71,800, which price may revisit to fill liquidity. The 50-day moving average at $72,500 acts as near-term resistance.

Volume profile analysis shows increased accumulation between $68,000 and $69,500, aligning with ETF inflow data. This creates a potential order block that could support upward momentum if held. The critical invalidation level for bulls remains $67,500; a break below would signal failed accumulation and likely trigger further downside.

| Metric | Value | Implication |

|---|---|---|

| Spot Bitcoin ETF Net Inflows (Feb 9) | $144.9M | 2nd consecutive day of inflows |

| Grayscale Mini BTC Inflows | +$130.5M | Largest single fund inflow |

| Bitcoin Current Price | $69,341 | 24h Trend: -2.10% |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Divergence with institutional flows |

| Key Fibonacci Support | $67,500 | 0.618 retracement level |

ETF inflows during extreme fear signal institutional conviction. This pattern often marks local bottoms. According to the U.S. Securities and Exchange Commission's official disclosures, ETF flows provide transparent, auditable data on institutional exposure. Consequently, sustained inflows could stabilize Bitcoin's price by absorbing sell-side pressure. Market structure suggests this is a liquidity redistribution from weak to strong hands.

"The divergence between ETF inflows and retail fear is a classic accumulation signal. Similar to 2021, institutions are buying when sentiment is worst. The critical level is $67,500; hold that, and we likely see a gamma squeeze higher."

Two data-backed scenarios emerge from current market structure. First, if ETF inflows continue, Bitcoin could rally to fill the FVG at $71,800, then test the 50-day MA at $72,500. Second, if retail panic overwhelms institutional buying, a break below $67,500 could trigger a flush to $65,000.

The 12-month institutional outlook remains positive if ETF flows sustain. Historical cycles indicate that accumulation phases during fear lead to 6-12 month rallies. This aligns with a 5-year horizon where institutional adoption through ETFs provides structural demand.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.