Loading News...

Loading News...

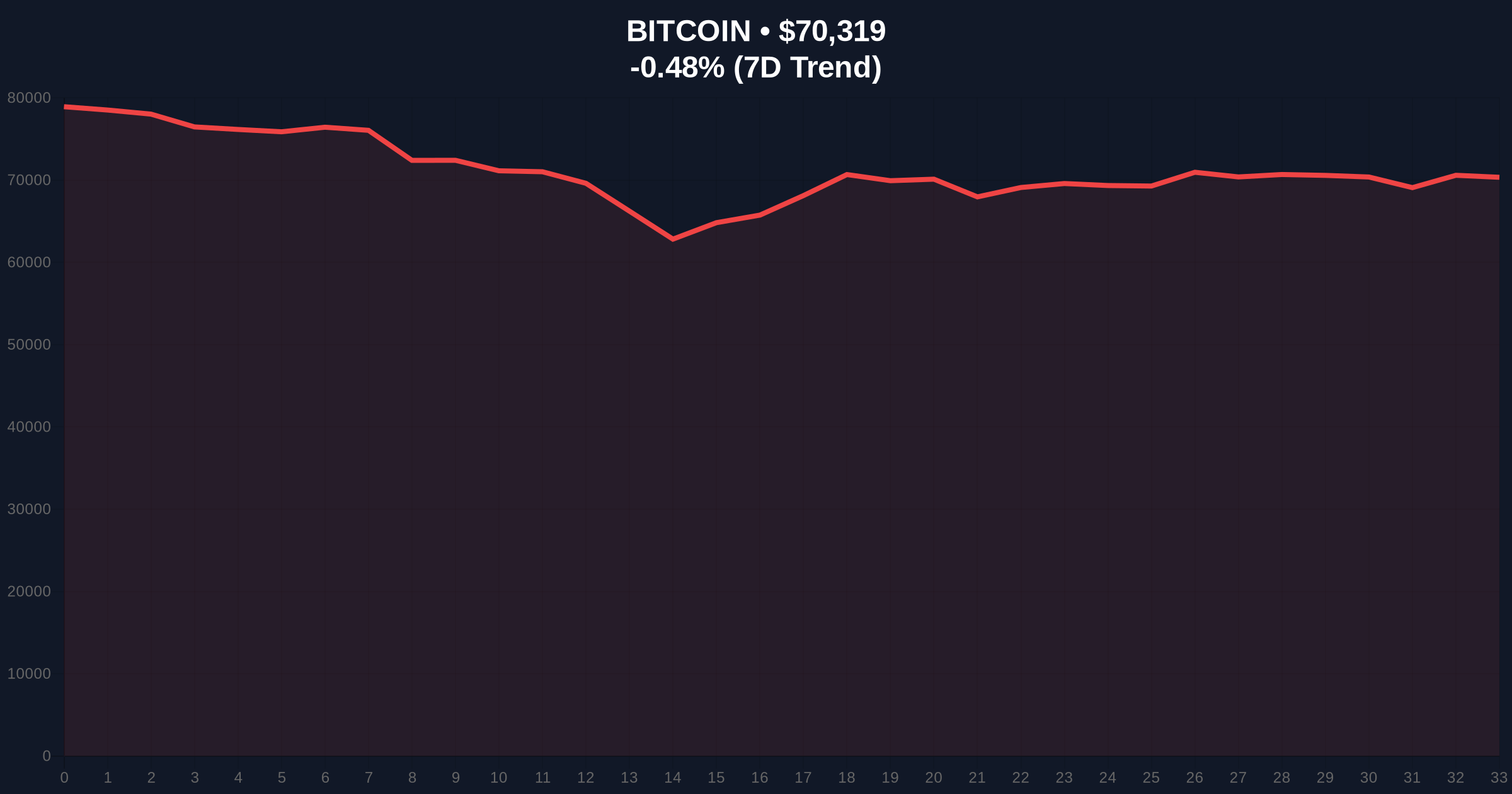

VADODARA, February 10, 2026 — The Bitcoin Fear & Greed Index has collapsed to a historic low of 5, signaling extreme market fear. This level mirrors the 2018 bear market and March 2020 COVID-19 crash. However, bearish futures trends and key technical indicators suggest further downside risk. Market structure remains fragile.

According to Cointelegraph, the Bitcoin Fear & Greed Index plummeted to 5 over the weekend. Crypto trader Michaël van de Poppe identified this as an all-time low. The daily Relative Strength Index (RSI) for BTC dropped to 15. That enters an extreme oversold zone.

Meanwhile, CryptoQuant analysis reveals BTC trades below its 50-day moving average around $87,000. It also sits under the 200-day moving average near $102,000. The firm's Z-score comparing BTC and gold prices stands at -1.6. This indicates persistent selling pressure. Market analysts interpret these levels as similar to past capitulation events.

Historically, extreme fear often precedes market bottoms. The 2018 bear market and March 2020 crash saw similar RSI and sentiment readings. In contrast, current futures market data shows contango narrowing. This suggests institutional hedging against further declines.

Underlying this trend, the global macroeconomic backdrop remains challenging. Rising interest rates and geopolitical tensions amplify crypto volatility. Consequently, retail investors face heightened uncertainty. For deeper context on market fear dynamics, see our analysis on how the Altcoin Season Index has stalled at 24 amid similar conditions.

Market structure suggests a critical juncture. The 50-day MA at $87,000 acts as immediate resistance. A break above could trigger a short squeeze. Conversely, support clusters around the $68,000 Fibonacci 0.618 retracement level from the 2025 high.

On-chain data indicates increased UTXO age bands moving to exchanges. This signals long-term holders distributing. Volume profile analysis shows a liquidity grab below $70,000. The Fair Value Gap (FVG) between $75,000 and $80,000 remains unfilled. This creates a potential magnet for price action.

| Metric | Value | Implication |

|---|---|---|

| Fear & Greed Index | 5 (Extreme Fear) | Historic low, potential contrarian signal |

| BTC Current Price | $70,341 | Below key moving averages |

| 24h Trend | -0.55% | Continued downward pressure |

| Daily RSI | 15 | Extreme oversold condition |

| BTC-Gold Z-score | -1.6 | Selling pressure dominates |

This scenario matters for portfolio risk management. Extreme fear often marks cycle bottoms. However, bearish futures trends contradict this signal. Institutional liquidity cycles show capital outflows from crypto futures. Retail market structure appears fragile with high leverage liquidations.

Real-world evidence includes increased exchange inflows. Whale wallets move assets to custodial platforms. This aligns with hedging behavior. The Federal Reserve's monetary policy continues to influence global liquidity, impacting crypto as a risk asset.

"The Fear & Greed Index at 5 is unprecedented. It signals maximum panic. Yet, futures term structure and on-chain metrics show no clear reversal. We monitor the $87,000 level closely. A break above could change the narrative." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook remains cautious. Regulatory clarity and ETF flows could provide tailwinds. However, macroeconomic headwinds persist. Historical cycles suggest consolidation phases follow extreme fear readings. The 5-year horizon depends on Bitcoin's adoption as a macro hedge.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.