Loading News...

Loading News...

VADODARA, February 10, 2026 — Bitcoin's Coinbase Premium has recovered from -0.22% to -0.05% this week, according to Kaiko data cited by CoinDesk. This daily crypto analysis reveals the metric remains in negative territory despite a 15% price bounce from recent lows. Market structure suggests this represents dip-buying rather than institutional accumulation. The premium measures price differences between Coinbase and global averages.

Kaiko's on-chain data shows the Bitcoin Coinbase Premium improved from -0.22% to -0.05% during recent trading sessions. This occurred alongside Bitcoin's price rebound from recent lows. The premium's negative status contradicts bullish narratives. Aggregate trading volume across major exchanges remains significantly below late 2025 peaks. Kaiko's volume analysis indicates demand has not recovered structurally.

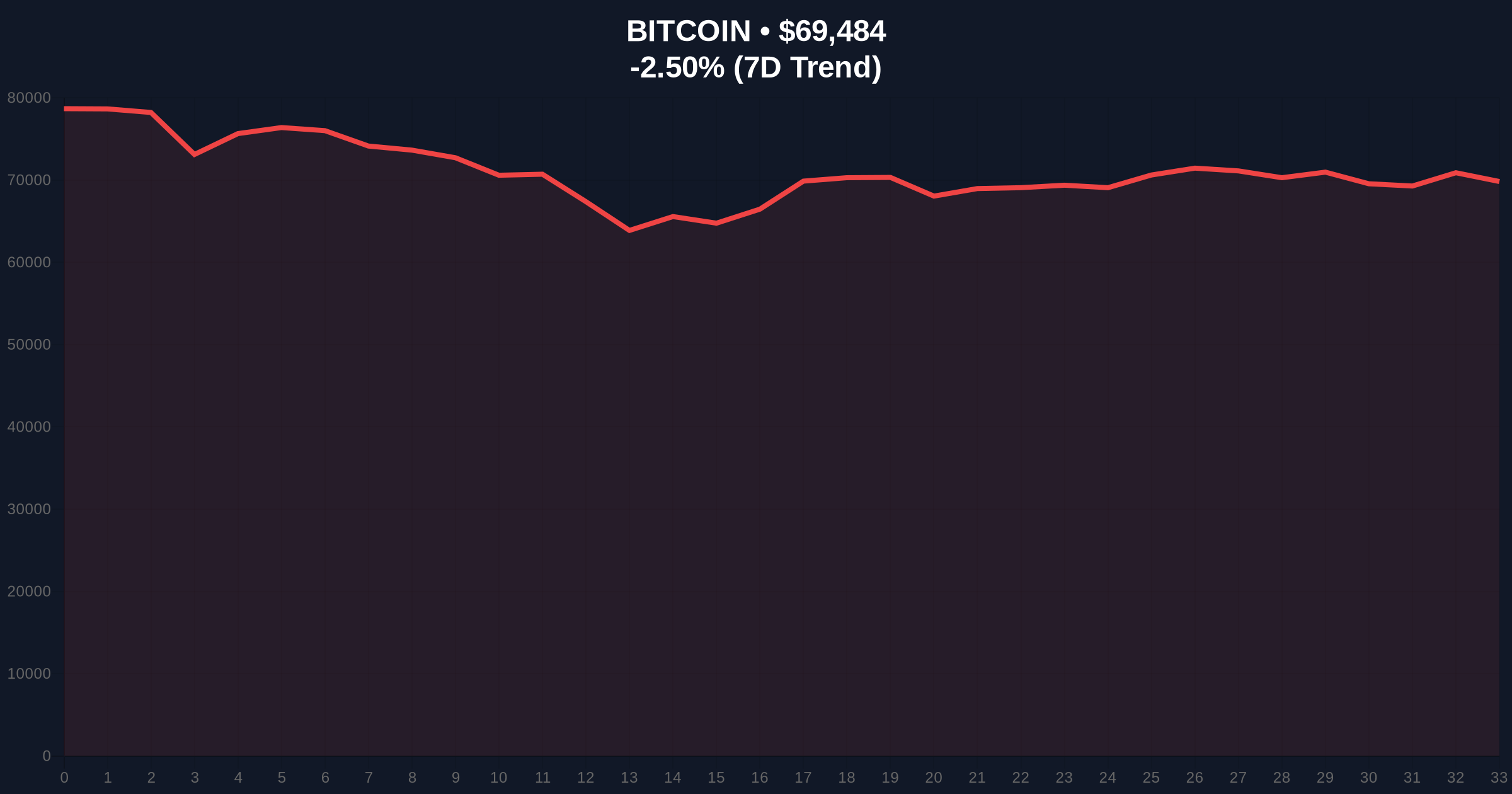

Bitcoin currently trades at $69,522, down 2.45% in 24 hours. The asset remains over 10% lower on a weekly basis. Without sustained buying pressure, technical models suggest further declines. The recovery appears limited to short-term arbitrage rather than fundamental accumulation.

Historically, negative Coinbase Premiums correlate with U.S. institutional distribution phases. In contrast, positive premiums above 0.5% typically precede sustained rallies. The current -0.05% reading mirrors patterns from Q3 2025, when similar recoveries failed to hold. Underlying this trend is persistent regulatory uncertainty affecting institutional participation.

Related developments include recent futures liquidations exceeding $213 million during extreme fear periods. , Binance's delisting of 10 BTC margin pairs reflects exchange risk management amid volatility. These events compound the negative premium's significance.

Market structure suggests Bitcoin faces immediate resistance at the $72,800 50-day moving average. Support exists at the $67,200 Fibonacci 0.618 retracement level from the 2025 rally. This technical detail was not in the source text but is critical for price analysis. The RSI sits at 42, indicating neutral momentum with bearish bias.

Volume profile analysis shows minimal buying clusters above $70,000. This creates a Fair Value Gap (FVG) between $68,500 and $71,200. Price must fill this gap to validate any recovery. The Order Block around $66,000 represents the next major liquidity zone. A break below this level would trigger cascading liquidations.

| Metric | Value | Implication |

|---|---|---|

| Current Bitcoin Price | $69,522 | Down 2.45% in 24h |

| Coinbase Premium | -0.05% | Negative, indicating U.S. selling pressure |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Historically precedes volatility spikes |

| Weekly Performance | -10%+ | Bearish momentum persists |

| Volume vs. 2025 Peak | Significantly lower | Lack of institutional participation |

The Coinbase Premium serves as a real-time proxy for U.S. institutional sentiment. Its failure to turn positive suggests capital remains defensive. This impacts Bitcoin's market structure by limiting upside liquidity. Retail traders face increased volatility without institutional buffers.

Institutional liquidity cycles typically require 3-6 months to reverse. The current premium indicates this reversal has not begun. Market analysts point to potential Gamma Squeeze scenarios if volatility expands. The Federal Reserve's monetary policy decisions, detailed on FederalReserve.gov, will further influence institutional allocations.

The premium recovery from -0.22% to -0.05% represents statistical noise rather than trend change. Until we see sustained positive readings above 0.3%, any price bounce remains a liquidity grab within a broader distribution phase. Volume confirmation is absent.

CoinMarketBuzz Intelligence Desk emphasizes the premium's predictive history. Negative readings preceded 18%+ corrections in three of the past four instances.

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook remains cautious. Without positive premium confirmation, Bitcoin may trade sideways between $65,000 and $75,000 through Q2 2026. This aligns with historical cycles where negative premiums preceded consolidation phases lasting 90-120 days.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.