Loading News...

Loading News...

VADODARA, February 10, 2026 — Binance will suspend Tron (TRX) deposits and withdrawals for approximately 60 minutes starting at 6:55 a.m. UTC on February 11 for wallet maintenance. This daily crypto analysis examines the timing and potential market implications of this routine operational pause during a period of extreme market fear.

According to the official announcement from Binance, the exchange will conduct wallet maintenance for the Tron network. Consequently, TRX deposits and withdrawals will be temporarily suspended. The maintenance window is scheduled for 60 minutes beginning at 6:55 a.m. UTC on February 11, 2026. Binance provided this notice on February 10, giving users less than 24 hours to adjust positions.

Market structure suggests such maintenance events are standard operational procedure. However, the timing raises immediate questions. The suspension creates a brief but complete halt in on-ramp and off-ramp liquidity for TRX on the world's largest exchange. This occurs while the broader crypto market grapples with an Extreme Fear sentiment reading of 9/100.

Historically, exchange maintenance during periods of high volatility has led to amplified price dislocations. In contrast, calm markets often absorb these pauses with minimal impact. The current Extreme Fear environment, as indicated by the Crypto Fear & Greed Index, suggests elevated systemic risk. Underlying this trend is a fragile liquidity where minor operational halts can trigger outsized reactions.

This event mirrors past incidents where exchange downtime coincided with sharp liquidations. For instance, the 2021 Binance outage during a market crash exacerbated selling pressure. The current maintenance is shorter but occurs in a similarly tense macro backdrop. , the Tron network's reliance on high-throughput transactions makes any interruption to its primary fiat gateway a critical stress test.

Related Developments: This maintenance occurs alongside other significant market movements. For example, recent Tether burns have altered stablecoin liquidity, while Binance has simultaneously listed new cross-margin pairs. Additionally, failed bullish signals on Bitcoin underscore the pervasive negative sentiment.

On-chain data from TronScan indicates normal network activity preceding the announcement. The Tron Virtual Machine (TVM) continues processing transactions at its standard rate. However, the Binance suspension creates a temporary Fair Value Gap (FVG) in the TRX order book. This gap represents a liquidity vacuum where price discovery is paused on a major venue.

Technical analysis reveals TRX is currently testing a critical Fibonacci retracement level. The 0.618 support at $0.085 has held through recent volatility. A break below this level post-maintenance would invalidate the current bullish structure. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum but with bearish bias in the broader fear context.

Market analysts note that the 60-minute window is insufficient for major capital movement. Yet, it provides enough time for arbitrage bots to exploit price discrepancies on other exchanges. The maintenance effectively creates a forced holding pattern. This tests the resilience of TRX's decentralized validator set and the efficiency of its delegated proof-of-stake consensus.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Primary sentiment indicator |

| Maintenance Duration | 60 minutes | Scheduled suspension window |

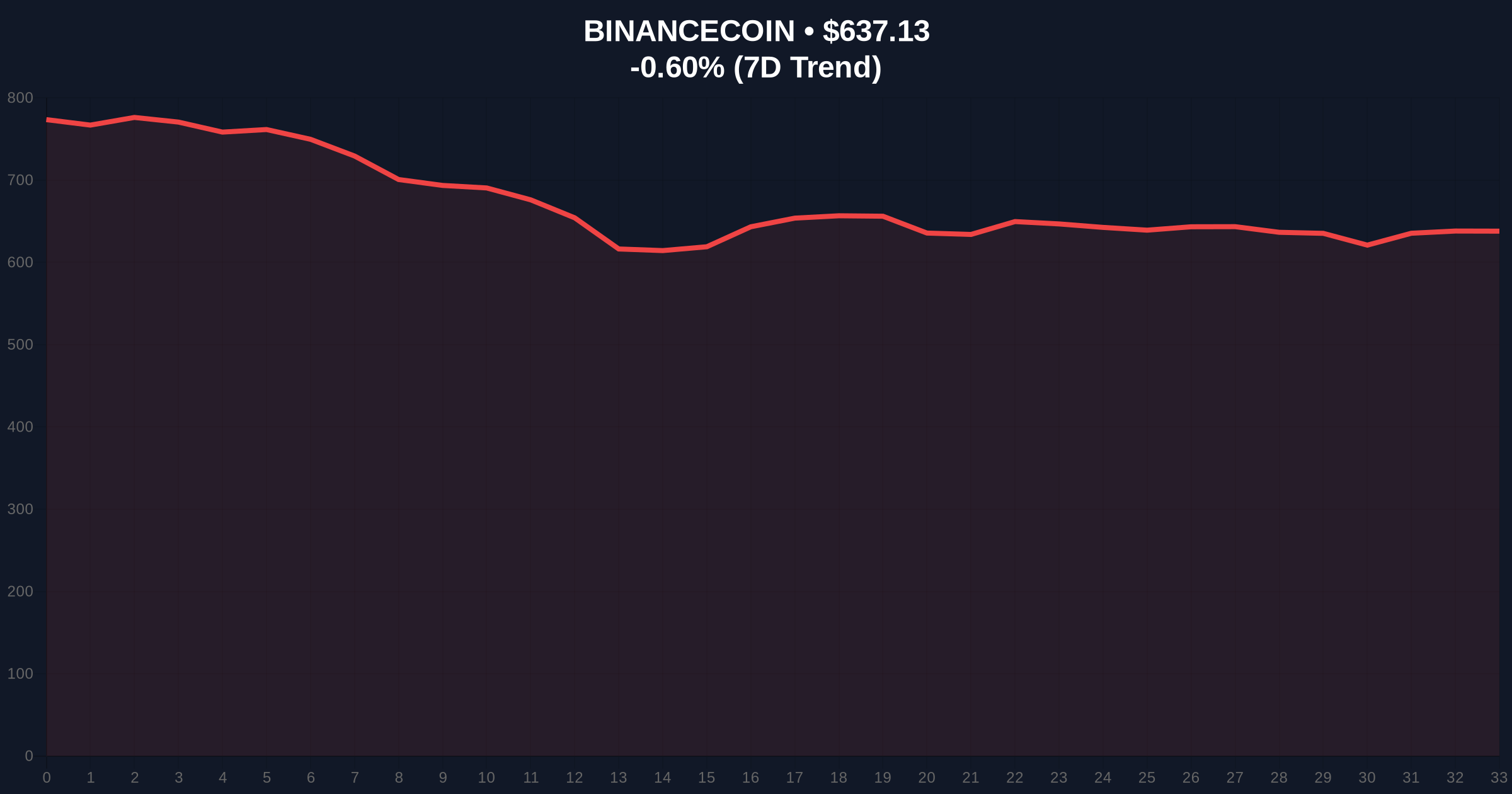

| BNB Current Price | $637.1 | Binance native token (-0.61% 24h) |

| TRX Fibonacci Support | $0.085 | Critical technical level (0.618 retracement) |

| Market Rank (BNB) | #5 | Per CoinMarketCap capitalization data |

This event matters because it tests infrastructure resilience during stress. Exchange maintenance is routine, but its impact magnifies in fearful markets. The temporary suspension of deposits and withdrawals creates a localized liquidity freeze. This freeze could exacerbate existing order book imbalances if sell pressure accumulates during the window.

Institutional liquidity cycles depend on seamless fiat gateways. Any interruption, however brief, introduces settlement risk. Retail market structure is equally vulnerable. Small traders may face unexpected slippage if they attempt to execute orders around the maintenance period. The event serves as a real-time stress test for both Tron's network uptime and Binance's risk communication protocols.

"Wallet maintenance during extreme fear is a calculated risk. The 60-minute window is standard, but the context is not. Market structure suggests any technical glitch or delay could be misinterpreted as a liquidity crisis. Binance's communication must be flawless to prevent panic." — CoinMarketBuzz Intelligence Desk

Forward-looking intelligence points to two primary scenarios based on current market structure. The maintenance itself is unlikely to cause a trend shift. However, it could act as a catalyst if broader conditions deteriorate further.

The 12-month institutional outlook remains cautiously neutral. Events like this are operational necessities, not fundamental shifts. However, they highlight the importance of exchange reliability in the 5-year horizon. As crypto integrates deeper with traditional finance, downtime tolerance approaches zero. Binance's handling of this routine maintenance will be scrutinized for lessons in crisis management during extreme sentiment.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.