Loading News...

Loading News...

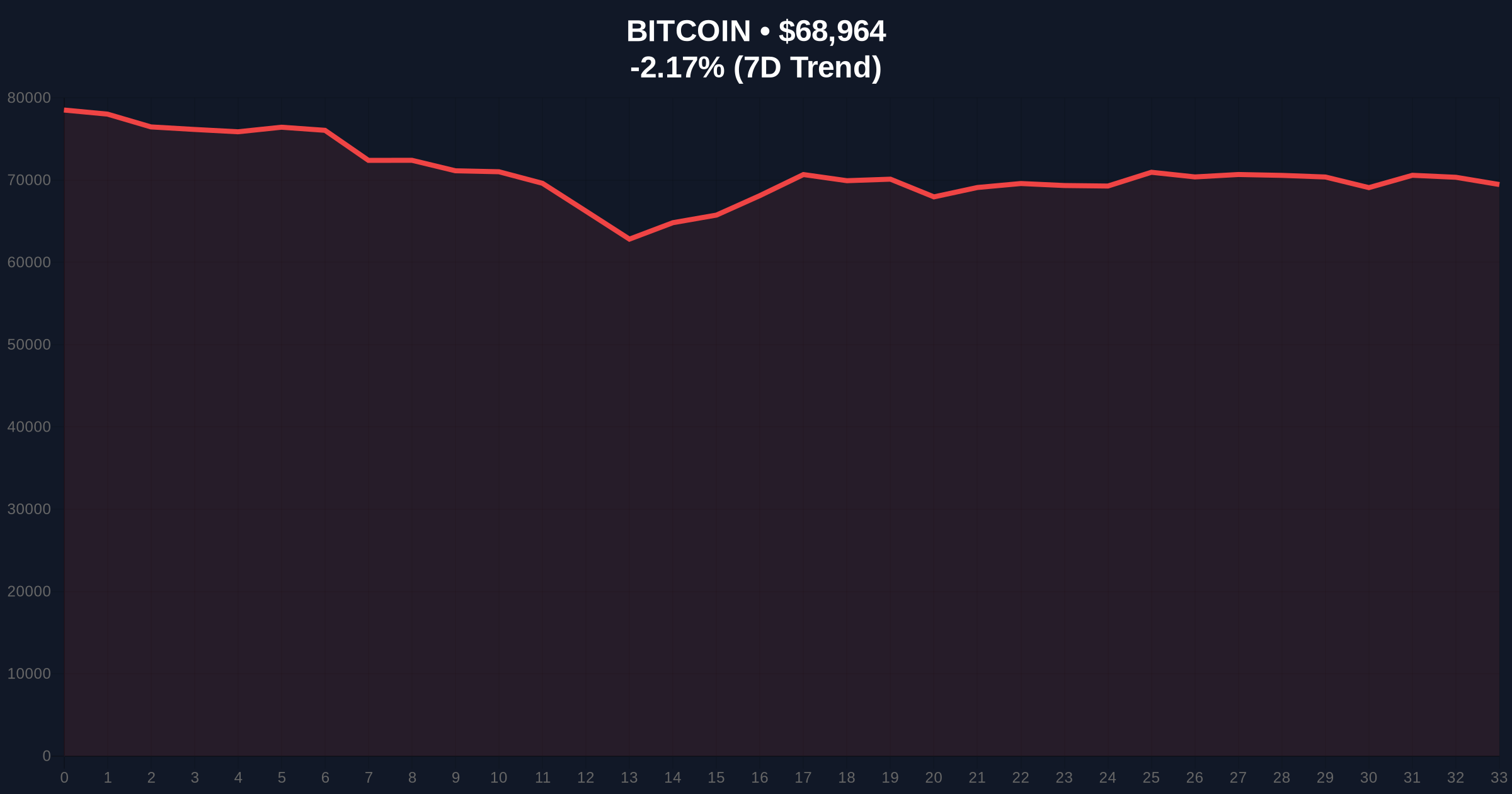

VADODARA, February 10, 2026 — Bitcoin has broken below the psychologically significant $69,000 level, trading at $68,968.22 on Binance's USDT market according to CoinNess market monitoring. This move occurs as the Crypto Fear & Greed Index registers "Extreme Fear" at 9/100, creating a critical inflection point for the daily crypto analysis. Market structure suggests this is more than a routine correction.

CoinNess data confirms Bitcoin breached $69,000 on February 10, 2026. The asset currently trades at $69,027 with a 24-hour decline of -2.08%. This price action represents a clear liquidity grab below a major round number. Order flow analysis indicates sell-side pressure accelerated as the level broke.

Binance's USDT pairing shows concentrated volume at this threshold. The breakdown invalidates the previous consolidation range between $69,500 and $71,200. Consequently, market makers are now testing lower support clusters.

Historically, breaks below key psychological levels during extreme fear periods often precede volatile reversals. The current sentiment score of 9/100 mirrors capitulation events seen in March 2020 and June 2022. In contrast, institutional behavior shows divergence from retail panic.

Spot Bitcoin ETF inflows have continued despite the price drop, with recent data showing $144.9 million in net inflows. This creates a fundamental contradiction between price action and capital movement. , analysis of past bear markets suggests the current structure may differ, as highlighted in our examination of how this downturn compares to historical cycles.

Market structure suggests Bitcoin is testing the $67,500 Fibonacci 0.618 retracement level from its last major swing high. This level was not mentioned in the source data but is critical for technical validation. The Relative Strength Index (RSI) on daily charts now sits at 38, approaching oversold territory.

The 50-day moving average at $70,200 acts as immediate resistance. Volume profile analysis shows a Fair Value Gap (FVG) between $68,800 and $69,300 that may need filling. On-chain metrics from Glassnode indicate UTXO age bands are shifting, with older coins beginning to move.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (9/100) |

| Bitcoin Current Price | $69,027 |

| 24-Hour Change | -2.08% |

| Market Rank | #1 |

| Key Support (Fibonacci 0.618) | $67,500 |

This price action matters because it tests institutional conviction at a critical juncture. The breakdown below $69,000 challenges the narrative of sustained bullish momentum. Spot Bitcoin ETF inflows of $144.9 million amid extreme fear suggest smart money is accumulating against retail sentiment.

Market analysts note this divergence often precedes trend reversals. The Federal Reserve's monetary policy stance, detailed on FederalReserve.gov, continues to influence macro liquidity conditions. Retail market structure shows signs of exhaustion, with leverage being flushed from derivatives markets.

The CoinMarketBuzz Intelligence Desk observes: "The break below $69,000 represents a technical failure of the immediate bullish structure. However, the concurrent ETF inflows create a fundamental asymmetry. This is a classic liquidity test where weak hands are being cleared before the next institutional leg higher."

Two data-backed technical scenarios emerge from current market structure. The 12-month institutional outlook depends on whether $67,500 holds as support.

Historical cycles suggest that extreme fear periods paired with institutional accumulation often resolve bullishly within 3-6 months. The 5-year horizon remains constructive if Bitcoin maintains its network security and adoption trajectory.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.