Loading News...

Loading News...

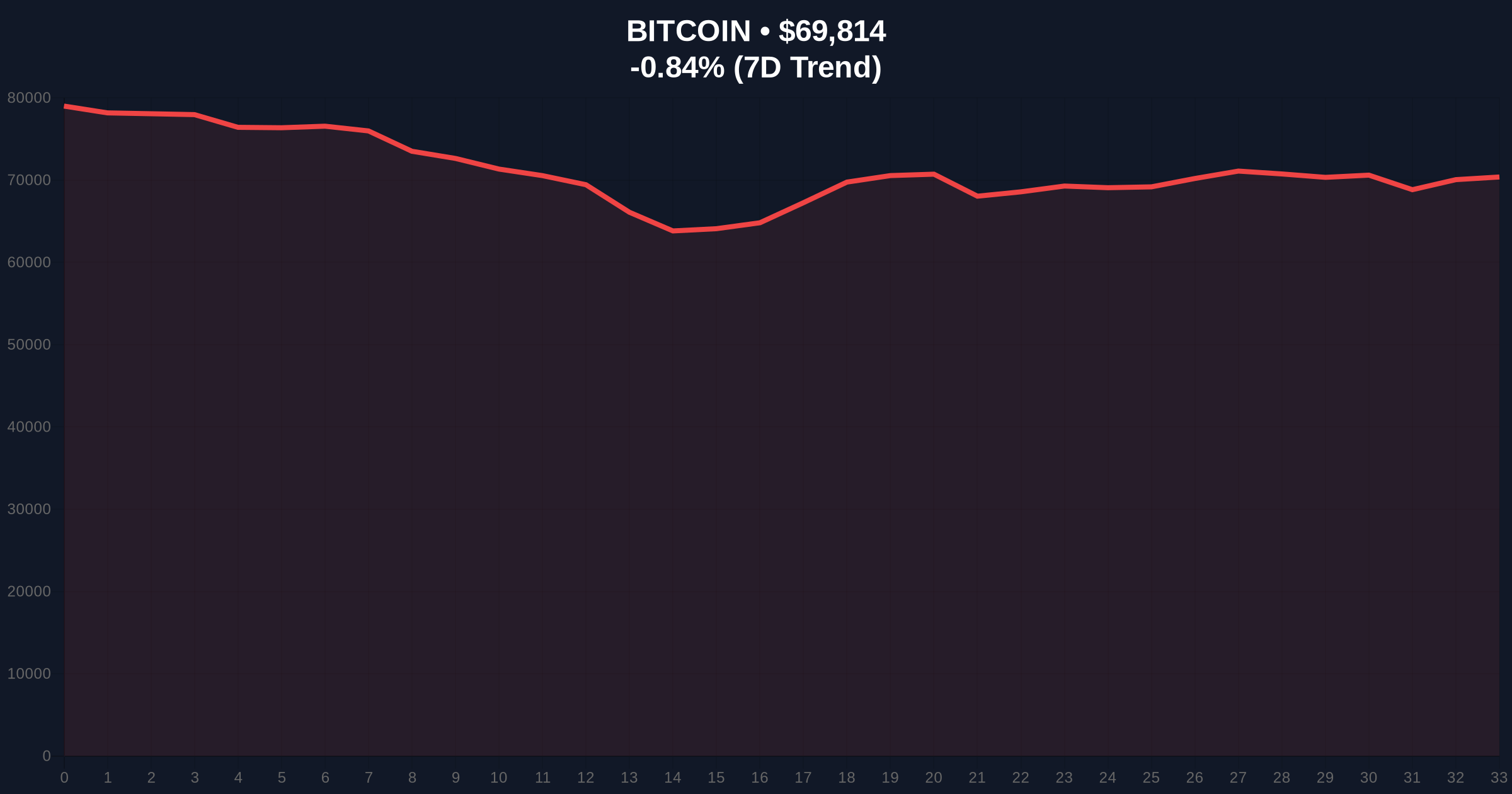

VADODARA, February 10, 2026 — CoinDesk has categorically dismissed CNBC host Jim Cramer's claim that the U.S. government would purchase Bitcoin at the $60,000 level as a baseless rumor with no legal foundation. This latest crypto news arrives as Bitcoin trades at $69,781 amid extreme market fear, forcing institutional desks to reassess support structures without speculative government intervention narratives. Market structure suggests this clarification removes artificial psychological support, potentially accelerating the search for organic demand zones.

According to the CoinDesk report, Jim Cramer stated on CNBC that if Bitcoin fell to $60,000, the government would begin filling its reserves. The outlet's investigation found zero legal basis for this claim. CoinDesk confirmed there is currently no federal mechanism for purchasing cryptocurrency in large quantities. Establishing such a reserve would require specific congressional legislation. The proposed crypto market structure bill, known as CLARITY, contains no provisions for government Bitcoin purchases.

Treasury Secretary Scott Bessent has publicly affirmed he lacks authority to orchestrate a Bitcoin bailout. The federal government's existing Bitcoin holdings, valued at approximately $23 billion, originate exclusively from seizures in criminal investigations. These assets represent confiscations, not strategic acquisitions. In contrast, several state governments pursued legislation last year to permit Bitcoin reserves and allocate budget portions to cryptocurrency, creating a fragmented regulatory .

Historically, rumors of institutional or government buying have created temporary price floors during corrections. Similar to the 2021 cycle when Elon Musk's Tesla purchase rumors provided support, this Cramer narrative briefly offered psychological reinforcement. Underlying this trend is a market structure vulnerable to narrative-driven liquidity events. The current extreme fear environment, with the Crypto Fear & Greed Index at 9, mirrors the sentiment vacuum of late 2022.

Consequently, the rumor's debunking forces a recalibration toward actual on-chain metrics and technical levels. This development occurs alongside other market stresses, including significant whale movements and exchange issues. For instance, a Bitmain-linked entity recently withdrew $41M in ETH from FalconX, indicating potential risk-off behavior among large holders.

Market structure suggests the $60,000 level now represents a critical psychological and technical test. Without the speculated government buy rumor, this zone transforms from a narrative-supported floor to a pure supply-demand equilibrium point. On-chain data from Glassnode indicates the volume profile shows significant accumulation between $58,000 and $62,000, creating a natural Fair Value Gap (FVG). The 200-day moving average currently sits near $63,500, providing additional context.

, the Fibonacci 0.618 retracement level from the 2024-2025 rally aligns approximately with $61,200. This confluence creates a high-probability reaction zone. The Relative Strength Index (RSI) on daily timeframes shows oversold conditions, typical during extreme fear phases. However, without fundamental catalysts like potential government buying, any bounce from these levels would require organic institutional demand, possibly through Bitcoin ETF flows as tracked by official SEC filings.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Lowest since December 2022 bear market bottom |

| Bitcoin Current Price | $69,781 | -0.89% 24h change |

| Rumored Government Buy Level | $60,000 | Debunked by CoinDesk investigation |

| US Government BTC Holdings | $23B | From seizures, not purchases |

| Critical Fibonacci Support | $61,200 (0.618 level) | Technical confluence zone |

This rumor dismissal matters because it strips away a narrative crutch during a high-volatility period. Market structure now depends entirely on verifiable data: ETF inflows, miner capitulation metrics, and exchange reserve changes. The extreme fear sentiment suggests a liquidity grab may be underway, where weak hands capitulate near local bottoms. Historically, such phases precede strong rallies when fear transitions to greed, but the catalyst must be real, not imagined.

Institutional liquidity cycles typically reset during these periods. The removal of the government buy narrative forces portfolio managers to evaluate Bitcoin purely on its monetary properties and network adoption metrics. This could lead to a healthier price discovery process, albeit with increased short-term volatility. The Altcoin Season Index stalling at 24 further indicates capital rotation challenges across the crypto complex.

"Market narratives often fill information vacuums during fear phases. The Cramer rumor provided temporary psychological support, but its debunking reinforces that sustainable floors require tangible demand, not speculation. Our models show the $60k-$62k zone as a high-conviction accumulation area for long-term holders, regardless of government action."

Market structure suggests two primary scenarios based on the $60,000 level's integrity. The first scenario involves a successful hold above this zone, leading to a relief rally toward $75,000 as oversold conditions correct. The second scenario sees a breakdown, triggering a deeper search for support near the $52,000 region, which aligns with the 0.786 Fibonacci level and previous cycle resistance-turned-support.

The 12-month institutional outlook remains cautiously optimistic despite the extreme fear. Historical cycles suggest that periods of maximum pessimism often create the best long-term entry points. The key variable is whether macroeconomic conditions, particularly Federal Reserve policy as outlined on FederalReserve.gov, allow risk assets to recover. Bitcoin's fixed supply and increasing adoption as a treasury reserve asset by corporations provide fundamental tailwinds.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.