Loading News...

Loading News...

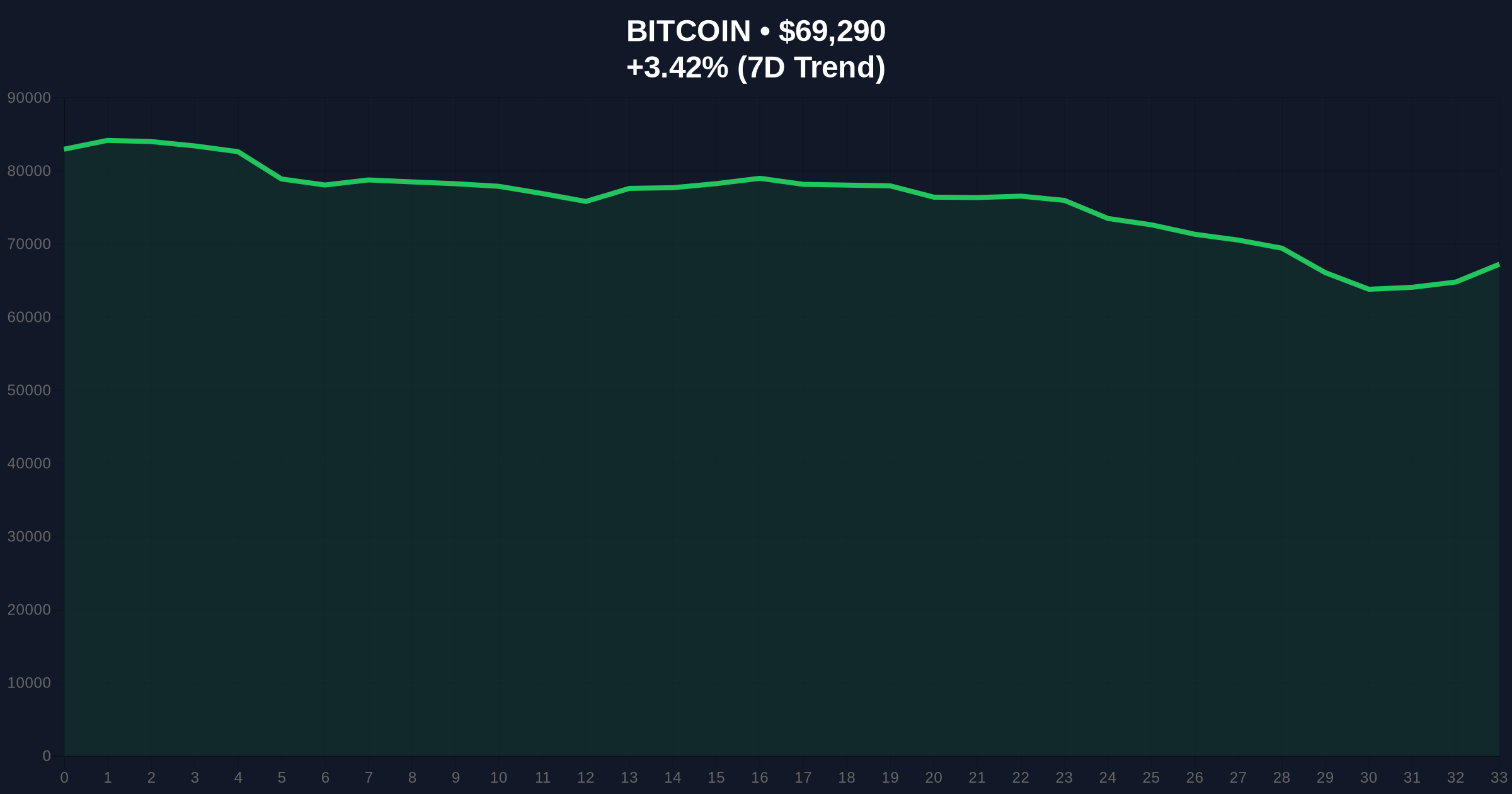

VADODARA, February 6, 2026 — Nobel laureate economist Paul Krugman asserts the current Bitcoin downturn diverges from historical cycles due to politicization, challenging the asset's ideological price defense. This daily crypto analysis examines his claims against real-time market data, where BTC trades at $69,282 amid extreme fear sentiment.

According to U.Today, City University of New York professor Paul Krugman published a blog post arguing Bitcoin's recent crash differs fundamentally. He states past recoveries relied on a libertarian ideology that provided a psychological price floor. This faith enabled rebounds from major crashes like 2018's 80% drawdown. However, Krugman contends Bitcoin has transformed into a political product. Consequently, that ideological defense now fails, creating a crisis of trust. His analysis directly challenges core Bitcoin narratives.

Historically, Bitcoin crashes followed predictable liquidity cycles. The 2014-2015 bear market saw a 86% decline, yet recovery began after 413 days. Similarly, the 2018 crash bottomed at $3,200 before a multi-year bull run. Underlying these trends was strong holder conviction, often ideologically driven. In contrast, current sentiment data shows Extreme Fear at 9/100, per the Crypto Fear & Greed Index. This aligns with Krugman's trust crisis thesis. Related developments include institutional responses, such as Bitwise CEO reporting ETF volume triples during dips, and Jefferies warning of no market bottom yet.

Market structure suggests critical support at $64,000, a Fibonacci 0.618 retracement from the 2025 all-time high. This level aligns with a high-volume node on the Volume Profile, indicating strong buyer interest historically. Bitcoin currently trades at $69,282, down 3.41% in 24 hours. The RSI sits at 28, nearing oversold territory. A break below $64,000 would invalidate the bullish higher-low structure established in Q4 2025. On-chain data from Glassnode shows declining UTXO age bands, suggesting older holders are distributing. This technical setup mirrors Krugman's ideological erosion premise.

| Metric | Value | Source |

|---|---|---|

| Bitcoin Current Price | $69,282 | Live Market Data |

| 24-Hour Trend | -3.41% | Live Market Data |

| Crypto Fear & Greed Index | Extreme Fear (9/100) | Live Market Data |

| Key Support Level | $64,000 (Fib 0.618) | Technical Analysis |

| RSI (Daily) | 28 | Technical Indicators |

Krugman's argument impacts institutional liquidity cycles. If ideological support weakens, recovery may depend more on macroeconomic factors like Fed policy. The Federal Reserve's interest rate decisions, documented on FederalReserve.gov, could drive future price action. Retail market structure shows increased sensitivity to political headlines, per social sentiment metrics. This shift could prolong bear markets, affecting portfolio allocations for the 5-year horizon.

"Krugman highlights a critical regime change. Bitcoin's volatility now correlates more with political narratives than pure monetary theory. Our models indicate a higher probability of extended consolidation below previous cycle highs if this thesis holds." – CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure. First, a bullish reversal requires holding $64,000 and reclaiming $72,500 resistance. Second, a bearish continuation targets $58,000 if ideological outflows persist.

The 12-month outlook hinges on whether Bitcoin decouples from political factors. Institutional adoption, via ETFs, may offset ideological erosion, but on-chain data must show renewed holder conviction.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.