Loading News...

Loading News...

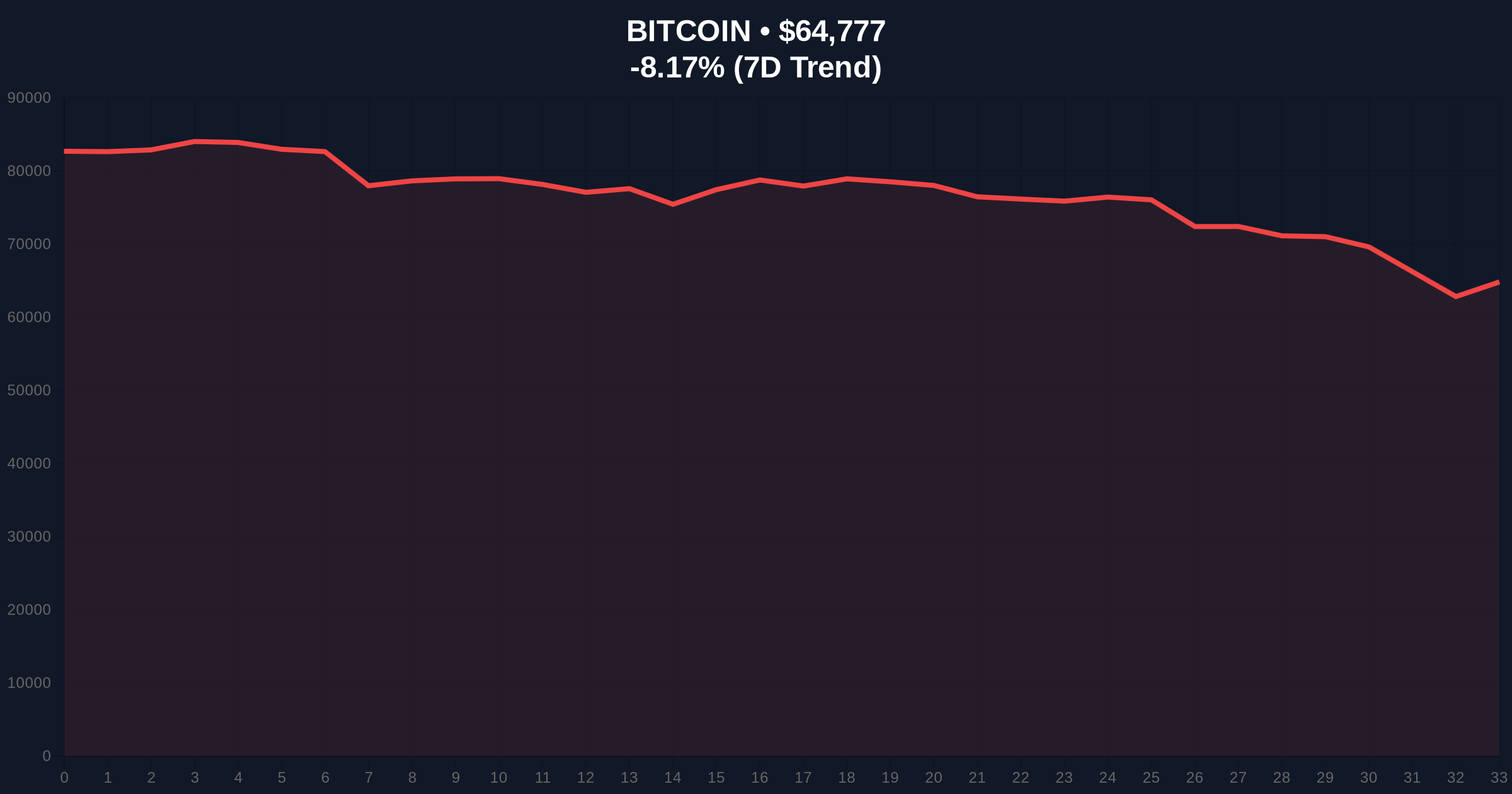

VADODARA, February 6, 2026 — U.S. investment bank Jefferies issued a stark warning today. The firm sees no signs of a short-term bottom in the cryptocurrency market. This daily crypto analysis comes as Bitcoin plunged to $64,764, down 8.19% in 24 hours. Market structure suggests a liquidity grab is underway.

Jefferies attributed the downturn to global risk-off sentiment. Liquidity adjustments from capital outflows drove the sell-off. According to the bank's statement, short-term bottoms remain elusive. Long-term drivers include improving regulation and institutional participation. The analysis concluded rebounds require genuine revenue mechanisms.

Market analysts interpret this as a caution against premature accumulation. On-chain data indicates significant exchange inflows. This suggests distribution, not accumulation. The Jefferies report aligns with current price action.

Historically, sharp declines precede prolonged consolidation. The 2021 cycle saw similar capital outflow phases. In contrast, current outflows lack immediate reversal signals. Underlying this trend is a global macro shift. The Federal Reserve's latest policy statements on interest rates have tightened liquidity.

Related developments highlight the extreme fear environment:

Bitcoin's price broke below the 200-day moving average. This signals a structural shift. The Relative Strength Index (RSI) sits at 28, indicating oversold conditions. However, oversold does not guarantee reversal. A Fair Value Gap (FVG) exists between $67,000 and $69,000.

This gap represents a liquidity void. Price must fill it to establish equilibrium. The Fibonacci 0.618 retracement level from the 2025 low sits at $62,500. This aligns with high-volume nodes on the Volume Profile. Market structure suggests this zone acts as critical support.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Historically a contrarian signal, but not yet a bottom indicator. |

| Bitcoin Price (24h Change) | $64,764 (-8.19%) | Break below 200-DMA confirms bearish momentum. |

| RSI (Daily) | 28 | Oversold, but divergence absent for reversal confirmation. |

| Fibonacci Support (0.618) | $62,500 | Critical level for maintaining bull market structure. |

| Fair Value Gap | $67,000-$69,000 | Liquidity zone that price must reclaim for recovery. |

Jefferies' analysis impacts institutional allocation decisions. Capital outflows reduce market liquidity. This increases volatility for retail traders. The bank's focus on revenue-generating projects signals a shift. Future rallies may exclude speculative tokens without fundamentals.

On-chain forensic data confirms outflow pressure. Exchange net position changes show sustained selling. This validates Jefferies' liquidity adjustment thesis. The maturing infrastructure cited includes Ethereum's upcoming Pectra upgrade and EIP-4844 blobs for scaling.

"The absence of a short-term bottom aligns with our liquidity models. Capital flight creates order blocks that resist quick recovery. Markets need time to absorb this supply. Any rebound requires sustained institutional inflow, not just retail FOMO."

Two data-backed scenarios emerge from current structure.

The 12-month outlook depends on macro liquidity. Federal Reserve policy remains key. Historically, easing cycles trigger crypto rallies. Jefferies' long-term drivers suggest a 2027 recovery phase. This aligns with a 5-year horizon for infrastructure maturation.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.