Loading News...

Loading News...

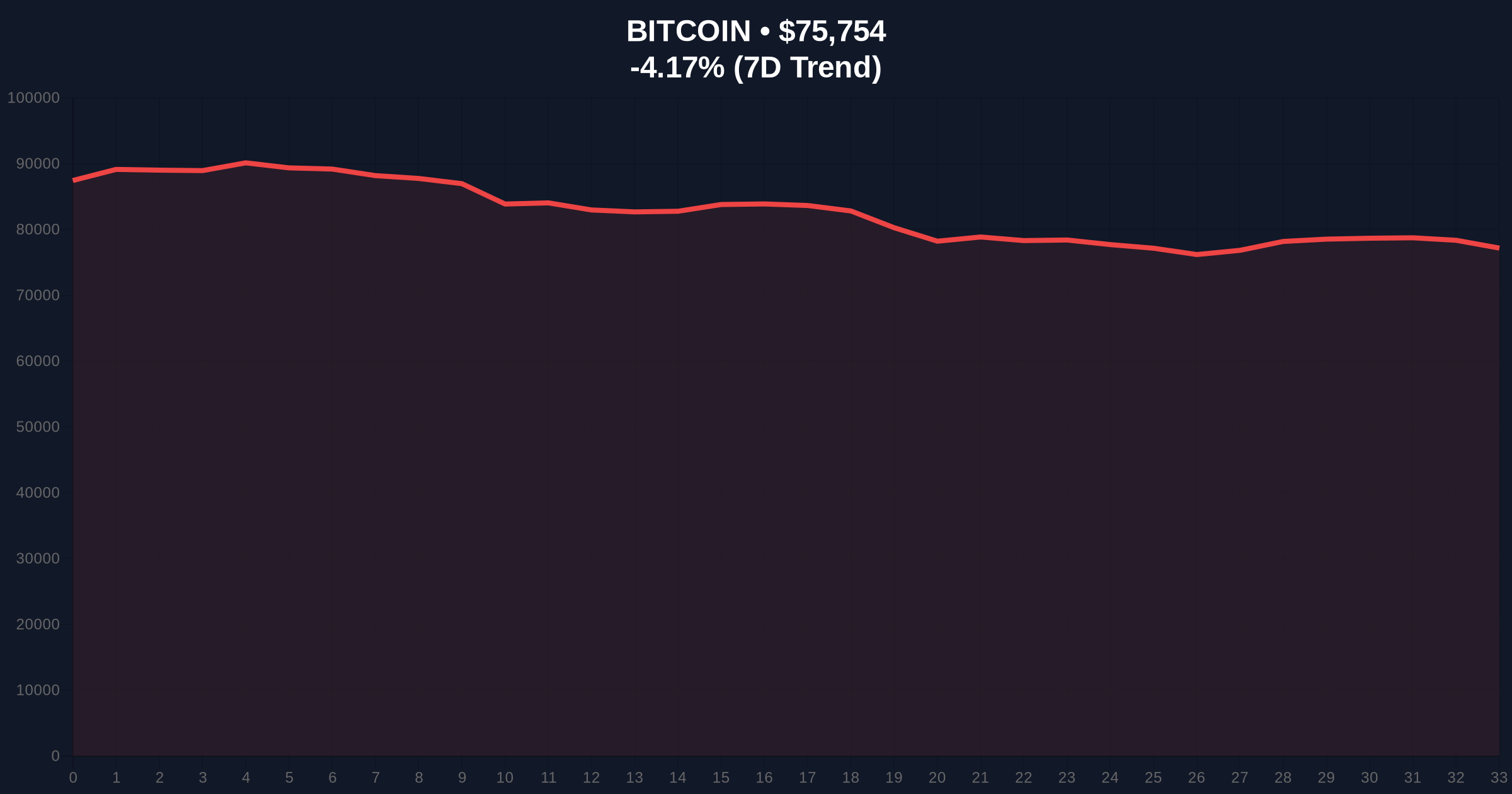

VADODARA, February 3, 2026 — Dan Morehead, founder of crypto investment firm Pantera Capital, predicted Bitcoin will significantly outperform gold over the next decade. He made this statement today at a panel discussion during the Ondo Summit in New York. Morehead cited periodic market leadership swaps and similar ETF inflows between the assets. This latest crypto news arrives as Bitcoin trades at $75,745, down 4.18% in 24 hours, amid extreme fear sentiment.

According to Morehead's remarks at the Ondo Summit, Bitcoin and gold have swapped market leadership multiple times. He noted both assets have seen comparable ETF fund inflows recently. Morehead emphasized fiat currency dilution at about 3% annually. This makes limited-supply assets like Bitcoin or gold rational long-term choices. His prediction directly challenges traditional safe-haven narratives. The statement aligns with Pantera Capital's historical bullish stance on Bitcoin. Market analysts view this as a strategic institutional positioning move.

Historically, Bitcoin and gold have exhibited inverse correlations during risk-off events. In contrast, the 2021 cycle saw both assets rally simultaneously amid inflationary fears. Similar to the 2021 correction, current extreme fear sentiment often precedes major liquidity grabs. Underlying this trend, Bitcoin's post-halving issuance schedule contrasts sharply with gold's annual production increases. According to on-chain data from Glassnode, Bitcoin's stock-to-flow model remains intact despite recent price drops. This reinforces Morehead's supply-driven argument.

Related developments include Bitcoin's recent price action below $77,000 and TeraWulf's mining expansion defying market fear.

Market structure suggests Bitcoin faces immediate resistance at the $78,000 order block. The daily RSI sits at 42, indicating neutral momentum with bearish bias. A critical Fibonacci 0.618 retracement level from the 2025 low to high provides support at $72,500. This level aligns with a high-volume node on the volume profile. Breaking below it would invalidate the current bullish structure. Conversely, reclaiming the 50-day moving average near $79,200 could signal trend reversal. The Fair Value Gap (FVG) between $76,500 and $77,500 remains unfilled, acting as a liquidity magnet.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) | Indicates peak capitulation zones historically |

| Bitcoin Current Price | $75,745 | Down 4.18% in 24h |

| Gold Price (Spot) | ~$2,400/oz | For performance comparison |

| Annual Fiat Dilution | ~3% | As cited by Morehead per monetary policy |

| Bitcoin Market Rank | #1 | Dominance at ~52% |

Morehead's prediction matters for institutional portfolio construction. It signals a shift from gold to Bitcoin as a primary inflation hedge. On-chain data indicates sustained accumulation by long-term holders despite price volatility. This aligns with the Federal Reserve's ongoing balance sheet policies, which impact fiat dilution rates. Retail market structure shows increased selling pressure near local tops. However, institutional inflows via ETFs continue to provide underlying support. The debate mirrors historical gold vs. fiat dynamics but with digital scarcity.

"Pantera's stance reflects a quantitative view of monetary debasement. Bitcoin's fixed supply and verifiable scarcity create a compelling case against traditional stores of value. Market cycles suggest these predictions gain traction during fear phases, as seen in 2018 and 2022." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. First, a bullish reversal requires holding the $72,500 Fibonacci support. Second, a bearish continuation would see a break below that level targeting $68,000. The 12-month institutional outlook hinges on ETF flow sustainability and macro liquidity conditions.

Historical cycles suggest extreme fear periods like today often precede significant rallies. The 5-year horizon favors Bitcoin due to its programmed scarcity versus gold's elastic supply. Institutional adoption, as tracked by Ethereum.org's data on asset tokenization, supports this thesis.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.