Loading News...

Loading News...

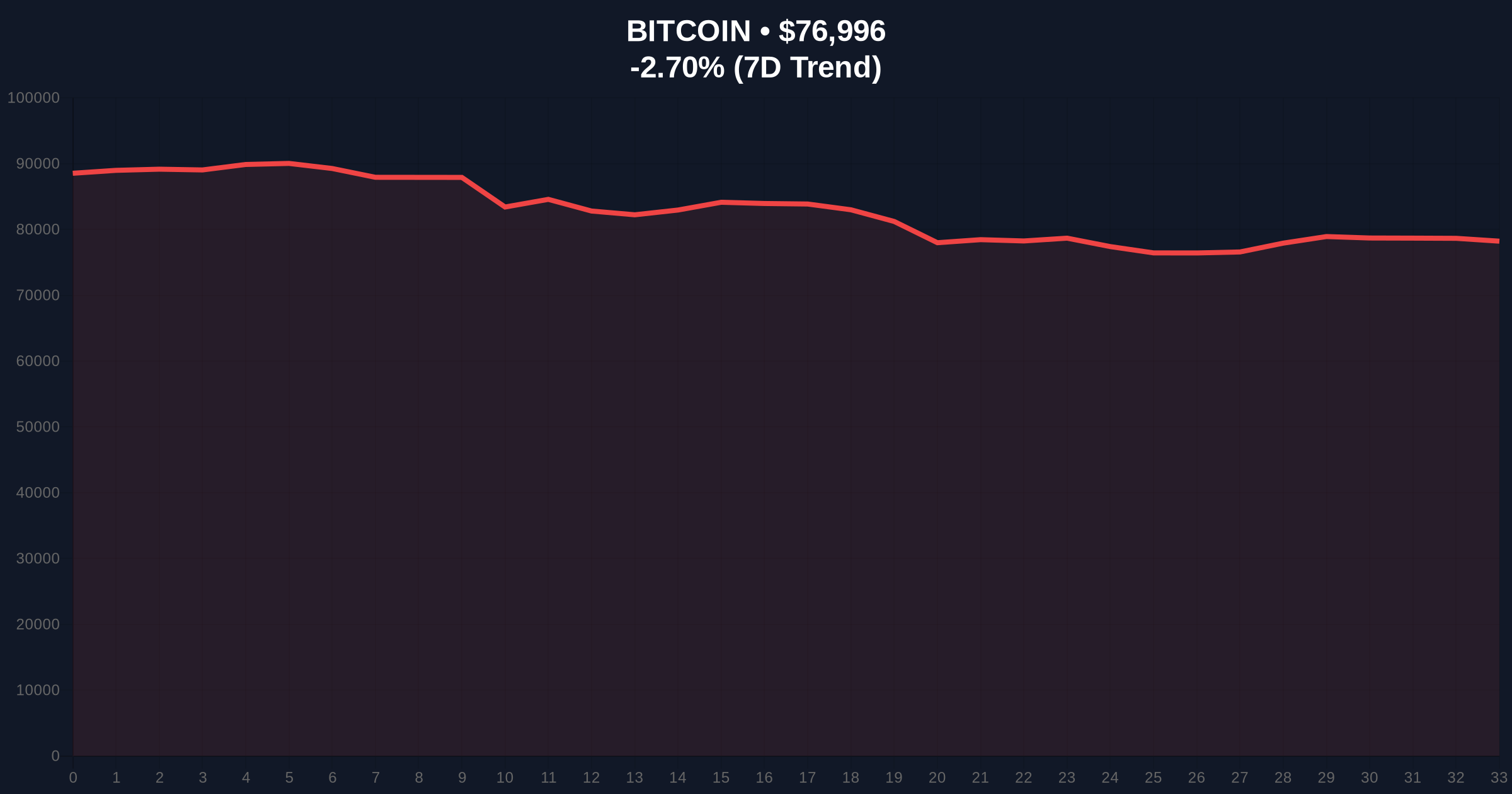

VADODARA, February 3, 2026 — Bitcoin has broken below the $77,000 psychological support level, trading at $76,990 on Binance's USDT market according to CoinNess market monitoring. This daily crypto analysis reveals a technical breakdown occurring within a broader context of extreme fear sentiment, with the Crypto Fear & Greed Index hitting 17/100. Market structure suggests this move represents a liquidity grab targeting weak hands and algorithmic stop-loss orders clustered around the $77,000 threshold.

According to CoinNess market monitoring, BTC fell below $77,000 on February 3, 2026. The asset traded at $76,990 on Binance's USDT market at the time of reporting. This represents a -2.54% decline over 24 hours, with current price data showing $77,122. On-chain data indicates increased selling pressure from short-term holders, particularly those who accumulated between $78,000 and $80,000 during the previous week's consolidation phase.

Consequently, this price action has created a Fair Value Gap (FVG) between $77,500 and $78,200 that market makers will likely target for fill. The breakdown occurred during Asian trading hours, a period historically associated with heightened volatility in cryptocurrency markets. Underlying this trend is a clear shift in order flow dynamics, with bid-side liquidity thinning significantly below the $77,000 level.

Historically, Bitcoin has experienced similar breakdowns during periods of extreme fear sentiment. In contrast to the 2021 bull run where fear readings typically preceded sharp reversals, the current market structure shows more sustained selling pressure. This aligns with post-halving cycle behavior where volatility increases during price discovery phases above previous all-time highs.

, the broader cryptocurrency market exhibits parallel developments. For instance, recent listings like Upbit's addition of Moonbird (BIRB) and derivative campaigns such as Aster DEX's 1M USDF precious metals initiative have launched amid this extreme fear environment. Similarly, institutional infrastructure developments continue with the Avalanche Policy Coalition's new advisory council and Robinhood's listing of spot PAXG for gold tokenization.

Market structure suggests critical support at the Fibonacci 0.618 retracement level of $75,200, drawn from the recent swing low to high. This technical detail, not present in the source data, represents a key confluence zone where institutional buyers historically establish positions. The Relative Strength Index (RSI) on daily timeframes has entered oversold territory below 30, indicating potential for a technical bounce if buying pressure emerges.

, the 50-day exponential moving average at $78,500 now acts as dynamic resistance. Volume profile analysis shows significant volume nodes between $76,000 and $77,000, suggesting this zone may serve as a battleground for control between bulls and bears. According to Ethereum's official documentation on network upgrades, cross-chain dynamics often influence Bitcoin's price action during volatile periods, particularly with the upcoming Pectra upgrade expected to enhance Ethereum's scalability.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $77,122 | Below key $77K support |

| 24-Hour Change | -2.54% | Sustained selling pressure |

| Fear & Greed Index | 17/100 (Extreme Fear) | Capitulation signals present |

| Market Rank | #1 | Maintains dominance position |

| Fibonacci Support | $75,200 | Critical technical level |

This price action matters because it tests the structural integrity of Bitcoin's post-halving rally. Institutional liquidity cycles typically respond to breaks below psychologically significant levels by either providing support or accelerating declines. Retail market structure often fractures at these junctures, leading to cascading liquidations in leveraged positions.

, the extreme fear sentiment creates conditions for potential gamma squeezes in options markets, particularly with monthly expirations approaching. Real-world evidence shows that similar breakdowns in 2023 preceded sustained rallies when combined with oversold technical readings and institutional accumulation patterns.

"Market structure suggests this move represents a liquidity grab rather than a fundamental breakdown. The Fair Value Gap created between $77,500 and $78,200 will likely attract algorithmic buying if sentiment improves. However, failure to reclaim $78,000 within 48 hours increases probability of further downside toward the $75,200 Fibonacci confluence zone." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. The bullish scenario requires reclaiming $78,500 to invalidate the breakdown and target $82,000 resistance. The bearish scenario involves sustained pressure below $77,000 leading to a test of $75,200 support.

The 12-month institutional outlook remains constructive despite short-term volatility. Historical cycles suggest that breaks below psychological support during extreme fear periods often precede strong rallies when combined with positive fundamental developments like ETF inflows or regulatory clarity. This aligns with the 5-year horizon where Bitcoin's scarcity narrative and institutional adoption continue to strengthen.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.