Loading News...

Loading News...

VADODARA, February 4, 2026 — MicroStrategy faces a $1.5 billion unrealized loss on its Bitcoin holdings. On-chain data confirms the firm has sold only once since 2022. This defiance occurs amid extreme market fear. The latest crypto news reveals a critical stress test for institutional conviction.

Lookonchain reported the $1.5 billion unrealized loss. MicroStrategy previously endured over 500 days of unrealized losses from 2022 to 2023. The company sold 704 BTC on December 22, 2022. It immediately repurchased 810 BTC. Since that transaction, MicroStrategy has strictly maintained a buy-and-hold strategy. Lookonchain noted this unwavering approach. Market structure suggests a deliberate liquidity grab during volatility.

Historically, prolonged unrealized losses trigger capitulation. MicroStrategy's 500-day loss period mirrors the 2018 bear market. In contrast, the firm's single sale indicates strategic discipline. Underlying this trend is a shift toward Bitcoin as a treasury reserve asset. This mirrors corporate adoption patterns seen in 2021. , extreme fear sentiment often precedes major reversals. The current 14/100 Fear & Greed Index signals maximum pessimism. Consequently, MicroStrategy's hold could mark a local bottom.

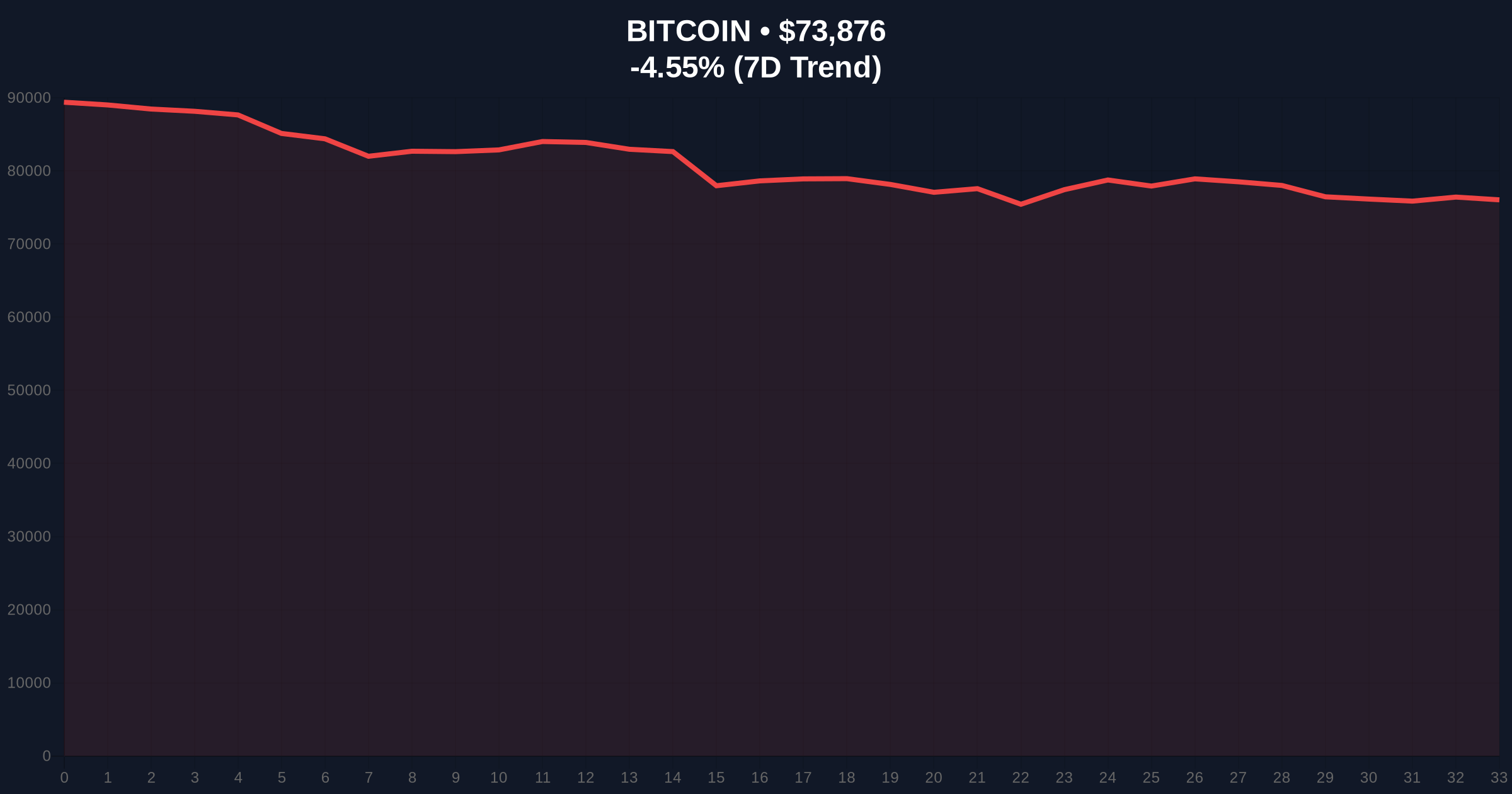

Related developments include Bitcoin's recent break above $75,000 and UBS expanding its digital asset business amid similar conditions.

Bitcoin currently trades at $73,611. The 24-hour trend shows a -4.90% decline. Key support resides at the Fibonacci 0.618 retracement level of $70,000. This level aligns with the 200-day moving average. Resistance sits at $78,000, forming a clear order block. RSI readings hover near oversold territory at 32. Volume profile indicates accumulation below $75,000. Market structure suggests a fair value gap between $70,000 and $73,000. A break below $70,000 invalidates the bullish structure.

| Metric | Value |

|---|---|

| MicroStrategy Unrealized Loss | $1.5 Billion |

| Bitcoin Current Price | $73,611 |

| 24-Hour Price Change | -4.90% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| MicroStrategy BTC Sales Since 2022 | 1 |

MicroStrategy's behavior impacts institutional liquidity cycles. The firm holds approximately 1% of Bitcoin's circulating supply. Its refusal to sell despite massive losses sets a precedent. Retail market structure often follows institutional leads. This could reduce panic selling during downturns. On-chain data indicates long-term holder conviction remains intact. The $1.5 billion loss tests the "digital gold" narrative. Success here validates Bitcoin's store-of-value thesis. According to SEC.gov filings, MicroStrategy's strategy is fully disclosed, providing transparency for investors.

"MicroStrategy's single sale event in December 2022 was a tax-loss harvesting maneuver, not a strategic exit. The immediate repurchase confirms this. Their current $1.5B unrealized loss is a stress test for corporate Bitcoin adoption. Market structure suggests they are accumulating, not distributing, which is bullish for long-term price discovery." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on Bitcoin's UTXO age bands. Older coins remain dormant, signaling holder conviction. MicroStrategy's strategy aligns with this long-term horizon. If the firm holds through this loss, it reinforces Bitcoin's 5-year investment case. Consequently, other corporations may follow, increasing institutional demand.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.